FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

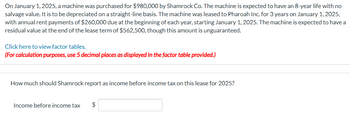

Transcribed Image Text:On January 1, 2025, a machine was purchased for $980,000 by Shamrock Co. The machine is expected to have an 8-year life with no

salvage value. It is to be depreciated on a straight-line basis. The machine was leased to Pharoah Inc. for 3 years on January 1, 2025,

with annual rent payments of $260,000 due at the beginning of each year, starting January 1, 2025. The machine is expected to have a

residual value at the end of the lease term of $562,500, though this amount is unguaranteed.

Click here to view factor tables.

(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

How much should Shamrock report as income before income tax on this lease for 2025?

Income before income tax

$

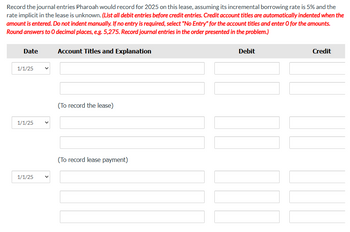

Transcribed Image Text:Record the journal entries Pharoah would record for 2025 on this lease, assuming its incremental borrowing rate is 5% and the

rate implicit in the lease is unknown. (List all debit entries before credit entries. Credit account titles are automatically indented when the

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.

Round answers to O decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.)

Date

1/1/25

1/1/25

1/1/25

Account Titles and Explanation

(To record the lease)

(To record lease payment)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 2, 2021, Morales Paint Company purchased a truck that cost $60,000 with a residual value of $2,500. The expected useful life of the truck is 4 years and 100,000 miles. It is expected to be driven 13,000 miles in the first year; 40,000 miles the second year; 27,000 miles in the third year and 20,000 miles in the fourth year. A. Prepare a depreciation schedule for the asset’s entire useful life using each of the following methods: Straight Line Production (Units of Production) Double Declining Balance B. Prepare the journal entry to record depreciation expense for year 2 for each of the Depreciation Methods (a total of 3 journal entries). C. Assume that the company decided to sell the equipment in year 3 for $15,000 in cash. Prepare the required journal entry for each of the Depreciation Methods (a total of 3 journal entries).arrow_forwardOn January 1, 2025, a machine was purchased for $1,040,000 by Metlock Co. The machine is expected to have an 8-year life with no salvage value. It is to be depreciated on a straight-line basis. The machine was leased to Ivanhoe Inc. for 3 years on January 1, 2025, with annual rent payments of $260,000 due at the beginning of each year, starting January 1, 2025. The machine is expected to have a residual value at the end of the lease term of $562,500, though this amount is unguaranteed. Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) (a) Your answer is correct. How much should Metlock report as income before income tax on this lease for 2025? Income before income tax $ (b) eTextbook and Media List of Accounts Date 130,000 Record the journal entries Ivanhoe would record for 2025 on this lease, assuming its incremental borrowing rate is 5% and the rate implicit in the lease is unknown. (List all debit entries…arrow_forward[The following information applies to the questions displayed below] On January 1, 2024, the Excel Delivery Company purchased a delivery van for $33,000. At the end of its five-year service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 100,000 miles. Required: Calculate annual depreciation for the five-year life of the van using each of the following methods. 1. Straight line. Answer is complete but not entirely correct. Straight-line $ 30,000 per yeararrow_forward

- Coronado Manufacturing purchased a machine on January 1, 2023 for use in its factory. Coronado paid $512,000 for the machine and estimated that it had a useful life of 10 years, at the end of which time the machine was expected to have a residual value of $50,000. During its life, the machine was expected to produce 280,000 units. During 2023, the machine produced 31,500 units, and produced 42,600 in 2024. The machine was subject to a 20% CCA rate, and Coronado's year-end was December 31. The machine is eligible for the Accelerated Investment Incentive.arrow_forwardBlossom Company purchased a large piece of equipment on October 1, 2023. The following information relating to the equipment was gathered at the end of October: Price Credit terms $40,000 2/10, n/30 Engineering costs $3,000 Maintenance costs during regular production operations $6,000 It is expected that the equipment could be used for 12 years, after which the salvage value would be zero. Blossom intends to use the equipment for only 10 years, however, after which it expects to be able to sell it for $2,600. The equipment was delivered on October 1 and the invoice for the equipment was paid on October 9, 2023. Blossom uses the calendar year to prepare financial statements. Blossom follows IFRS for financial statement purposes. (a) Calculate the depreciation expense for the years indicated using the following methods. (Do not round intermediate calculations. Round final answers to 0 decimal places, e.g. 5,275.) 1. Straight-line method for 2023 $ 2. Sum-of-the-years'-digits method for…arrow_forwardBucker Company purchased a fabrication machine on January 1, 2020 for $55,000. The machine is expected to have an estimated useful of 5 years or 100,000 units produced. The machine is expected to have a residual value of $5,000 after the five years of use. a. Calculate the amount of depreciation each year using the straight-line method. b. Calculate the depreciation each year using the units-of-production method given the following usage: 2020: 22,000 units; 2021: 23,000 units; 2022: 21,000 units; 2023: 19,000 units; 2024: 15,000 units c. Calculate the depreciation each year using the double-declining balance method. d. Which of the three methods results in the lowest net income for 2021? e. Which of the three methods resuls in the lowest net income for 2024?arrow_forward

