FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

On May 1, 2022, Ivanhoe Corp. issued $990,000, 9%, 5-year bonds at face value. The bonds were dated May 1, 2022, and pay interest

annually on May 1. Financial statements are prepared annually on December 31.

List of accounts

Accounts Payable

Accounts Receivable

Accumulated Depreciation -Buildings

Accumulated Depreciation-Equipment

Allowance for Doubtful Accounts

Bad Debt Expense

Bonds Payable

Buildings

Cash

Cash Dividends

Common Stock

Depreciation Expense

Discount on Bonds Payable

Dividends Payable

Equipment

Gain on Bond Redemption

Interest Expense

Interest Payable

Inventory

Land

Lease Liability

Leased Asset-Equipment

Loss on Bond Redemption

Mortgage Payable

Notes Payable

Other Operating Expenses

Paid-in Capital in Excess of Par-Common Stock

Paid-in Capital in Excess of Par-Preferred Stock

Preferred Stock

Premium on Bonds Payable

Rent Expense

Rent Revenue

Retained Earnings

Right-of-Use-Asset

Salaries and Wages Expense

Salaries and Wages Payable

Sales Revenue

Treasury Stock

Unearned Rent Revenue

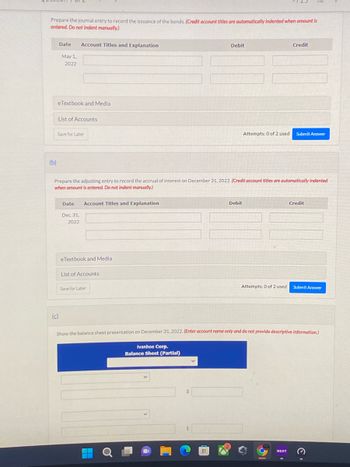

Transcribed Image Text:Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is

entered. Do not indent manually)

(b)

Date

May 1,

2022

eTextbook and Media

(c)

Account Titles and Explanation

List of Accounts

Save for Later

Date

Dec 31,

2022

Prepare the adjusting entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented

when amount is entered. Do not indent manually.)

Account Titles and Explanation

eTextbook and Media

List of Accounts

Save for Later

Debit

Ivanhoe Corp.

Balance Sheet (Partial)

Debit

Attempts: 0 of 2 used Submit Answer

Credit

Attempts: 0 of 2 used

NZXT

Credit

Show the balance sheet presentation on December 31, 2022. (Enter account name only and do not provide descriptive information.)

Submit Answer

C

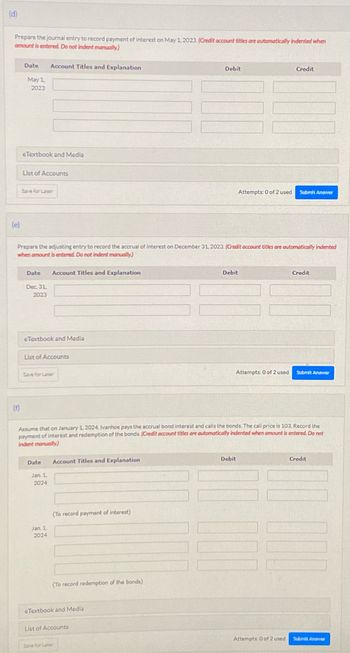

Transcribed Image Text:(d)

Prepare the journal entry to record payment of interest on May 1, 2023. (Credit account tities are automatically indented when

amount is entered. Do not indent manually)

(e)

Date Account Titles and Explanation

May 1

2023

(f)

eTextbook and Media

List of Accounts

Save for Later

Date

Dec. 31,

2023

Prepare the adjusting entry to record the accrual of interest on December 31, 2023. (Credit account titles are automatically indented

when amount is entered. Do not indent manually)

eTextbook and Media

List of Accounts

Account Titles and Explanation

Save for Laber

Date

Jan 1,

2024

Jan. 1,

2024

Account Titles and Explanation

(To record payment of interest)

(To record redemption of the bonds)

eTextbook and Media

Debit

Assume that on January 1, 2024, Ivanhoe pays the accrual bond interest and calls the bonds. The call price is 103. Record the

payment of interest and redemption of the bonds. (Credit account titles are automatically indented when amount is entered. Do not

indent manually)

List of Accounts

Save for Later

Attempts: 0 of 2 used

Debit

Attempts: 0 of 2 used

Debit

Credit

Submit Answer

Attempts: 0 of 2 used

Credit

Submit Answer

Credit

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane Electric sold $6,240,000, 10%, 10-year bonds on January 1, 2022. The bonds were dated January 1, 2022, and paid interest annually on January 1. The bonds were sold at 98. At December 31, 2022, $12,480 of the Discount on Bonds Payable account has been amortized. Show the balance sheet presentation of the long-term liability at December 31, 2022. (Enter account name only and do not provide descriptive information.) Crane ElectricBalance Sheet (Partial)choose the accounting period select an opening section name enter a balance sheet item $enter a dollar amount select between addition and deduction : enter a balance sheet item enter a dollar amount $enter a subtotal of the two previous amountsarrow_forwardOn January 1, 2022, Oriole Company issued $430,000, 8%, 10-year bonds at face value. Interest is payable annually on January 1. (a) Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (b) Date Jan. 1, 2022 Account Titles and Explanation eTextbook and Media List of Accounts Save for Later Debit Date Account Titles and Explanation Dec. 31, 2022 Credit Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Attempts: 0 of 5 used Submit Answer Creditarrow_forwardOn January 1, 2025, Stellar Corporation issued $450,000 of 7% bonds, due in 10 years. The bonds were issued for $423,783, and pay interest each July 1 and January 1. Stellar uses the effective-interest method. Prepare the company's journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Assume an effective-interest rate of 8%. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)arrow_forward

- Shaq Corporation issued $10,000 of 20-year bonds on January 1, 2024. The bonds pay interest semiannually. This is a partial bond amortization schedule for the bonds. Payment Cash Effectiveinterest Increase in balance Outstandingbalance 9,080 1 400 409 9 9,089 2 400 409 9 9,098 3 400 409 9 9,107 4 400 410 10 9,117 What is the effective annual rate of interest on the bonds?arrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forwardAlvin Jackson Co. issued $10,000 of bonds on January 1, 2021. The bonds pay interest semi-annually. This is a partial bond amortization schedule for the bonds. Payment Cash Effective interest Decrease in balance Outstanding balance 9,080 1 400 409 9 9,089 2 400 409 9 9,098 3 400 409 9 9,107 4 400 What is the interest expense on the bonds for the year ended December 31, 2022? A. $800. B. $819. C. $818. D. $809.arrow_forward

- (d) What will be the total interest payments over the five-year life of the bonds? Total interest expense? Total interest payments Total interest expensearrow_forwardMarigold Corporation issued $660,000 of 6% bonds on May 1,2025 . The bonds were dated January 1,2025 , and mature January 1 , 2028 , with interest payable July 1 and January 1 . The bonds were issued at face value plus accrued interest. Prepare Marigold's journal entries for (a) the May 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry.arrow_forwardSunland Company sold \(\$ 3, 170, 000, 9 \ %, 10 \) - year bonds on January 1, 2025. The bonds were dated January 1, 2022 5 and pay interest on January 1. The company uses straight-line amortization on bond premiums and discounts. Financial statements are prepared annually. (a) Prepare amortization table for issuance of the bonds sold at 103 for the first three interest payments. Prepare amortization table for issuance of the bonds sold at 97 for the first three interest payments.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education