FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

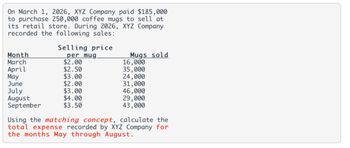

Transcribed Image Text:On March 1, 2026, XYZ Company paid $185,000

to purchase 250,000 coffee mugs to sell at

its retail store. During 2026, XYZ Company

recorded the following sales:

Month

March

April

May

June

July

August

September

Selling price

per mug.

$2.00

$2.50

$3.00

$2.00

$3.00

$4.00

$3.50

Mugs sold

16,000

35,000

24,000

31,000

46,000

29,000

43,000

Using the matching concept, calculate the

total expense recorded by XYZ Company for

the months May through August.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Neat Logos buys logo-imprinted merchandise and then sells it to university bookstores. Sales are expected to be $2,009,000 in September, $2,250,000 in October, $2,378,000 in November, and $2,560,000 in December. Neat Logos sets its prices to earn an average 30% gross profit on sales revenue. The company does not want inventory to fall below $440,000 plus 10% of the next month's cost of goods sold. Prepare a cost of goods sold, inventory, and purchases budget for the months of October and November.arrow_forwardCoparrow_forwardThe Wizz Electronics sells a variety of electronic devices including a variety of WIFI SMART camerabulbs. The business began the second quarter (April to June) of 2022 with 15 (V380PRO) camera bulbsat a total cost of $108,750. The following transactions relating to the “V380PRO” camera bulbs werecompleted during the quarter. April 7 90 bulbs were purchased at a cost of $6,850 each. In addition, the business paid freightcharges of $800 cash on each bulb to have the inventory shipped from the point ofpurchase to their warehouse. April 30 The sales for April were 75 bulbs which yielded total sales revenue of $803,250. (15 ofthese bulbs were sold on account to two longstanding customers of the business) May 6 A new batch of 80 bulbs was purchased at a total cost of $654,800 May 9 Upon inspection of the inventory purchased on May 6, five (5) of the bulbs were found tobe defective and were returned to the supplier. May 31 During the month 62 of the camera bulbs…arrow_forward

- q2: Junko Company manufactures financial calculators and produced 97,000 units during the year. The finished goods inventory was 1,260 units on January 1 and 1,040 units on December 31. The average unit cost is $118, what was the cost of goods manufactured and the cost of goods sold for the year? Please choose the correct option and show your calculation to validate your selection: A. $11,446,000 & $11,471,960 B. $10,839,680 & $11,446,000 C. $11,446,000 & $12,839,680 D. $10,888,240 & $11,446,000arrow_forwardEddie's Bar and Restaurant Supplies expects its revenues and payments for the first part of the year to be: Sales Purchases January $14,000 $18,000 February 20,000 21,300 March 26,000 19,100 April 22,000 22,400 May 18,000 14,700 Seventy percent of the firm's sales are on credit. Past experience shows that 40 percent of accounts receivable are collected in the month after sale, and the remainder is collected in the second month after sale. Prepare a schedule of cash receipts for March, April and May. Eddie's pays its payments in the following month. Eddie's had a cash balance of $2,000 on March 1, which is also its minimum required cash balance. There is an outstanding loan of $2,000 on March 1. Prepare a cash budget for March, April, and May. Can you provide the excel formulas used so then I can do it myself and learn as well, please.arrow_forwardEddie’s Galleria sells billiard tables. The company has the following purchases and sales for 2021. Date Transactions Units Unit Cost Total Cost January 1 Beginning inventory 150 $540 $ 81,000 March 8 Purchase 120 570 68,400 August 22 Purchase 100 600 60,000 October 29 Purchase 80 640 51,200 450 $260,600 Jan. 1–Dec. 31 Sales ($700 each) 400 Eddie is worried about the company’s financial performance. He has noticed an increase in the purchase cost of billiard tables, but at the same time, competition from other billiard table stores and other entertainment choices have prevented him from increasing the sales price. Eddie is worried that if the company’s profitability is too low, stockholders will demand he be replaced. Eddie does not want to lose his job. Since 60 of the 400 billiard tables sold have not yet been picked up by the customers as of December 31, 2021, Eddie decides incorrectly to include these tables in ending inventory. He appropriately includes…arrow_forward