- Beats Corporation constructed a machine at a total cost of $206 million. Construction was completed at the end of 2020 and the machine was placed in service at the beginning of 2021. The machine was being depreciated over a 10-year life using the sum - of-the- yearsdigits method. By that method, accumulated depreciation at the end of 2023 is $972 milion. The residual value is expected to be $8.0 million. At the beginning of 2024, Beats decided to change to the straight-line method. Ignoring income taxes, what will be Beats's depreciation expense for 2024? Do not round intermedlate calculations. $14.4 million $27.2 million $5.4 million $16.2 millionarrow_forwardThis company purchased a semitruck at the beginning of 2021 at a cost of $100,000. The truck had an estimated life of 5 years and an estimated residual value of $20,000 and will be depreciated using the straight-line method. On January 1, 2023, the company made major repairs of $30,000 to the truck that extended its remaining useful life. Thus, starting with 2023, the truck has a remaining life of 5 years and a new salvage value of $8,000. What amount should be recorded as depreciation expense each year starting in 2023?arrow_forwardRufiel Corporation purchased a new machine on JULY 1, 2020. The machine cost $40,000 and had an estimated salvage value of $4,000. (NOTE THE PURCHASE DATE IS JULY 1, 2020) Inverness estimated that the machine will have a useful life of 6 years or 100,000 units. Inverness uses the machine in its manufacturing operations and produces 20,000 units in Year 1, 33,000 units in Year 2 and 19,000 units in Year 3, 17,000 units in Year 4 and 6,000 units in Year 5 and 5,000 units in Year 6. b) Indicate what is the balance of Accumulated Depreciation at the end of each year using the Units-of-Production Methodarrow_forward

- Tamarisk Corp. (TC) purchased a building in early January 2020, and classified the cost of the basic structure of $128,000 in an account called Buildings. TC accounts for this class of asset using the revaluation model, revalues the class every three years, and uses straight-line depreciation. The building structure is expected to have a useful life of 25 years with no residual value. TC has a December 31 fiscal year end. The asset's fair value at December 31, 2022, is $114,540. (a1) Calculate TC's depreciation for the first three years. TC's annual depreciation $ Save for Later 2020 2021 2022 Attempts: 0 of 1 used Submit Answerarrow_forwardWildhorse Corporation bought a machine on June 1, 2023, for $36,600, f.o.b. the place of manufacture. Freight to the point where it was set up was $240, and $560 was expended to install it. The machine’s useful life was estimated at 10 years, with a salvage value of $2,950. On June 1, 2024, an essential part of the machine is replaced, at a cost of $2,430, with one designed to reduce the cost of operating the machine. The cost of the old part and related depreciation cannot be determined with any accuracy.On June 1, 2027, the company buys a new machine of greater capacity for $41,300, delivered, trading in the old machine which has a fair value and trade-in allowance of $23,600. Preparing the old machine for removal from the plant cost $89, and expenditures to install the new one were $1,770. It is estimated that the new machine has a useful life of 10 years, with a salvage value of $4,720 at the end of that time. (The exchange has commercial substance.)Assuming that depreciation is to…arrow_forwardOn January 1, 2018, Hobart Mfg. Co. purchased a drill press at a cost of $21,900. The drill press is expected to last 10 years and has a residual value of $5.100. During its 10- year life, the equipment is expected to produce 500,000 units of product. In 2018 and 2019, 20,500 and 75,000 units, respectively, were produced. Required: Compute depreciation for 2018 and 2019 and the book value of the drill press at December 31, 2018 and 2019, assuming the units-of-production method is used. (Round depreciation per unit to 2 decimal places.) 2018 2019 Depreciation Book Valuesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education