FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

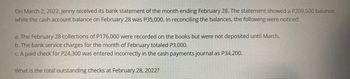

Transcribed Image Text:On March 2, 2022, Jenny received its bank statement of the month ending February 28. The statement showed a P209,500 balance

while the cash account balance on February 28 was P35,000. In reconciling the balances, the following were noticed:

a. The February 28 collections of P176,000 were recorded on the books but were not deposited until March.

b. The bank service charges for the month of February totaled P3,000.

c. A paid check for P24,300 was entered incorrectly in the cash payments journal as P34,200.

What is the total outstanding checks at February 28, 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When the bank statement is received on July 3, it shows a balance, before reconciliation, of $6,120 as of June 30. After reconciliation, the adjusted balance is $3,650. If one deposit in transit amounted to $1,470, what was the total of the outstanding checks assuming that no other adjustments would be made to the bank statement?arrow_forwardThe following information relates to Oriole Limited's Cash account. The reconciled cash balance from June's bank reconciliation is $19,590. During the month of July, Oriole recorded cash receipts of $21,400 and cash payments of $24,300 in the general ledger Cash account. An examination of the company's July bank statement shows a balance of $19,630 on July 31; outstanding cheques $4,000; deposits in transit $1,820; EFT collections on account that were not yet recorded on the books $2,192; NSF cheque $1,248; NSF fee $72; and bank service charges $112. Determine the cash balance per Oriole Limited's books. Cash balance Prepare the bank reconciliation at July 31. (List items that increase balance as per bank & books first.) Add Cash balance per bank Bank service charge Reconciled cash balance per bank Deposits in transit NSF cheque and fee Outstanding cheques EFT collections on account Oriole Limited Bank Reconciliation July 31 $arrow_forwardBeckett Co. received its bank statement for the month ending June 30, 2019, and reconciled the statement balance to the June 30, 2019, balance in the Cash account. The reconciled balance was determined to be $6,428. The reconciliation recognized the following items: 1. Deposits in transit were $3,335. 2. Outstanding checks totaled $2,612. 3. Bank service charges shown as a deduction on the bank statement were $80. 4. An NSF check from a customer for $671 was included with the bank statement. Beckett Co. had not been previously notified that the check had been returned NSF. 5. Included in the canceled checks was a check written for $770. However, it had been recorded as a disbursement of $940. Required: Prepare the Bank reconciliation statement for the month ending June 30, 2019. BECKETT COMPANY Bank Reconciliation June 30, 2019 Balance per bank Balance per books Add: Add: Deduct: Deduct: Reconciled balance $ O Reconciled balancearrow_forward

- The accountant of Jonathan Manufacturing Company was tasked to perform monthly bank reconciliation. She downloaded the company’s April 30, 2019 bank statement that showed a balance of P32,400. She also printed the cash ledger from the company’s computerized accounting system. It contains the ending balance of P8,350. She also found the following reconciling items:a. The bank statement showed bank service fee of P800.b. The bank collected P1,500 from a note receivable for Jonathan Manufacturing. Also, a collection fee of P250.00 was charged.c. Deposit in transit, P51,000.d. Checks outstanding on April 30, P79,100.e. The accountant found a check issued to Rhys Corp. for P4,500 that cleared the bank but was not in the cash ledger. Requirement:a. Prepare the bank reconciliation statement.b. Journalize the adjusting entries.arrow_forwardThe checking account balance per bank statement is P3,874,000. Included in the bank statement are a bank service charge of P10,000, a note collection by the bank of P400,000 and the return of P100,000 from a matured time deposit. Outstanding checks totaled P490,000 while deposits in transit total P210,000. The depositor incorrectly recorded a cash collection of P82,000 as P28,000. What is the adjusted cash in bank? * A.P3,540,000 B.P3,594,000 C.P3,648,000 D.P4,154,000arrow_forwardplease answerarrow_forward

