FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

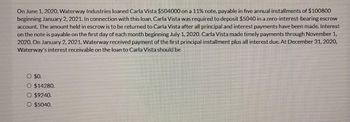

Transcribed Image Text:On June 1, 2020, Waterway Industries loaned Carla Vista $504000 on a 11% note, payable in five annual installments of $100800

beginning January 2, 2021. In connection with this loan, Carla Vista was required to deposit $5040 in a zero-interest-bearing escrow

account. The amount held in escrow is to be returned to Carla Vista after all principal and interest payments have been made. Interest

on the note is payable on the first day of each month beginning July 1, 2020. Carla Vista made timely payments through November 1,

2020. On January 2, 2021, Waterway received payment of the first principal installment plus all interest due. At December 31, 2020,

Waterway's interest receivable on the loan to Carla Vista should be

O $0.

O $14280.

O $9240.

O $5040.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- December 11, 2019, Hooper Inc. made a credit sale to Marshall Company and required Marshall to sign a $12,000, 60-day note. Prepare the journal entries necessary to record the receipt of the note by Hooper, the accrual of interest on December 31, 2019, and the customer’s repayment on February 9, 2020, assuming: 1. Interest of 12% was assessed in addition to the face value of the note. 2. The note was issued as a $12,000 non-interest-bearing note with a present value of $11,765. The implicit interest rate on the note receivable was 12%. Assume a 360-day year. (Round to the nearest dollar.)arrow_forwardOn February 10, 2021, after issuance of its financial statements for 2020, Sunland Company entered into a financing agreement with Cleveland Bank, allowing Sunland Company to borrow up to $8060000 at any time through 2023. Amounts borrowed under the agreement bear interest at 3% above the bank's prime interest rate and mature two years from the date of loan. Sunland Company presently has $3100000 of notes payable with Star National Bank maturing March 15, 2021. The company intends to borrow $4910000 under the agreement with Cleveland and liquidate the notes payable to Star National Bank. The agreement with Cleveland also requires Sunland to maintain a working capital level of $12050000 and prohibits the payment of dividends on common stock without prior approval by Cleveland Bank. From the above information only, the total short-term debt of Sunland Company as of the December 31, 2020 balance sheet date is $8060000. $0. $3990000. $3100000.arrow_forwardTolino Company signed a 5-year note payable on January 1, 2020, of $200,000. The note requires annual principal payments each December 31 of $40,000 plus interest of 6%. The entry to record the annual payment on December 31, 2021, includes:arrow_forward

- Greener Pastures Corporation borrowed $1,950,000 on November 1, 2021. The note carried a 9 percent interest rate with the principal and interest payable on June 1, 2022. (a) The note issued on November 1. (b) The interest accrual on December 31. Indicate the effects of the amounts for the above transactions.arrow_forwardThe following selected transactions relate to liabilities of United Insulation Corporation. United's fiscal year ends on December 31. 2024 January 13 Negotiated a revolving credit agreement with Parish Bank that can be renewed annually upon bank approval. The amount available under the line of credit is $27.0 million at the bank's prime rate. February 1 Arranged a three-month bank loan of $6.6 million with Parish Bank under the line of credit agreement. Interest at the prime rate of 13% was payable at maturity. May 1 Paid the 13% note at maturity. December 1 Supported by the credit line, issued $16.3 million of commercial paper on a nine - month note. Interest was discounted at Issuance at a 12% discount rate. December 31 Recorded any necessary adjusting entry(s). 2025 September 1 Paid the commercial paper at maturity. Required: Prepare the appropriate journal entries through the maturity of each liability.arrow_forward7) On December 1, 2022, Olympia Hot Yoga issued a note payable to Columbia Bank for $45,000 with an annual interest rate of 6% and a term of six months (due May 31, 2023). What is the amount of interest expense recognized by Olympia Hot Yoga in 2022? What is the amount of interest expense recognized by Olympia Hot Yoga in 2023? What is the total amount Olympia Hot Yoga will pay to Columbia Bank on the maturity date?arrow_forward

- On January 1, 2021, Eagle Company borrows $26,000 cash by signing a four-year, 8% installment note. The note requires four equal payments of $7,850, consisting of accrued interest and principal on December 31 of each year from 2021 through 2024. Prepare the journal entries for Eagle to record the note's issuance and each of the four payments. Note: Round your intermediate calculations and final answers to the nearest dollar amount.arrow_forwardOn January 1, 2025, Coronado Co. borrowed and received $150,000 from a major customer evidenced by a zero-interest-bearing note due in 4 years. As consideration for the zero-interest-bearing feature, Coronado agrees to supply the customer's inventory needs for the loan period at lower than the market price. The appropriate rate at which to impute interest is 9%. Prepare the journal entry to record the initial transaction on January 1, 2025. Prepare the journal entry to record any adjusting entries needed at December 31, 2025. Assume that the sales of Coronado's product to this customer occur evenly over the 4-year period and that the effective-interest method is used.arrow_forwardDaarrow_forward

- Flounder, Inc. issued a $115,000, 4-year, 12% note at face value to Flint Hills Bank on January 1, 2025, and received $115,000 cash. The note requires annual interest payments each December 31. Prepare Flounder's journal entries to record (a) the issuance of the note and (b) the December 31 interest payment.arrow_forwardOn June 1, 2021, Dirty Harry Co. borrowed cash by issuing a 6-month noninterest-bearing note with a maturity value of $430,000 and a discount rate of 7%. Assuming straight-line amortization of the discount, what is the carrying value of the note as of September 30, 2021? (Round all calculations to the nearest whole dollar amount.)arrow_forwardCampus Flights takes out a bank loan in the amount of $200,500 on March 1, 2019. The terms of the loan include a repayment of principal in ten equal installments, paid annually from March 1. The annual interest rate on the loan is 8%, recognized on December 31, the fiscal year-end date. The interest recognized for the first payment date as of December 31, 2019 is $13,267. The interest recognized for the year 2020 as of the first payment date is $16,040. The principal due on the first payment date, March 1, 2020 is $186,659. 1. Compute the interest recognized for the second payment date as of December 31, 2020. _______________ 2. Compute the total interest for the year 2020. __________ IMPORTANT: Please count your months carefully as the note's "year" crosses between two fiscal years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education