- A merchandiser plans to sell 12,100 units next month at a selling price of $110 per unit. It also gathered the following cost estimates for next month: Cost Cost of goods sold Advertising expense Depreciation expense Shipping expense Administrative salaries Sales commissions Insurance expense Cost Formula $60 per unit sold. $150,000 per month $70,000 per month. $100,000 per month +$10 per unit sold $50,000 per month. 5% of sales $15,000 per month What is the estimated total contribution margin for next month?arrow_forwardEd’s Waterbeds has made the following sales projections for the next six months. All sales are credit sales. March $ 44,000 June $ 48,000 April 50,000 July 56,000 May 39,000 August 58,000 Sales in January and February were $47,000 and $46,000 respectively. Experience has shown that 5 percent of total sales are uncollectible, 40 percent are collected in the month of sale, 50 percent are collected in the following month, and 5 percent are collected two months after sale. a. Prepare a monthly cash receipts schedule for the firm for March through August. Ed’s WaterbedsCash Receipts Schedule January February March April May June July August Sales $ $ $ $ $ $ $ $ Collections of current sales Collections of prior month's sales Collections of sales 2 months earlier Total cash receipts $ $ $ $ $ $ b. Of the sales…arrow_forwardBelvedere Bricks manufactures bricks for the construction industry. It estimates that in June, it will sell 70,000 bricks at a retail price of $6.40 per brick. All sales are cash sales. Each brick costs $4.40 to produce. In addition, Belvedere Bricks estimates it will pay in cash $19,000 of general and administrative expenses. The opening cash balance on 1 June is $48,000.Calculate the ending cash balance for Belvedere Brick's cash budget for the month of June. Group of answer choices $121,000 $73,000 $140,000 $169,000 None of the other optionsarrow_forward

- Pelotoni Dips Inc. manufactures a single product that has become very popular in the Windsor area. The income statement for the most recent three months prior to taxes are as follows: Pelotini Dips Inc. Income Statement Quarterly Statement ending March 31, 2021 Q1 Q2 Q3 Q4 Sales in Units 4,400 4,000 5,000 4,600 Sales Revenues $440,000 $400,000 $500,000 $460,000 Less:COGS $264,000 $240,000 $300,000 $276,000 Gross Margin $176,000 $160,000 $200,000 $184,000 Less: Expenses Advertising $ 21,000 $ 21,000 $ 21,000 $ 21,000 Shipping $ 35,000 $ 34,000 $ 38,000 $ 36,000 Salaries and Commissions $ 83,000 $ 78,000 $ 90,000 $ 85,000 Insurance $ 6,000 $ 6,000 $ 6,000 $ 6,000 Depreciation $ 15,000 $ 15,000 $ 15,000 $ 15,000 Total Operating Expenses $160,000 $154,000 $170,000 $163,000 Net Income (before taxes) $ 16,000 $ 6,000 $ 30,000 $ 21,000…arrow_forwardBombs Away Video Games Corporation has forecasted the following monthly sales: January $ 114,000 July $ 59,000 February 107,000 August 59,000 March 39,000 September 69,000 April 39,000 October 99,000 May 34,000 November 119,000 June 49,000 December 137,000 Total annual sales = $924,000 Bombs Away Video Games sells the popular Strafe and Capture video game. It sells for $5 per unit and costs $2 per unit to produce. A level production policy is followed. Each month's production is equal to annual sales (in units) divided by 12. Of each month's sales, 20 percent are for cash and 80 percent are on account. All accounts receivable are collected in the month after the sale is made. Construct a monthly production and inventory schedule in units. Beginning inventory in January is 39,000 units. Note: Input all your answers as positive numbers. Prepare a monthly schedule of cash receipts. Sales in December before the planning year are $100,000. Prepare a cash payments…arrow_forwardCari Furniture has the following information in respect of Coffee tables for 2021: Production specifications: Beginning Inventory Target Ending Inventory Direct Materials: Particle board 20,000 b.f. 18,000 b.f. Teak 25,000 b.f. 22,000 b.f. Finished goods: Coffee tables 5,000 units 3,000 units Revenue expected for 2021 are: Selling price $392 per table Units sold 52,000 coffee tables Each coffee table requires 9.00 b.f. of particle board and 10.00 b.f. of Teak. Costs for 2020 and expected for 2021 include: 2020 2021 Particle board (per b.f.) $ 3.90 $ 4.00 Teak (per b.f.) $ 5.80 $ 6.00 Laminating labor (per hour) $24.00 $25.00 Machining labor (per hour) $29.00 $30.00 Prepare the materials usage budget.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education