FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

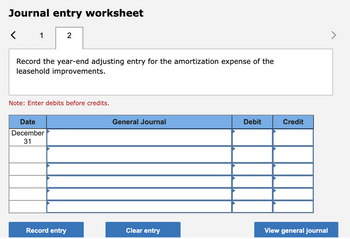

Transcribed Image Text:Journal entry worksheet

1

2

Record the year-end adjusting entry for the amortization expense of the

leasehold improvements.

Note: Enter debits before credits.

Date

December

31

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

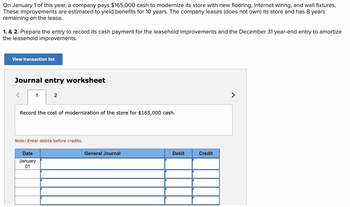

Transcribed Image Text:On January 1 of this year, a company pays $165,000 cash to modernize its store with new flooring, internet wiring, and wall fixtures.

These improvements are estimated to yield benefits for 10 years. The company leases (does not own) its store and has 8 years

remaining on the lease.

1. & 2. Prepare the entry to record its cash payment for the leasehold improvements and the December 31 year-end entry to amortize

the leasehold improvements.

View transaction list

Journal entry worksheet

1

2

Record the cost of modernization of the store for $165,000 cash.

Note: Enter debits before credits.

Date

January

01

General Journal

Debit

Credit

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vishnuarrow_forwardJelly Co. processes jam and sells it to the public. Jelly leases equipment used in its production processes from Squishy, Inc. This year, Jelly leases a new piece of equipment from Squishy. The lease term is 5 years and requires equal rental payments of $15,000 at the beginning of each year. In addition, there is a renewal option to allow Jelly to keep the equipment one extra year for a payment at the end of the fifth year of $10,000 (which Jelly is reasonably certain it will exercise). The equipment has a fair value at the commencement of the lease of $76,024 and an estimated useful life of 7 years. Squishy set the annual rental to earn a rate of return of 5%, and this fact is known to Jelly. The lease does not transfer title, does not contain a bargain purchase option, and the equipment is not of a specialized nature. Which of the 5 lease tests does the lease qualify as a finance lease for? Choose all that apply. Transfer of Ownership Test [Select ] Bargain Purchase Option Test […arrow_forward50) Crestfield leases office space. On January 3, the company incurs $15,000 to improve the leased office space. These improvements are expected to yield benefits for 10 years. Crestfield has 5 years remaining on its lease. What journal entry would be needed to record the expense for the first year related to the improvements? A) Debit Amortization Expense-Leasehold Improvements $1,500; credit Accumulated Amortization Leasehold Improvements $1,500. B) Debit Depletion Expense $3,000; credit Accumulated Depletion $3,000. C) Debit Depreciation Expense $1,500; credit Accumulated Depreciation $1,500. D) Debit Depletion Expense $15,000; credit Accumulated Depletion $15,000. E) Debit Amortization Expense-Leasehold Improvements $3,000; credit Accumulated Amortization Leasehold Improvements $3,000.arrow_forward

- Michael purchased a new piece of equipment to be used in its new facility. The $380,000 piece of equipment was purchased with a $57,000 down payment and with cash received through the issuance of a $323,000, 8%, 5-year mortgage payable issued on January 1, 2022. The terms provide for annual installment payments of $80,897 on December 31. Principal Reduction Year Period 1 2 January 1, 2022 Year 2022 Year 2023 Cash Paid 80,897 80,897 Interest Expense (8% Interest Rate) Note Payable Balance 323,000 Fill in the necessary blanks in the amortization table for YEARS 2022 and 2023. Do NOT use dollar signs or commas in your answer. (Round answers to 0 decimal places, e.g. 125.)arrow_forwardManufacturers Southern leasedhigh tech electronics equipment from international machines on January 1, 2024. international machines manufactured the equipment at a cost of $89,000. Manufacturers Southern's fiscal year ends December 31. Manufacturers Southern's fiscal year ends December 31. Lease term 2 years (8 quarterly periods) Quarterly rental payments $16,000 at the beginning of each period Economic life of asset 2 years Fair value of asset $117,590 Implicit interest rate 10% Required: 1. Show how International Machines determined the $16,000 quarterly lease payments. 2. Prepare appropriate entries for International Machines to record the lease at its beginning, January 1, 2024, and the second lease payment on April 1, 2024arrow_forwardGordon Inc., a private company that follows ASPE, entered into a lease agreement with Canada Leasing Corporation to lease a warehouse for six years. Annual lease payments are $21,000, payable at the beginning of each lease year. Gordon Inc. signed the lease agreement on January 1, 2021, and made the first payment on that date. At the end of the lease, the machine will revert back to Canada Leasing Corporation. The normal useful life of the warehouse is 10 years. At the time of the lease, the warehouse could be purchased for $108,000. Gordon does not know the implicit rate of the lease; Gordon's incremental borrowing rate is 10%. Gordon uses straight-line depreciation for this type of asset. Required: Using the three criteria under ASPE, prove whether this is an operating or capital lease. Prepare a lease amortization schedule for the lease. Round all amounts to the nearest dollar. Prepare the journal entries for 2021 and 2022 for Gordon Inc. Round amounts to the nearest…arrow_forward

- Crestfield leases office space. On January 3, the company incurs $26,000 to improve the leased office space. These improvements are expected to yield benefits for 10 years. Crestfield has 5 years remaining on its lease. What journal entry would be needed to record the expense for the first year related to the improvements?arrow_forwardRahularrow_forwardA saltwater disposal system is added to Lease A's gathering system at a cost of $225,000. Assume the following acquisition costs and monthly operating expense fro the motn of May 2018 is $30,000. Case A: The disposal system serves several wells on two different leases. There are 7 wells on lease A and 10 wells on Lease B. Case B: the disposal system serves only the wells on Lease A. Required: Record the acquisition cost and the monthly expenses.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education