- The Cash account of Ranger Security Systems reported a balance of $2,550 at December 31, 2025. There were outstanding checks totaling $800 and a December 31 deposit in transit of $100. The bank statement, which came from Tri Cities Bank, listed the December 31 balance of $3,910. Included in the bank balance was a collection of $670 on account from Sally Jones, a Ranger Security Systems customer who pays the bank directly. The bank statement also shows a $20 service charge and $10 of interest revenue that Ranger Security System earned on its bank balance. Prepare Ranger Security System's bank reconciliation at December 31. Ranger Security Systems Bank Reconciliation Bank: Balance, December 31, 2025 ADD: Deposit in transit December 31, 2025 LESS: Outstanding checks Adjusted bank balance, December 31, 2025 Book: Balance, December 31, 2025 ADD: LESS: Service charge Adjusted book balance, December 31, 2025arrow_forwardGiven the following information to reconcile GCompany’s cash book balance with its bank statement balance as of July 31, 2021: a. Cheques #296 for $1,334 and #307 for $12,754 were outstanding on the September 30 bank reconciliation. Cheque #307 was returned with the October cancelled cheques, but cheque #296 was not. It was also found that cheque #315 for $893 and cheque #321 for $2,000, both written in July, were not among the cancelled cheques returned with the statement. b. In comparing the cancelled cheques returned by the bank with the entries in the accounting records, it was found that cheque #320 for the July rent was correctly written for $4,090 but was erroneously entered in the accounting records as $4,900. c. Also enclosed with the statement was a $74 debit memo for bank services. It had not been recorded because no previous notification had been received. d. A credit memo enclosed with the bank statement indicated that there was an electronic fund transfer related to a…arrow_forwardOn December 15, you recieved your bank statement showing a balance of $2270.32. Your checkbook shows a balance of $2433.33. Outstanding checks are $225.50 and $356.20. The account earned $77.52. Deposits in transit amount to $805.23, and there is a service charge of $17.00. Calculate the reconciled balance. options are: a. 163.01 b. 2046.79 c. 2372.81 d. 2493.85arrow_forward

- the December bank statement has a balance of $5,300 before reconciliation. after reconciliation the adjust balance is 4100. if one deposit in transit amounted to 800 what was the total of the outstanding checks, assuming no other adjustments would be made to the bank statementarrow_forwardThe books of Cajardo Service, Inc. disclosed a cash balance of P687,570 on December 31, 2010. The bank statement as of December 31 showed a balance of P547,800. Addifional information that might be useful in reconciling the two balances follows: A. Check No. 748 for P30,000 was originally recorded on the books as P45,000. B. A Customer's note dated September 25 was discounted on October 12. The note was dishonored on December 29, the note's maturity date. The bank charged Cajardo's account for P142,650, including a protest fee of P2,650. C. The deposit of December 24 was recorded on the books as P28,950 but it was actually a deposit of P27.000. D. Outstanding checks totaled P98,850 as of December 31. E. There woas a bank service charge for December of P2,100 not yet recorded on the books. F. Cajardo's account had been charged on December 26 for a customer's NSF check for P12.960. G. Cajardo properly deposited P6.000 on December 3 that was not recorded by the bank. H. Receipts of…arrow_forwardBank Reconciliation and Adjusting Entries (Appendix 6.1) Odum Corporation’s cash account showed a balance of $17,198 on March 31, 2019. The bank statement balance for the same date indicated a balance of $17,924.55. The following additional information is available concerning Odum’s cash balance on March 31: • Undeposited cash on hand on March 31 amounted to $724.50. • A customer’s NSF check for $173.80 was returned with the bank statement. • A note for $2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified Odum of this collection on the bank statement. • The bank service charge for March was $15. • A deposit of $951.75 mailed to the bank on March 31 did not appear on the bank statement. The following checks mailed to creditors had not been processed by the bank on March 31: #429 $57.40 #432 $147.50 #433 $214.80 #434 $191.90 A customer check for $149.50 in payment of his account and listed correctly for that amount on the bank state-ment had…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education