FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

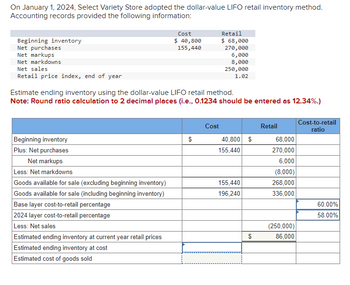

Transcribed Image Text:On January 1, 2024, Select Variety Store adopted the dollar-value LIFO retail inventory method.

Accounting records provided the following information:

Beginning inventory

Net purchases

Net markups

Net markdowns

Net sales

Retail price index, end of year

Beginning inventory

Plus: Net purchases

Net markups

Less: Net markdowns

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

Base layer cost-to-retail percentage

2024 layer cost-to-retail percentage

Less: Net sales

Cost

$ 40,800

155,440

Estimate ending inventory using the dollar-value LIFO retail method.

Note: Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.)

Estimated ending inventory at current year retail prices

Estimated ending inventory at cost

Estimated cost of goods sold

$

Retail

$ 68,000

270,000

6,000

8,000

250,000

1.02

Cost

40,800 $

155,440

155,440

196,240

$

Retail

68,000

270,000

6,000

(8,000)

268,000

336,000

(250,000)

86,000

Cost-to-retail

ratio

60.00%

58.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide answer in text (Without image)arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forwardpp. Subject :- Accountingarrow_forward

- You have the following information for Bramble Inc. for the month ended June 30, 2022. Bramble uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $31 June 4 Purchase 135 34 June 10 Sale 110 61 June 11 Sale return 15 61 June 18 Purchase 55 37 June 18 Purchase return 10 37 June 25 Sale 65 67 June 28 Purchase 35 41arrow_forwardPlease help with Question Aarrow_forwardOn August 31, 2010, Harvey Co. decided to change from the FIFO periodic inventory system to the weightedaverage periodic inventory system. Harvey is on a calendar year basis. The cumulative effect of the change is determineda. As of January 1, 2010.b. As of August 31, 2010. c. During the eight months ending August 31, 2010, by a weighted-average of the purchases.d. During 2010 by a weighted-average of the purchases.arrow_forward

- You have the following information for Ivanhoe Inc. for the month ended October 31, 2025. Ivanhoe uses a periodic system for inventory. Date Oct. 1 Oct. 9 Oct. 11 Oct. 17 Oct. 22 Oct. 25 Oct. 29 (a1) (a2) Description Beginning inventory Purchase Sale Purchase Sale Purchase Sale Ending inventory $ Cost of goods sold Gross profit Units Unit Cost or Selling Price $26 +A 55 - Your answer is partially correct. $ 140 tA 100 1.LIFO. 2. FIFO. 3. Average-cost. (Round answers to O decimal places, e.g. 125.) 100 55 65 110 Calculate ending inventory, cost of goods sold, and gross profit under each of the following methods. LIFO 2424 7841 4034 $ $ 28 $ 45 29 50 31 50 FIFO 2885 7380 5370 i +A tA $ LA AVERAGE-COST 2580 7685 4190arrow_forwardRapid Resources, which uses the FIFO inventory costing method, has the following account balances at July 31, 2025, prior to releasing the financial statements for the year: Merchandise Inventory, ending $ Cost of Goods Sold Net Sales Revenue Date 16,500 71,000 122,000 Jul. 31 Requirement 1. Prepare any adjusting journal entry required from the given information. (Record debits first, then credits. Select the explanation on the last line of the journal entry. For situations that do not require an entry, make sure to select "No entry required" in the first cell in the "Accounts" column and leave all other cells blank.) Accounts and Explanation Credit Rapid has determined that the current replacement cost (current market value) of the July 31, 2025, ending merchandise inventory is $13,500. Read the requirements. Debit 4arrow_forwardsanjayarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education