FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

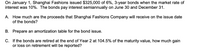

Transcribed Image Text:On January 1, Shanghai Fashions issued $325,000 of 6%, 3-year bonds when the market rate of

interest was 10%. The bonds pay interest semiannually on June 30 and December 31.

A. How much are the proceeds that Shanghai Fashions Company will receive on the issue date

of the bonds?

B. Prepare an amortization table for the bond issue.

C. If the bonds are retired at the end of Year 2 at 104.5% of the maturity value, how much gain

or loss on retirement will be reported?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CCI Inc. has a 9.85% bond that mature on March 15, 2034. Assume that the interest on these bonds is paid quarterly. With a face value of $1,000, what would the bond price be as of March 15, 2024 to an investor who holds the bond until maturity and requires an 10.25% rate of return?arrow_forwardSuppose Home Depot issues 30-year bonds on which it pays a 4.00% (nominal) interest rate. Further, suppose that both Home Depot and the purchasers of its bonds anticipate inflation will average 2.00% during the life of the loan. Now suppose the inflation rate after the loan is made (i.e. after the bond is purchased) is actually 1.00% per annum. It follows that the actual real rate of interest is and, ceteris paribus, are (is) better off than anticipated as a result of the difference between the anticipated and the actual rate of inflation. Select one: a. 2.00%, Bondholders b. 2.00%, Home Depot O c. 3.00%, Bondholders d. 3.00%, Home Depotarrow_forwarda) What factors should be considered in determining the issue price of a debenture. b) On 1 July 2018 Bombo Ltd issues $2 million in six-year debentures that pay interest each six months at a coupon rate of 8 per cent. At the time of issuing the securities, the market requires a rate of return of 6 per cent. Interest expense is determined using the effective-interest method. Required: (i) (ii) Determine the issue price of the debenture. Provide the journal entries at: 1 July 2018, 30 June 2019, & 30 June 2020.arrow_forward

- Company I issues a $40,000,000 bond on January 1, 2020 with a coupon rate of 7%. The present value of the bond is $37,282,062 and the market rate of interest was 8%. The bond has a 10-year life and will make semiannual interest payments and will use the straight line amortization method. A) Is the bond issued at a face value, a discount, or premium? B) What is the amount of the semi-annual interest payments? C) What is the amount that will be recorded to interest expense each time an interest payment is made? D) What is the carrying value of the bond on December 31, 2021?arrow_forwardHow do I Prepare a journal entry for a bond to record the installment payment and any interest. with an effective interest rate for the bond is 14% per year? Is this the correct way below? Credit Cash Debit Mortgage payable Debit Interest Payable Credit Casharrow_forwardDetermine the price of a $1.3 million bond issue under each of the following independent assumptions: Maturity 11 years, interest paid annually, stated rate 10%, effective (market) rate 12%. Maturity 11 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. Maturity 11 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. Maturity 9 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. Maturity 9 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%.arrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardWeek 2a) What factors should be considered in determining the issue price of a debenture. b) On 1 July 2018 Bombo Ltd issues $2 million in six-year debentures that pay interest each six months at a coupon rate of 8 per cent. At the time of issuing the securities, the market requires a rate of return of 6 per cent. Interest expense is determined using the effective-interest method.Required:(i) Determine the issue price of the debenture.(ii) Provide the journal entries at: 1 July 2018, 30 June 2019, & 30 June 2020arrow_forwardAssume that a 5-year bond pays interest of $90 once a year (1 payment / year) and will mature for $1,000. Also assume that the yield to maturity on this bond is currently 10 percent. Given this information, determine the duration of this bond. Enter your answer in decimal format, truncated to 2 decimal places. For example, if your answer is 7.1186 years, enter "7.11".arrow_forward

- A bond matures in 20 years, at which time it pays the owner $1,000. It also pays $70 at the end of each of the next 20 years. If similar bonds are currently yielding 7%, what is the market value of the bond? Select one:cannot be determined from the information givenexactly $1,000under $1,000over $1,000arrow_forwardon Assume that you purchase a 30-year stripped bond with a $100,000 face value. The current bond price is $9,937.73 and the yield is 8%. Calculate the interest revenue during the first year of holding the bond. Calculate amounts to nearest dollar, no $. Answer:arrow_forwardThe stated rate is 5%; the market rate is 4%. The future value of Bonds payable is $1,000. When calculating the PV of the bonds what amount would you use as the annuity or annual payment? $40 $10 E $50 $90 $100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education