Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

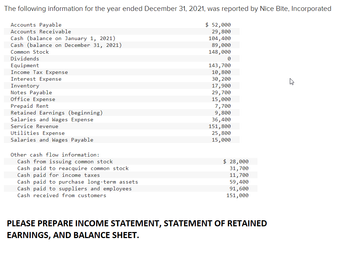

Transcribed Image Text:The following information for the year ended December 31, 2021, was reported by Nice Bite, Incorporated

Accounts Payable

Accounts Receivable

Cash (balance on January 1, 2021)

Cash (balance on December 31, 2021)

Common Stock

Dividends

Equipment

Income Tax Expense

Interest Expense

Inventory

Notes Payable

Office Expense

Prepaid Rent

Retained Earnings (beginning)

Salaries and Wages Expense

Service Revenue

Utilities Expense

Salaries and Wages Payable

Other cash flow information:

Cash from issuing common stock

Cash paid to reacquire common stock

Cash paid for income taxes

Cash paid to purchase long-term assets

Cash paid to suppliers and employees

Cash received from customers

$ 52,000

29,800

104,400

89,000

148,000

0

143,700

10,800

30, 200

17,900

29,700

15,000

7,700

9,800

36,400

151,800

25,800

15,000

$ 28,000

31,700

11,700

59,400

91,600

151,000

PLEASE PREPARE INCOME STATEMENT, STATEMENT OF RETAINED

EARNINGS, AND BALANCE SHEET.

W

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Dux Company. Additional information from Dux’s accounting records is provided also. DUX COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 111.0 $ 33.0 Accounts receivable 61.0 63.0 Less: Allowance for uncollectible accounts (6.0 ) (5.0 ) Dividends receivable 16.0 15.0 Inventory 68.0 63.0 Long-term investment 28.0 23.0 Land 83.0 40.0 Buildings and equipment 173.0 263.0 Less: Accumulated depreciation (9.0 ) (115.0 ) $ 525.0 $ 380.0 Liabilities Accounts payable $ 26.0 $ 33.0 Salaries payable 15.0 18.0 Interest payable 17.0 15.0 Income tax payable 20.0 21.0 Notes payable 43.0 0 Bonds payable 94.0…arrow_forwardThe following information (in millions) was taken from the December 31 financial statements Accounts receivable, gross Allowance for expected credit losses Accounts receivable, net Revenues Total current assets Total current liabilities 13) Calculate the current ratio for 2020 13) 2021 $ 1.102 28 1,074 14,477 3,426 3,120 2020 $ 1.080 26 1,054 13,819 3,102 3,274 2019 $ 1.241 28 1,213 14,917 2,830 4,287arrow_forwardPresented below is the unaudited balance sheet as of December 31, 2019, prepared by Zeus Manufacturing Corporation’s bookkeeper.Prepare a corrected classified balance sheet as of December 31, 2019. This financial statement should include a proper heading, format, and necessary descriptions.arrow_forward

- Use the following information for Company COLTIB to create the BalanceSheet for 2020 and 2021arrow_forwardAs per the latest annual report, the following information is made available from the financial statements of ABC Inc. for the year 2019. Sales COGS EBIT EBITDA Interest Expense Net Income Total Debt Total Assets. Particulars Net Fixed Assets Total Equity Current Assets Current Liabilities Cash & Cash Equivalents Accounts Receivables Inventories Accounts Payable Required: Amount (in millions) Current Ratio Quick Ratio Cash Ratio Debt to Equity Ratio Debt Ratio Receivables Turnover Ratio Inventory Turnover Ratio. Gross Margin Operating Profit Margin Net Margin £250,174 £151,782 £53,930 (a) You are required to calculate the following ratios: £66,477 £3,576 £45,256 £98,047 £328,516 £27,378 £80,488 £152,819 £95,718 £38,844 £12,926 £4,106 £46,236 b) After calculating all 10 ratios, explain how the above results can aid ABC Inc's decision making process.arrow_forwardRequired: For each of the following accounts, what amount will Voltac report on its 2024 financial statements? a. Inventory b. Cost of goods sold c. Sales d. Accounts receivable e. Accounts payable f. Casharrow_forward

- Indicate how a company computes the amount of interest and income taxes that it paid during the year.arrow_forwardOn September 30, Cody Companys selected account balances are as follows: In general journal form, prepare the entries to record the following: Oct. 15Payment of liabilities for FICA taxes and the federal income tax. 31Payment of liability for state unemployment tax. 31Payment of liability for federal unemployment tax.arrow_forwardInterest and Income Taxes Staggs Company has prepared its 2019 statement of cash flows. In conjunction with this statement, it plans to disclose the interest and income taxes it paid during 2019. The following information is available from its 2019 income statement and beginning and ending balance sheet: Required: 1. Compute the amounts of interest paid and income taxes paid by Staggs for 2019. 2. Next Level Under IFRS, how would interest paid and income taxes paid be reported?arrow_forward

- Elegant Linens uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Elegant Linens considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between total uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.arrow_forwardConsider the following accounts and determine if the account is a current liability, a noncurrent liability, or neither. A. cash B. federal income tax payable this year C. long-term note payable D. current portion of a long-term note payable E. note payable due in four years F. interest expense G. state income taxarrow_forwardNoren Company uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Noren Company considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between totals uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College