FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:On March 1, 2024, Gold Examiner receives $139,000 from a local bank and promises to deliver 94 units of certified 1-ounce gold bars

on a future date. The contract states that ownership passes to the bank when Gold Examiner delivers the products to Brink's, a third-

party carrier. In addition, Gold Examiner has agreed to provide a replacement shipment at no additional cost if the product is lost in

transit. The stand-alone price of a gold bar is $1,410 per unit, and Gold Examiner estimates the stand-alone price of the replacement

insurance service to be $90 per unit. Brink's picked up the gold bars from Gold Examiner on March 30, and delivery to the bank

occurred on April 1.

Required:

1. How many performance obligations are in this contract?

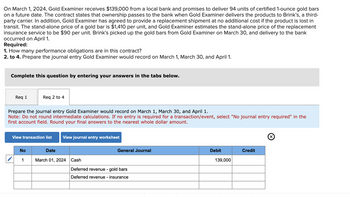

2. to 4. Prepare the journal entry Gold Examiner would record on March 1, March 30, and April 1.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2 to 4

Prepare the journal entry Gold Examiner would record on March 1, March 30, and April 1.

Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the

first account field. Round your final answers to the nearest whole dollar amount.

View transaction list View journal entry worksheet

No

1

Date

March 01, 2024

General Journal

Cash

Deferred revenue - gold bars

Deferred revenue - insurance

Debit

139,000

Credit

Ⓡ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sanaz Corporation sells computers under a 3-year warranty contract that requires the corporation to replace defective parts and to provide the necessary repair labor. During 2020, the corporation sells for cash 700 computers at a unit price of $2,000. On the basis of past experience, the3-year warranty costs are estimated to be $130 for parts and $170 for labor per unit.(For simplicity, assume that all sales occurred on December 31, 2020.) The warranty is not sold separately from the computer. Required a. Record any necessary journal entries in 2020.b. What liability relative to these transactions would appear on the December 31, 2020, balance sheet and how would it be classified?c. In 2021, the actual warranty costs to Sanaz Corporation were $30,500 for parts and $45,100 for labor. Record any necessary journal entries in 2021arrow_forwardOn December 31, 2025, Cullumber Company acquired a computer from Plato Corporation by issuing a $614,000.00 zero-interest- bearing note, payable in full on December 31, 2029. Cullumber Company's credit rating permits it to borrow funds from its several lines of credit at 10%. The computer is expected to have a 5-year life and a $76,000 salvage value. Click here to view factor tables. (a) Prepare the journal entry for the purchase on December 31, 2025. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 2 decimal places, eg. 58,971.23. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation December 31,2025 eTextbook and Media List of Accounts Debit Creditarrow_forwardOn January 15, 2023, Caramel Company enters into a contract to build custom equipment for Candy Company. The contract specified a delivery date of of March 1. The equipment was not delivered until March 31. the contract required full payment of $75,000 30 days after delivery. the revenue for this contract should bearrow_forward

- Gen sells cellular phones. Each phone sells for P10,000 and carries a warranty against defects of period of 1 year counting from the date of purchase. The firm sold 60,000 phones in 2019. Past experience indicates that 10% of the phones will need some type of repair during the warranty period. In the past, the firm has incurred expenditures at P400 on each telephone needing repair due to manufacturing defects. At the beginning of the year, the Estimate Liability for Warranties account had a credit of P59,400. Actual expenditures during the year amounted to P1.5M. The balance of the Estimated Liability for Warranties at year-end is: O 500,000 O 2,400,000 O 1,500,000 0 950,000arrow_forwardEarly in 2020, Swifty Equipment Company sold 600 Rollomatics at $5,700 each. During 2020, Swifty spent $20,000 servicing the 2- year assurance warranties that accompany the Rollomatic. All sales transactions are on a cash basis. (a) Prepare 2020 entries for Swifty. Assume that Swifty estimates the total cost of servicing the warranties in the second year will be $37,000. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit List of Accountsarrow_forwardOn May 3, 2020, Vaughn Company consigned 90freezers, costing $470each, to Remmers Company. The cost of shipping the freezers amounted to $870and was paid by Vaughn Company. On December 30, 2020, a report was received from the consignee, indicating that45freezers had been sold for $750each. Remittance was made by the consignee for the amount due after deducting a commission of6%, advertising of $180, and total installation costs of $310on the freezers sold. (Round answers to O decimal places, e.g. 5,275.) (a) Compute the inventory value of the units unsold in the hands of the consignee. Inventory value $ (b) Compute the profit for the consignor for the units sold. Profit on consignment sales $ (c) Compute the amount of cash that will be remitted by the consignee. Remittance from consignee $arrow_forward

