SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Not use

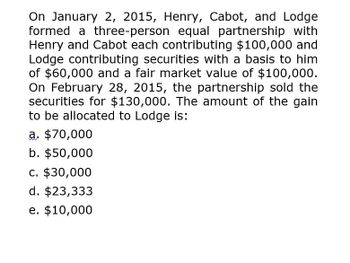

Transcribed Image Text:On January 2, 2015, Henry, Cabot, and Lodge

formed a three-person equal partnership with

Henry and Cabot each contributing $100,000 and

Lodge contributing securities with a basis to him

of $60,000 and a fair market value of $100,000.

On February 28, 2015, the partnership sold the

securities for $130,000. The amount of the gain

to be allocated to Lodge is:

a. $70,000

b. $50,000

c. $30,000

d. $23,333

e. $10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after Tatum receives a 10,000 salary and Brook receives a 15,000 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is: A. $40,000 B. $25,000 C. ($5,000) In addition, show the resulting entries to each partners capital account. Tatums capital account balance is $50,000 and Brooks is $60,000.arrow_forwardTHE NEXT ITEM(S) IS/ARE BASED ON THE FOLLOWINGOn January 1, 2017, AA and BB formed a partnership by contributing cash of P50,000 and P40,000,respectively. They have agreed to give AA 60% interest in capital and BB 50% interest in profit andlosses.Since January 1, 2017, the following events have occurred for the partnership:Event 1: On April 1, 2017, after charging the old partners’ capital their share from a loss of P15,000 forthe 1st quarter, CC was taken in as a partner by purchasing 20% partnership interest,proportionately from AA and BB as agreed among the partners. CC paid a total of P12,000 forthe purchased interest and was given a 20% interest in profits. The old partners have agreed tomaintain their old profit and loss ratios.Event 2: On July 1, 2017, to improve sales and profitability, the partnership merged with another firmowned by DD, after crediting the partners for a profit of P10,000 for the second quarter. DD’snet assets had a fair value of P30,000 when contributed and…arrow_forwardOn January 1, 2018, A, B and C formed ABC Partnership with original capital contribution of P600,000, P1,000,000 and P400,000. A is appointed as managing partner. Read the data below. What is A's share in partnership profit for 2018?arrow_forward

- 1. On May 1, 2019, Gonzaga and Balace formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. Gonzaga contributed a parcel of land that cost P10,000. Balace contributed P40,000 cash. The land was sold for P18,000 on May 1,2019, immediately after formation of the partnership. What amount should be recorded in Gonzaga's capital account on formation of the partnership? a. P15,000 b. P17,400 C. P10,000 d. P18,000arrow_forwardOn May 1, 2017, BJ and Paige formed a partnership. Each contributed assets with the following agreed-upon valuations. BJ Paige Cash 80,000 20,000 Equipment 50,000 60,000 Building 0 240,000 Loan payable 0 100,000arrow_forwardThe partnership of RRD and OBAMA began business on January 1, 2016. The following assets werecontributed by each partner (the noncash assets are stated at their fair values on January 1, 2016): RRD OBAMACash P30,000 P 20,000Inventories 50,000 -Land - 200,000Equipment 100,000 -The land was subject to a P65,000 mortgage, which the partnership assumed on January 1, 2016. Theequipment was subject to an instalment note payable that had an unpaid principal amount of P35,000 onJanuary 1, 2016. The partnership also assumed this note payable. According to the partnership agreement,each partner was to have a 50 percent capital interest on January 1, 2016 with total partnership capital beingP300,000. RRD and OBAMA agreed to share partnership income and losses in the following manner: RRD OBAMAInterest on beginning capital balances 4% 4%Salaries P15,000 P10,000Remainder 60% 40% During 2016, the following events occurred: Inventory was acquired at a cost of P30,000. At December 31, 2016, the…arrow_forward

