FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

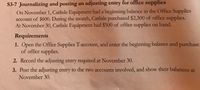

Transcribed Image Text:S3-7 Journalizing and posting an adjusting entry for office supplies

On November 1, Carlisle Equipment had a beginning balance in the Office Supplies

account of $600. During the month, Carlisle purchased $2,300 of office supplies.

At November 30, Carlisle Equipment had $500 of office supplies on hand.

Requirements

1. Open the Office Supplies T-account, and enter the beginning balance and purchase

of office supplies.

2. Record the adjusting entry required at November 30.

3. Post the adjusting entry to the two accounts involved, and show their balances at

November 30.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The beginning balance of supplies is $4000. On December 31st, the physical count of remaining supplies, $500. Record the adjusting journal entries for the supplies used during the year. supplies Expense - supplies-arrow_forwardLily Advertising Ltd's opening trial balance on January 1 shows Supplies $1,620. On January 11, the company purchased additional supplies for $1,750 on account. On January 31, there are $1,140 of supplies on hand. (a) Prepare the journal entry to record the purchase of supplies on January 11. (List all debit entries before credit entries. Credit account titles are automatically intended when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 11 eTextbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answerarrow_forwardAn invoice is dated for June 28 for $8657 with terms of 8/10 EOM,ROG . The merchandise was received on July 3 , how much should be paid on or before August 1?arrow_forward

- Your company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this?arrow_forwardAt January 31, 2021, the balance in Foster Inc.’s Supplies account was $750. During February, Foster purchased supplies of $900 and used supplies of $1,125. At the end of February, the balance in the Supplies account should be a $775 debit. b $525 credit. c $975 debit. d $525 debit.arrow_forwardDecember 31, 20, according to the Trial Balance, the Office Supplies account has a balance of 2,100.00.Adjustment data reveals that 960.00 of office supplies are on hand at the end of the period.Journalize the adjusting entry.arrow_forward

- Quantum Solutions Company, a computer consulting firm, has decided to write off the $33,550 balance of an account owed by a customer, Alliance Inc. Required: On March 1, journalize the entry to record the write-off, assuming that (a) the direct write-off method is used and (b) the allowance method is used. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Quantum Solutions Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Alliance Inc. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215…arrow_forwardAinsley Emporium sells gift cards to customers. In December, customers purchased $10,000 of gift cards. During December, the gift card recipients used gift cards to purchase $3,000 of goods. Prepare Ainsley’s entry for (1) the sale of the gift cards and (2) the year-end adjusting entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record cash received for goods to be provided at a later date) (To record the sale of merchandise using a gift card)arrow_forwardOn December 31, the balance in the office supplies account is $1,295. A physical count shows $425 worth of supplies on hand. Journalize the adjusting entry for supplies. If an amount box does not require an entry, leave it blank. Dec. 31 Previousarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education