- Since 1970, Super Rise, Incorporated, has provided maintenance services for elevators. On January 1, 2024, Super Rise obtains a contract to maintain an elevator in a 90-story building in New York City for 10 months and receives a fixed payment of $98,000. The contract specifies that Super Rise will receive an additional $49,000 at the end of the 10 months if there is no unexpected delay, stoppage, or accident during the year. Super Rise estimates variable consideration to be the most likely amount it will receive. Required: Assume that, because the building sees a constant flux of people throughout the day, Super Rise is allowed to access the elevators and related mechanical equipment only between 3 a.m. and 5 a.m. on any given day, which is insufficient to perform some of the more time-consuming repair work. As a result, Super Rise believes that unexpected delays are likely and that it will not earn the bonus. Prepare the journal entry Super Rise would record on January 1. Assume…arrow_forwardEarly in 2020, Cheyenne Equipment Company sold 500 Rollomatics at $5,400each. During 2020, Cheyenne spent $22,000servicing the 2-year assurance warranties that accompany the Rollomatic. All sales transactions are on a cash basis. (a) Prepare 2020 entries for Cheyenne. Assume that Cheyenne estimates the total cost of servicing the warranties in the second year will be $37,000. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Creditarrow_forwardOn February 1, 2023, Armen Inc. entered into a contract to deliver one of its specialty machines to Idris Inc. The contract requires Idris Inc to pay the contract price of $15,000 in advance on February 20, 2023. Idris Inc. pays Armen Inc on February 20, 2023, and Armen Inc delivers the machine (costing $12,600) on February 28, 2023 and Idris Inc starts using the machine on March 3, 2023. When should Armen Inc recognize revenue?arrow_forward

- Wilder Watersports Inc. sells luxury yachts and related equipment. The sale price of each yacht includes a three-year comprehensive warranty that covers all repairs and maintenance for the period. Each yacht sells for $3,000,000. A review of competitor pricing indicates that a similar warranty, if sold separately, would be valued at $10,000. On January 1, 2021, Wilder Watersports Inc. sold seven yachts. Repair costs actually incurred for these yachts were as follows: Year ended December 31, 2021 $12,000 Year ended December 31, 2022 $30,000 Year ended December 31, 2023 $35,000 Required: a. Prepare all the necessary journal entries for 2021, 2022, and 2023 to reflect the above transactions. b. Calculate the amount of unearned revenue to be reported at December 31, 2022arrow_forwardOn 27 January 2021, Johnson Engineering Ltd signed a contract to supply a new machine to Yummy Confectionary Ltd for $92,000 (including GST). This includes $75,000 for the machine (excluding GST), $2,000 for delivering and installing the machine (excluding GST) and $3,000 for servicing the machine in 6 months. Johnson Engineering Ltd delivers and installs the machine on 12 February 2021. An invoice for $92,000 is also given to Yummy Confectionary Ltd on this day. Yummy Confectionary Ltd transfers $92,000 to Johnson Engineering Ltd on 21 February 2021 via internet banking. Johnson Engineering Ltd services the machine on 12 August 2021. Required: Prepare journal entries for invoicing of the contract on 12 February 2021 and the servicing of the machine on 12 August 2021. Johnson Engineering Ltd’s General Journal: Date Account Names Debit Credit 12/2/2021 (To record the invoice for contract with…arrow_forwardIn August 2021, Commonlo Corp. commits to selling 100 of its merchandise to M&H Co. for P30,000 (P300 per product). The merchandise is to be delivered to M&H over the next 6 months. After 60 merchandises were delivered, the contract is modified and Commonlo promises to deliver 80 more products for an additional P21,600 (P270 per station). At year-end, Commonlo delivered an additional 90 products. All sales are cash on delivery. Assume that the additional term is a prospective modification to the original contract How much revenue will be recognized on the contract for the year 2021? Next « Previousarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education