FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

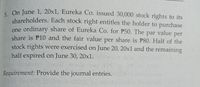

Transcribed Image Text:-On June 1, 20x1, Eureka Co. issued 30,000 stock rights to its

shareholders. Each stock right entitles the holder to purchase

one ordinary share of Eureka Co. for P50. The par value per

share is P10 and the fair value per share is P80. Half of the

stock rights were exercised on June 20, 20x1 and the remaining

half expired on June 30, 20xl.

Requirement: Provide the journal entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- WW Corp. resells 400 shares of its own common stock for $20 per share. WW had acquired these shares two months before for $16 per share. The resale of this stock would be recorded with a: Select one: a. Debit to Common Stock for $8,000 b. Credit to Additional Paid-In Capital for $1,600 c. Debit to Additional Paid-In Capital for $2,000 d. Credit to Treasury Stock for $8,000 e. Credit to Additional Paid-In Capital for $2,000arrow_forwardCaswell Corporation is authorized to issue 10,000 shares of common stock on December 31. It sells 8,000 shares at $16 per share. Required: Record the sale of the common stock, given the following independent assumptions: 3. The stock has no-par and no stated value.arrow_forwardOn February 13, Solo Inc. reacquires 50,000 shares of its $1 par value common stock at the current market price of $11. The stock was originally issued for $8. On August 22, Solo reissued the stock for $15. What is the overall effect of the February 13 and August 22 transactions on Solo's financial statements?arrow_forward

- At the start of 20X5, Happy Corp. had 20,000 shares of $5 par common stock issued and outstanding. All 20,000 shares had been issued in the prior year for $20 per share. On February 1, 20X5, Happy repurchased 6,000 shares of its own stock for $12 per share. It plans to reissue these shares at a future time. Question: What journal entry should Happy make to record the February 1, 20X5 transaction? Answer: It should debit for $ and credit + for $arrow_forwardOn January 23, 15,000 shares of Tolle Company are acquired at a price of $25 per share plus a $145 brokerage commission. On April 12, a $0.30-per-share dividend was received on the Tolle Company stock. On June 10, 6,200 shares of the Tolle Company stock were sold for $34 per share less a $130 brokerage commission. Prepare the journal entries for the original purchase, the dividend, and the sale under the cost method. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers to the nearest dollar.arrow_forwardOn May 27, Kick Off Inc. reacquired 3,000 shares of its common stock at $54 per share. On August 3, Kick Off sold 1,700 of the reacquired shares at $57 per share. November 14, Kick Off sold the remaining shares at $53 per share. Journalize the transactions of May 27, August 3, and November 14. For a compound transaction, if an amount box does not require an entry, leave it blank. May 27 Aug. 3 Nov. 14arrow_forward

- Maxville Company issues 250 shares of $50 par preferred stock and 1,000 shares of $10 par common stock in a "package" sale on December 31. Total proceeds received amount to $39,700. Required: 1. 2. Record the transaction for each independent assumption shown: The common stock has a current market value of $19 per share; the current market value of preferred stock is not known. The common stock and the preferred stock have a current market value per share of $22 and $62, respectively.arrow_forwardMaxville Company issues 250 shares of $50 par preferred stock and 1,000 shares of $10 par common stock in a “package” sale on December 31. Total proceeds received amount to $39,700. Required: Record the transaction for each independent assumption shown: 1. The common stock has a current market value of $19 per share; the current market value of preferred stock is not known. 2. The common stock and the preferred stock have a current market value per share of $22 and $62, respectively.arrow_forwardWW Corp. resells 400 shares of its own common stock for $20 per share. WW had acquired these shares two months before for $14 per share. The resale of this stock would be recorded with a: Select one: a. Debit to Common Stock for $8,000 b. Credit to Additional Paid-In Capital for $800 c. Credit to Treasury Stock for $8,000 d. Credit to Additional Paid-In Capital for $2,400 e. Credit to Additional Paid-In Capital for $2,000arrow_forward

- Aylmer Inc paid $230 for a call to purchase 800 shares of Belmont Inc on April 1, Y3. The strike price was $28.50 per share and could be exercised anytime in the next 6 months. On April 1, Y3, the market price for one share of Belmont Inc. was $29.30. Belmont's stock price rose. On June 30, Y3, the price for Belmont stock was $36.10 per share. The fair value of the option on June 30, Y3 was $8,340. REQUIRED Prepare the appropriate entries under two different scenarios: 1) Aylmer exercised the option 2) Aylmer did not exercise the option (just the June 30th entry)arrow_forwardVaughn Corporation sold 390 shares of treasury stock for $55 per share. The cost for the shares was $45. The entry to record the sale will include a O credit to Treasury Stock for $21450. O credit to Paid-in Capital from Treasury Stock for $3900. O debit to Paid-in Capital in Excess of Par for $3900. O credit to Gain on Sale of Treasury Stock for $17550.arrow_forwardNebraska Inc. issues 5,000 shares of common stock for $160,000. The stock has a stated value of $12 per share. The entry to journalize the stock issuance would include a credit to Common Stock for Oa. $5,000 Ob. $60,000 Oc. $160,000 Od. $100,000 Otherarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education