FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

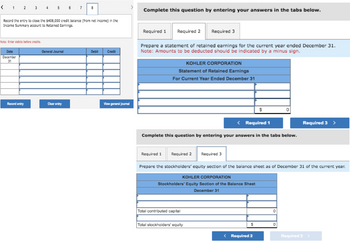

Transcribed Image Text:< 1 2 3 4 5 6

Record the entry to close the $408,000 credit balance (from net income) in the

Income Summary account to Retained Earnings.

Note: Enter debits before credits.

Date

December

31

Record entry

General Journal

7 8

Clear entry

Debit

Credit

View general Journal

Complete this question by entering your answers in the tabs below.

Required 1

Prepare a statement of retained earnings for the current year ended December 31.

Note: Amounts to be deducted should be indicated by a minus sign.

Required 2

Required 1

KOHLER CORPORATION

Statement of Retained Earnings

For Current Year Ended December 31

< Required 1

Complete this question by entering your answers in the tabs below.

Required 2

Required 3

Total contributed capital

Total stockholders' equity

Required 3

Prepare the stockholders' equity section of the balance sheet as of December 31 of the current year.

KOHLER CORPORATION

Stockholders' Equity Section of the Balance Sheet

December 31

$

S

< Required 2

0

Required 3 >

0

Required 3

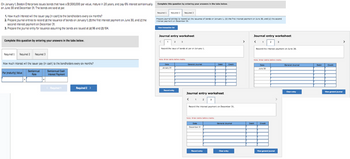

Transcribed Image Text:On January 1, Boston Enterprises issues bonds that have a $1,500,000 par value, mature in 20 years, and pay 6% interest semiannually

on June 30 and December 31. The bonds are sold at par.

1. How much interest will the issuer pay (in cash) to the bondholders every six months?

2. Prepare journal entries to record (a) the issuance of bonds on January 1, (b) the first interest payment on June 30, and (c) the

second interest payment on December 31.

3. Prepare the journal entry for issuance assuming the bonds are issued at (a) 96 and (b) 104.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

How much interest will the issuer pay (in cash) to the bondholders every six months?

Semiannual

Rate

Semiannual Cash

Interest Payment

Par (maturity) Value

< Required 1

Required 2 >

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare journal entries to record (a) the issuance of bonds on January 1, (b) the first interest payment on June 30, and (c) the second

interest payment on December 31.

View transaction

Journal entry worksheet

2

Required 3

Date

January 01

3

Record the issue of bonds at par on January 1.

Note: Enter debits before credits.

Record entry

General Journal

Note: Enter debits before credits.

Journal entry worksheet

< 1 2 3

Record the interest payment on December 31.

Dato

December 31

Debit

Record entry

Credit

General Journal

Clear entry

Journal entry worksheet

<

1

Debit

Record the interest payment on June 30.

Note: Enter debits before credits.

2

Date

June 30

Credit

View general journal

General Journal

Clear entry

Debit Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, Topeka Outfitters issued $175,000 of 6%, 3-year bonds when the market rate of interest was 10%. The bonds pay interest semiannually on June 30 and December 31. A. How much are the proceeds that Topeka Outfitters? will receive on the issue date of the bonds? B. Prepare an amortization table for the bond issue. C. If the bonds are retired at the end of Year 2 at 104.5% of the maturity value, how much gain or loss on retirement will be reported?arrow_forwardWhat would be the required journal entry on the date of issuance if a company issues $100,000 five-year, 10% bond for $103,769 and the interest is to be paid semiannually? debit cash, $100,000, and credit bond payable $100,000 debit cash $103,769, and credit bond payable $100,000 and credit premium on bonds payable $3,769 debit bonds payable $103,769 and debit discount on bonds payable $3,769, and credit cash $100,000 debit cash $103,769 and debit discount on bonds payable $3,769, and credit bonds payable $100,000arrow_forwardOn January 1, Shanghai Fashions issued $325,000 of 6%, 3-year bonds when the market rate of interest was 10%. The bonds pay interest semiannually on June 30 and December 31. A. How much are the proceeds that Shanghai Fashions Company will receive on the issue date of the bonds? B. Prepare an amortization table for the bond issue. C. If the bonds are retired at the end of Year 2 at 104.5% of the maturity value, how much gain or loss on retirement will be reported?arrow_forward

- answer in text form please (without image)arrow_forward1. Santos SA issues $300,000 in bonds dated January 1, 2022, due in five years with 9 percent interest payable annually on January 1. At the time of issue, the market rate for such bonds is 9percent.a) Illustrate the bond in line as principal invested and interest rate.b) Check the value of bound is it sold at par value.c) Register accounting transactions on journal entries.arrow_forwardOn Jan. 1, Year 1, Foxcroft Inc. issued 90 bonds with a face value of $1,060 for $99,400. The bonds had a stated rate of 5% and paid interest semiannually. What is the journal entry to record the first payment to the bondholders? If an amount box does not require an entry, leave it blank. Jun. 30 Interest Expense Interest Expense Cash Casharrow_forward

- On January 1, Innovative Solutions, Inc., issued $200,000 in bonds at face value. The bonds havea stated interest rate of 6 percent. The bonds mature in 10 years and pay interest once per year onDecember 31.Required:1. Prepare the journal entry to record the bond issuance.2. Prepare the journal entry to record the first interest payment on December 31. Assume nointerest has been accrued earlier in the year.3. Assume the bonds were retired immediately after the first interest payment at a quoted priceof 101. Prepare the journal entry to record the early retirement of the bonds.arrow_forwardOn the first day of the fiscal year, a company issues a $7,300,000, 8%, 10-year bond that pays semiannual interest of $292,000 ($7,300,000 × 8% × ½), receiving cash of $5,991,433. Journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank.arrow_forwardOn January 1, Topeka Outfitters issued $175,000 of 6%, 3-year bonds when the market rate of interest was 10%. The bonds pay interest semiannually on June 30 and December 31. How much are the proceeds that Topeka Outfitters? will receive on the issue date of the bonds?arrow_forward

- On January 1, Renewable Energy issues bonds that have a $42,000 par value, mature in six years, and pay 18% interest semiannually on June 30 and December 31. 1. Prepare the journal entry for issuance assuming the bonds are issued at (a) 99 and (b) 1031. 2. How much interest does the company pay (in cash) to its bondholders every six months if the bonds are sold at par? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry for issuance assuming the bonds are issued at (a) 99 and (b) 103½. View transaction listarrow_forwardDetermine the bond issue proceeds for each of the following bonds payable. All bonds are issued on January 1, 2023. a. Brandy Corporation issued bonds in the amount of $1,290,000 that will be paid in 3 years. Interest of $38,700 is payable semiannually each June 30 and December 31 with the first interest payment at the end of the first period on June 30, 2023. If the market rate of interest is 10%, what is the amount of the bond issue proceeds? (Use the present value and future value tables, a financial calculator, or a spreadsheet for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answer to the nearest cent, $X.XX.) B. Tandy Corporation issued bonds in the amount of $4,400,000 that will be paid in nine years. Interest of $132,000 is payable semiannually each June 30 and December 31 with the first interest payment at the end of the first period on June 30,…arrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education