- On May 1, 2020, Cruz and Ferrer formed a partnership with each contributing the following assets: Cruz Ferrer Cash P 30,000 P 70,000 Machinery and Equipment Building 25,000 75,000 225,000 Furniture and Fixtures 10,000 The building is subject to a mortgage loan of P90,000 which is to be assumed by the partnership. The partnership agreement provides that Cruz and Ferrer share profits and losses 30 percent and 70 percent, respectively. Assuming that the partner agreed to bring their respective capital in proportion to their respective profit and loss ratio, and using Ferrer's capital as the base, how much cash is to be invested by Cruz?arrow_forwardThe Prince-Robbins partnership has the following capital account balances on January 1, 2018: Prnce, Capital $95,000 Robbins, Capital 85,000 Prince is allocated 70 percentof all profits and losses with the remaining 30 percent assigned to Robbins after interest of 10 percent is given to each partner based on beginning capital balances. On January 2, 2018, Jeffrey invests $52,000 cash for a 20 percent interest in the partnership. This transaction is recorded by the goodwill method. After this transaction, 10 percent interest is still to go to each partner. Profits and losses will then be split as follows: Prince (50 percent), Robbins (30 percent), and Jeffrey (20 percent). In 2018, the partnership reports a net income of $24,000. a. Prepare the journal entry to record Jeffrey"s entrance into the partnership on January 2, 2018. b. Determine the allocation of income at the end of 2018.arrow_forwardThe Prince-Robbins partnership has the following capital account balances on January 1, 2018: Prince, Capital $ 150,000Robbins, Capital 110,000Prince is allocated 60 percent of all profits and losses with the remaining 40 percent assigned to Robbins after interest of 10 percent is given to each partner based on beginning capital balances. On January 2, 2018, Jeffrey invests $76,000 cash for a 20 percent interest in the partnership. This transaction is recorded by the goodwill method. After this transaction, 10 percent interest is still to go to each partner. Profits and losses will then be split as follows: Prince (50 percent), Robbins (30 percent), and Jeffrey (20 percent). In 2018, the partnership reports a net income of $36,000. Prepare the journal entry to record Jeffrey’s entrance into the partnership on January 2, 2018. Determine the allocation of income at the end of 2018.arrow_forward

- Griffin and Rhodes formed a partnership on January 1, 2022. Griffin contributed cash of P120,000 and Rhodes contributed land with a fair value of P160.000. The partnership assumed the mortgage on the land which amounted to P40,000 on January 1. Rhodes originally paid P90,000 for the land. On July 31, 2022, the partnership sold the land for P190,000. Assuming Griffin and Rhodes share profits and losses equally, how much of the gain from the sale of land should be credited to Griffin? O 30,000 15,000 O 35,000 12.857 3. Paul and Ray sell instruments through their partnership. To bring in additional funds and expertise, they decide to add Janet to the partnership. Paul's capital is P400,000, Ray's capital is P200,000, and Janet invested P180,000. It was agreed that Janet and Ray will have equal capital balances and Paul will have a 35% capital interest. Using the bonus method, what will be the adjusted capital of Paul? O 273,000 O 300,000 O 253,500 O 260,000arrow_forward1. On May 1, 2019, Gonzaga and Balace formed a partnershipandagreed to share profits and losses in the ratio of 3:7, respectively. Gonzaga contributed a parcel of land that cost P10,000. Balace contributed P40,000 cash. The land was sold for P18,000 on May 1,2019, immediately after formation of the partnership. What amount should be recorded in Gonzaga's capital account on formation of the partnership? a. P15,000 b. P17,400 P10,000 C. d. P18,000arrow_forwardThe Prince-Robbins partnership has the following capital account balances on January 1, 2024: Prince, Capital Robbins, Capital $ 105,000 95,000 Prince is allocated 60 percent of all profits and losses with the remaining 40 percent assigned to Robbins after interest of 7 percent is given to each partner based on beginning capital balances. On January 2, 2024, Jeffrey invests $58,000 cash for a 20 percent interest in the partnership. This transaction is recorded by the goodwill method. After this transaction, 7 percent interest is still to go to each partner. Profits and losses will then be split as follows: Prince (50 percent), Robbins (30 percent), and Jeffrey (20 percent). In 2024, the partnership reports a net income of $18,000. Required: a. Prepare the journal entry to record Jeffrey's entrance into the partnership on January 2, 2024. b. Prepare a schedule showing how the 2024 net income allocation to the partners should be determined. Complete this question by entering your answers…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT