FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

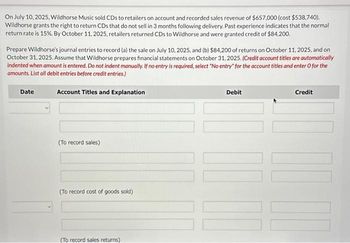

Transcribed Image Text:On July 10, 2025, Wildhorse Music sold CDs to retailers on account and recorded sales revenue of $657,000 (cost $538,740).

Wildhorse grants the right to return CDs that do not sell in 3 months following delivery. Past experience indicates that the normal

return rate is 15%. By October 11, 2025, retailers returned CDs to Wildhorse and were granted credit of $84,200.

Prepare Wildhorse's journal entries to record (a) the sale on July 10, 2025, and (b) $84,200 of returns on October 11, 2025, and on

October 31, 2025. Assume that Wildhorse prepares financial statements on October 31, 2025. (Credit account titles are automatically

indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Date

(To record sales)

(To record cost of goods sold)

(To record sales returns)

Debit

Credit

10 10 10

Transcribed Image Text:(To record cost of goods returned).

11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wally Co. began selling merchandise on November 1, 2022. The company offers a 50-day warranty for defective merchandise. Based on prior experience with similar merchandise, Wally Co. predicts that 2.80% of the units sold will encounter a fault within the warranty period, with a replacement or repair of a damaged unit costing an average of $30. In November, Wally Co. sold 25,000 units and 400 defective units were returned. In December, Wally Co. sold 32,000 units and 544 defective units were returned. The actual cost of replacing the defective units was $38,500. Prepare a journal entry to accrue for the estimated warranty costs for the November and December sales at December 31, 2022. Prepare one summary journal entry at December 31, 2022, to record the cost of replacing the defective merchandise returned during November and December. What amounts will be included in Wally Co.’s 2022 income statement and balance sheet at December 31, 2022, with regard to the warranty? Show steps…arrow_forwardPresented below are selected transactions of Pearl Restaurant for the month ending August 31, 2025. Pearl sells 80 gift cards at $78 per gift card and 55 of the gift cards are redeemed by year end. It is estimated that 10 of the gift cards will not be redeemed b. Pearl accepted a reservation for its private dining room for a rehearsal dinner in September. It received a security deposit of $300, which will be returned after the dinner is held. Prepare entries for the Pearl transactions. Of no entry is required, select "No Entry for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement. List oll debit entries before credit entries. Round Intermediate calculations to 2 decimal places, eg. 15.25% and final answers to O decimal places, eg. 5.125) Transaction Account Titles and Explanation Debit Date (To record the sale of 80 gift cards)…arrow_forwardDuring December, Far West Services makes a $3,600 credit sale. The state sales tax rate is 6% and the local sales tax rate is 2.5%. (Note: the sales tax amount is in addition to the credit sale amount.) Record sales and sales tax payable. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

- Sanjuarrow_forwardEvergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2021, the following transactions related to receivables occurred: Feb. 28 Sold merchandise to Lennox, Inc., for $20,000 and accepted a 6%, 7-month note. 6% is an appropriate rate for this type of note. Mar. 31 Sold merchandise to Maddox Co. that had a fair value of $15,040, and accepted a noninterest-bearing note for which $16,000 payment is due on March 31, 2022. Apr. 3 Sold merchandise to Carr Co. for $14,000 with terms 2/10, n/30. Evergreen uses the gross method to account for cash discounts. 11 Collected the entire amount due from Carr Co. 17 A customer returned merchandise costing $4,800. Evergreen reduced the customer’s receivable balance by $6,600, the sales price of the merchandise. Sales returns are recorded by the company as they occur. 30 Transferred receivables of $66,000 to a factor without recourse. The…arrow_forwardRecord journal entries for the following transactions of Wind Solutions.Jan. 1, 2018 Issued a $2,350,100 note to customer Solar Plex as terms of a merchandise sale. The merchandise’s cost to Wind Solutions is $1,002,650. Note contract terms included a 24-month maturity date, and a 2.1% annual interest rate.Dec. 31, 2018 Wind Solutions records interest accumulated for 2018.Dec. 31, 2019 Wind Solutions converts Solar Plex’s dishonored note into account receivable. This includes accumulated interest for the 24-month period.Mar. 8, 2020 Wind Solutions sells the outstanding debt from Solar Plex to a collection agency at 25% of the accounts receivable valuearrow_forward

- During February 2020, Buffalo Massage Ltd. sells $12,000 of gift cards for Valentine's Day gifts. From reliable past experience, management estimates that 10% of the gift cards sold will not be redeemed. By the end of February, $3,000 was redeemed by customers. Prepare the journal entries for Buffalo Massage for February 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forwardDuring its first year of operations, Fall Wine Tour earned net credit sales of $311,000. Industry experience suggests that bad debts will amount to 3% of net credit sales. At December 31, 2024, accounts receivable total $44,000. The company uses the allowance method to account for uncollectibles. Read the requirements. Requirement 1. Journalize Fall Wine Tour's Bad Debts Expense using the percent-of-sales method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 Requirement 2. Show how to report accounts receivable on the balance sheet at December 31, 2024. Balance Sheet (Partial): Current Assets:arrow_forwardOven Roasted sold $321,000 of consumer electronics during July under a two-year warranty. The cost to repair defects under the warranty is estimated at 5% of the sales price. On November 11, a customer was given $97 cash under terms of the warranty. Question Content Area a. Provide the journal entry for the estimated warranty expense on July 31 for July sales. If an amount box does not require an entry, leave it blank. Date Account Debit Credit July 31 Feedback Area Feedback Question Content Area b. Provide the journal entry for the November 11 cash payment. If an amount box does not require an entry, leave it blank. Date Account Debit Credit Nov. 11arrow_forward

- Help me selecting the right answer. Thank youarrow_forwardOn July 10, 2020, Bridgeport Music sold CDs to retailers on account and recorded sales revenue of $764.000 (cost $588,280) Bridgeport grants the right to return CDs that do not sell in 3 months following delivery, Past experience indicates that the normal return rate is 15%. By October 11, 2020, retailers returned CDs to Bridgeport and were granted credit of $78,200. Prepare Bridgeport's journal entries to record (a) the sale on July 10, 2020, and (b) $78,200 of returns on October 11, 2020, and on October 31, 2020. Assume that Bridgeport prepares financial statement on October 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter O for the amounts.) Account Titles and Explanation No. € (b) Date (To record sales) (To record cost of goods sold) (To record sales) (To record cost of goods sold) (To record sales returns) (To record cost of goods returned) Debit…arrow_forwardOn July 10, 2020, Cheyenne Music sold CDs to retailers on account and recorded sales revenue of $658,000 (cost $506, 660). Cheyenne grants the right to return CDs that do not sell in 3 months following delivery. Past experience indicates that the normal return rate is 15%. By October 11, 2020, retailers returned CDs to Cheyenne and were granted credit of $80,000. Prepare Cheyenne's journal entries to record (a) the sale on July 10, 2020, and (b) $80,000 of returns on October 11, 2020, and on October 31, 2020. Assume that Cheyenne prepares financial statement on October 31, 2020. (To record sales) (To record cost of goods) (To record sales returns) (To record cost of goods returned)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education