Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

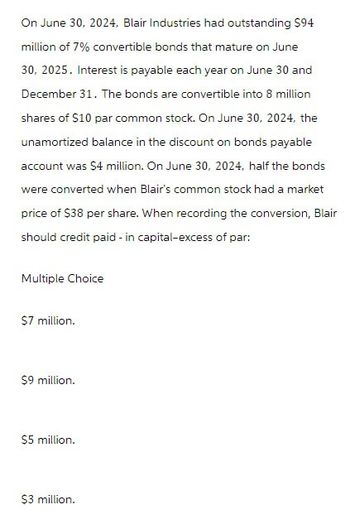

Transcribed Image Text:On June 30, 2024, Blair Industries had outstanding $94

million of 7% convertible bonds that mature on June

30, 2025. Interest is payable each year on June 30 and

December 31. The bonds are convertible into 8 million

shares of $10 par common stock. On June 30, 2024, the

unamortized balance in the discount on bonds payable

account was $4 million. On June 30, 2024, half the bonds

were converted when Blair's common stock had a market

price of $38 per share. When recording the conversion, Blair

should credit paid-in capital-excess of par:

Multiple Choice

$7 million.

$9 million.

$5 million.

$3 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2018, Wawatosa Inc. issued 5-year bonds with a face value of $200,000 and a stated interest rate of 12% payable semi-annually on July 1 and January 1. The bonds were sold to yield 10%. Assuming the bonds were sold at 107.732, what is the selling price of the bonds? Were they issued at a discount or a premium?arrow_forwardOn July 1, Somerset Inc. issued $200,000 of 10%, 10-year bonds when the market rate was 12%. The bonds paid interest semi-annually. Assuming the bonds sold at 58.55, what was the selling price of the bonds? Explain why the cash received from selling this bond is different from the $200,000 face value of the bond.arrow_forwardAggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018, and received $540,000. Interest is payable semi-annually. The premium is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of premiumarrow_forward

- Starmount Inc. sold bonds with a $50,000 face value, 12% interest, and 10-year term at $48,000. What is the total amount of interest expense over the life of the bonds?arrow_forwardOn July 1, a company sells 8-year $250,000 bonds with a stated interest rate of 6%. If interest payments are paid annually, each interest payment will be ________. A. $120,000 B. $60,000 C. $7,500 D. $15,000arrow_forwardOn Jan. 1, Year 1, Foxcroft Inc. issued 100 bonds with a face value of $1,000 for $104,000. The bonds had a stated rate of 6% and paid interest semiannually. What is the journal entry to record the issuance of the bonds?arrow_forward

- A company issued bonds with a $100,000 face value, a 5-year term, a stated rate of 6%, and a market rate of 7%. Interest is paid annually. What is the amount of interest the bondholders will receive at the end of the year?arrow_forwardCharleston Inc. issued $200,000 bonds with a stated rate of 10%. The bonds had a 10-year maturity date. Interest is to be paid semi-annually and the market rate of interest is 8%. If the bonds sold at 113.55, what amount was received upon issuance?arrow_forwardPinetop Corporation issued $150,000 10-year bonds at par. The bonds have a stated rate of 6% and pay interest annually. What is the journal entry to record the sale of the bonds?arrow_forward

- Piedmont Corporation issued $200,000 of 10-year bonds at par. The bonds have a stated rate of 6% and pay interest annually. What is the journal entry to record the first interest payment to the bondholders?arrow_forwardEvie Inc. issued 50 bonds with a $1,000 face value, a five-year life, and a stated annual coupon of 6% for $980 each. What is the total amount of interest expense over the life of the bonds?arrow_forwardEli Inc. issued $100,000 of 8% annual, 5-year bonds for $103,000. What is the total amount of interest expense over the life of the bonds?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning