FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

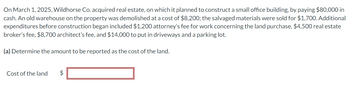

Transcribed Image Text:On March 1, 2025, Wildhorse Co. acquired real estate, on which it planned to construct a small office building, by paying $80,000 in

cash. An old warehouse on the property was demolished at a cost of $8,200; the salvaged materials were sold for $1,700. Additional

expenditures before construction began included $1,200 attorney's fee for work concerning the land purchase, $4,500 real estate

broker's fee, $8,700 architect's fee, and $14,000 to put in driveways and a parking lot.

(a) Determine the amount to be reported as the cost of the land.

Cost of the land

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2021, LMT Inc. acquired a piece of land to construct a new office building. You have the following information about this transaction: Price of land $180,000 Tax on purchase of land 5% of price Legal fees to transfer property of land to LMT $4,500 Cost of demolishing old building on land 5,600 Income from sale of windows of old building demolished 500 Cost of new office building foundation 23,400 Cost of office building construction 460,000 Cost of insurance during construction 2,000 Cost to repair a piece of equipment used in the office building’s construction 1,000 Cost of annual insurance on office building after the construction is finished 6,000 LMT management decided to allocate the following amounts to the parts of the office building, and estimated the corresponding useful lives and residual values as follows: Allocated cost Useful life Residual value Windows $50,000 10 years…arrow_forwardOn March 31, 2024, a company purchased the right to remove gravel from an old rock quarry. The gravel is to be sold as roadbed for highway construction. The cost of the quarry rights was $232,200, with estimated salable rock of 27,000 tons. During 2024, The company loaded and sold 5,000 tons of rock and estimated that 22,000 tons remained on December 31, 2024. On January 1, 2025, the company estimated that 10,000 tons still remained. During 2025, the company loaded and sold 15,000 tons. The company uses the units-of-production method. The company would record depletion in 2024 in the amount of: Note: Do not round depletion rate per ton. Multiple Choice $43,340. $52,773. $32,250. $43,000.arrow_forwardOn January 2, 2023, Lotus Spa purchased fixtures for $57,600 cash, expecting the fixtures to remain in service for nine years. Lotus Spa has depreciated the fixtures on a straight-line basis, with $9,000 residual value. On April 30, 2025, Lotus Spa sold the fixtures for $39,500 cash. Record both depreciation expense for 2025 and sale of the fixtures on April 30, 2025. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Apr. 30 Accounts and Explanation Debit Credit Before recording the sale of the fixtures, let's calculate any gain or loss on the sale of the fixtures. (Enter a loss with a minus sign or parentheses.) Fair value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss) Now, record the sale of the fixtures on April 30, 2025. Date Apr. 30 Accounts and Explanation Debit Creditarrow_forward

- Bright Co. received a government grant of 10,000,000 to install and run a windmill in an economically backward area. The entity had estimated that such a windmill would cost 25,000,000 to construct. The secondary condition attached to the grant is that the entity shall hire labor in the area where the windmill is located. The construction was completed on January 1, 2014. The windmill is to be depreciated using the straight-line method over a period of 10 years. What amount of grant income should be recognized for 2014? O2,500,000 1,500,000 O 1,000,000 5,000,000arrow_forwardOn July 1, 2024, a company purchased a $550,000 tract of land that is intended to be the site of a new office complex. The company incurred additional costs and realized salvage proceeds during 2024 as follows: Demolition of existing building on site $ 72,000 Legal and other fees to close escrow 12,400 Proceeds from sale of demolition scrap 9,800 What would be the balance in the land account as of December 31, 2024?arrow_forwardFarley Corporation purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, $70,000; broker's fees, $6,000; title search and other fees, $5,000; demolition of an old building on the property, $5,700; grading $1,200; digging foundation for the road, $3,000; laying and paving driveway. $25,000; lighting $7,500; signs, $1,500. List the items and amounts that should be included in the Land account. $ $arrow_forward

- Rossy Investigations purchased land, paying $97,000 cash plus a $250,000 note payable. In Addition, Rossy Investigations paid delinquent property tax of $2,000, title insurance costing $1,000, and $5,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $440,000. It also paid $56,000 for a fence around the property, $18,000 for a sign near the entrance, and $8,000 for special lighting on the grounds. Determine the cost of the land, land improvements, and building. Land Land Improvements Building Account Purchase price Note payable Property tax Title insurance Remove building Construct building Fence Sign Lighting Totals Submit All Partsarrow_forwardA company purchased a new forging machineto manufacture disks for airplane turbine engines.The new press cost $3,500,000, and it falls into aseven-year MACRS property class. The companyhas to pay property taxes to the local township forownership of this forging machine at a rate of 1.2%on the beginning book value of each year.(a) Determine the book value of the asset at thebeginning of each tax year.(b) Determine the amount of property taxes over themachine’s depreciable life.arrow_forwardDetermine the Cost of Land Village Delivery Company purchased a lot to construct a new warehouse for $243,000, paying $28,000 in cash and giving a short-term note for the remainder. Legal fees paid in connection with the purchase were $2,075, delinquent taxes assumed were $12,300, and fees paid to remove an old building from the land were $17,400. Materials salvaged from the demolition of the building were sold for $4,100. A contractor was paid $823,800 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. Xarrow_forward

- 7) Crass Spray Inc. (CSI) purchased equipment costing $60,000 on September 1, 2023. CSI made a $20,000 down payment and took out a loan for the remaining amount. Other cash expenditures related to this purchase included: Insurance during shipping: $500 Annual insurance policy: $2,400 Installation and testing costs: $600 Staff training costs on how to run the new equipment: $700 Required Determine the cost of the new equipment and record all required journal entries related to this equipment (you can ignore depreciation expense for the year).arrow_forwardZorzi Company purchased a machine on July 1, 2018, for $28.000. Zorzi paid $200 in title fees and county property tax of $125 on the machine In addition, Zorzi paid $500 shipping charges for delivery and $475 was paid to a local contractor to build and wire a platform for the machine on the plant floor The machine has an estimated useful life of 6 years with a salvage value of $3.000 Determine the depreciation base of Zorzis new machine. Zorzi uses straight-line depreciation. $25,000 $26.000 $26 300 None of the abovearrow_forwardOn January 1, Mitzu Company pays a lump-sum amount of $2,600,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $793,000, with a useful life of 20 years and a $75,000 salvage value. Land Improvements 1 is valued at $427,000 and is expected to last another 14 years with no salvage value. The land is valued at $1,830,000. The company also incurs the following additional costs. Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $398,000 salvage value Cost of new Land Improvements 2, having a 20-year useful life and no salvage value Problem 8-3A (Algo) Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet 2 3 4 Record the year-end adjusting entry for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education