FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

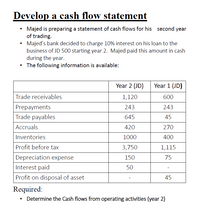

Transcribed Image Text:Develop a cash flow statement

Majed is preparing a statement of cash flows for his second year

of trading.

Majed's bank decided to charge 10% interest on his loan to the

business of JD 500 starting year 2. Majed paid this amount in cash

during the year.

The following information is available:

Year 2 (JD)

Year 1 (JD)

Trade receivables

1,120

600

Prepayments

243

243

Trade payables

645

45

Accruals

420

270

Inventories

1000

400

Profit before tax

3,750

1,115

Depreciation expense

Interest paid

150

75

50

Profit on disposal of asset

45

Required:

• Determine the Cash flows from operating activities (year 2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A businessman borrowed $1,300,000 from the bank to finance new equipment for his food co-packing factory. The loan is being paid back in uniform annual payments of $83,200, which corresponds to at an annual interest rate of of 4% over 25 years. What is the balance on the loan immediately after making the 8th annual payment? OA. $1,053,306 OB. $634,400 OC. $560,161 OD. $1,012,186 W Carrow_forwardA loan of $17,504 was repaid at the end of 16 months. What size repayment check (principal and interest) was written, if a 7.9% annual rate of interest was charged? Question content area bottom Part 1 The amount of the repayment check was $ enter your response here. (Round to twoarrow_forwardPlease answer fast without plagiarism please will upvotearrow_forward

- Wally has provided the information below – and asked you to create an Income Statement and Balance Sheet for AndrewCo for the year ended December 31, 2019. Sales were $1,200,000 Gross profit margin was 50% Operating margins were 10% The Bank of Toronto provided a loan on Jan 1, 2019 worth $300,000. The annual interest is 8% and is compounded annually. Interest only payments are needed – until the loan is due in 10 years, where a balloon payment for the full balance must be paid. The combined federal and provincial tax rates is 25% Wally knows that the ending cash balance in his company is 200,000. Accounts Receivables is 12% of sales Inventory is 15% of sales Accounts Payable is 5% of sales Accrued expenses payable is 5.5% of sales Capital equipment purchases were made at the start of the year. These total $50,000. These depreciate at 10% per year The owner will provide all other capital in the form of equity financing Wally has asked you to figure out his Selling General and…arrow_forwardAt the beginning of the year, Oriole Company has a cash balance of $25300. During the year, the company expects cash disbursements of $176000, and cash receipts of $154000. If Oriole Company requires an ending cash balance of $22000, how much must the company borrow? O $0. O $44000. O $18700. O $22000.arrow_forwardBank A makes a loan of $10,000 to Company B at a 10% interest rate. Which of the following is the correct journal entry for Bank A the day the loan is made? Group of answer choices Option A.)Dr. Cash (+A) $10,000 Cr. Notes Payable (+L) $10,000 Option B) Cr. Notes Payable (+L) $10,000 Dr. Cash (+A) $10,000 Option C) Dr. Notes Receivable (+A) $10,000 Cr. Cash (-A) $10,000 Option D) Dr. Notes Receivable (+A) $11,000 Cr. Cash (-A) $11,000 ANSWER BEFORE 11:30!!arrow_forward

- Stmt of Cash Flows and Req C, please The following transactions apply to Ozark Sales for Year 1: The business was started when the company received $50,000 from the issue of common stock. Purchased equipment inventory of $178,000 on account. Sold equipment for $192,000 cash (not including sales tax). Sales tax of 6 percent is collected when the merchandise is sold. The merchandise had a cost of $117,000. Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would amount to 5 percent of sales. Paid the sales tax to the state agency on $142,000 of the sales. On September 1, Year 1, borrowed $21,500 from the local bank. The note had a 6 percent interest rate and matured on March 1, Year 2. Paid $5,900 for warranty repairs during the year. Paid operating expenses of $56,000 for the year. Paid $124,000 of accounts payable. Recorded accrued interest on the note issued in transaction no. 6. Required Record the given transactions in a…arrow_forwardSolve in digital format 1. A company requested a bank loan of $ 100,000 agreed for a two-year term, at an interest rate of 18%, with a monthly capitalization clause. What is the future amount or value of the operation?arrow_forwardJune 30, 20X1 Titan Corp. licensed an archive financial database to Smart Co. for the next five years. Smart is to pay Titan $10,000 at the beginning of each year. Titan and Smart has an incremental borrowing annual interest rates of 5% and 6% respectively. Determine the amount of revenue to be recognized by Titan in 20X1? $45,460 $5,000 $50,000 $44,651arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education