FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

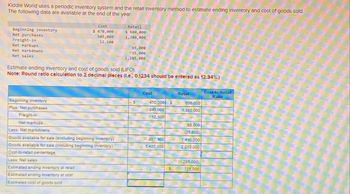

Transcribed Image Text:Kiddie World uses a periodic Inventory system and the retall Inventory method to estimate ending Inventory and cost of goods sold.

The following data are available at the end of the year.

Beginning inventory

Net purchases

Freight-in

Net markups

Net markdowns

Net sales

Cost

$470,000

945,000

12,100

Retail

$ 600,000

1,380,000

65,000

35,000

1,285,000

Estimate ending inventory and cost of goods sold (LIFO).

Note: Round ratio calculation to 2 decimal places (l.e., 0.1234 should be entered as 12.34%.)

Beginning inventory

Cost

Retail

Cost-to-Retail

Ratio

$

470,000 $

945,000

600,000

1,380,000

Plus: Net purchases

Freight-in

Net markups

Less: Net markdowns

12.100

65.000

(35,000)

Goods available for sale (excluding beginning Inventory)

957,100

1,410,000

Goods available for sale (including beginning Inventory)

1,427.100

2,010,000

Cost-to-retail percentage

Less: Net sales

Estimated ending inventory at retail

(1.285.000)

S

725,000

Estimated ending inventory at cost

Estimated cost of goods sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kiddie World uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the quarter ending September 30, 2021: Cost Retail Beginning inventory $ 460,000 $ 590,000 Net purchases 940,000 1,370,000 Freight-in 52,700 Net markups 64,000 Net markdowns 34,000 Net sales 1,280,000 Estimate ending inventory and cost of goods sold using the conventional method.arrow_forwardKiddie World uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the quarter ending September 30, 2021:Cost Retail Beginning inventory $ 320,000 $ 465,000 Net purchases 863,000 1,230,000 Freight-in 24,500 Net markups 50,000 Net markdowns 20,000 Net sales 1,210,000 please answer do not image formatarrow_forwardThe records of Earthly Goods provided the following Information for the year ended December 31, 2020. At Cost At Retail $ 521, 35e $ 977,150 4,138, 245 January 1 beginning inventory 6,448, 700 129, 350 5,595,700 49,600 Purchases Purchase returns Sales 62, 800 Sales returns Requlred: 1. Prepare an estimate of the company's year-end inventory by the retall method. (Round all calculations to two decimal places.) EARTHLY GOODS Estimated Inventory December 31, 2020 At Cost At Retail Goods available for sale: Goods available for sale Cost to retail ratio Estimated ending inventory at costarrow_forward

- Kiddie World uses a periodic inventory system and the retail Inventory method to estimate ending inventory and cost of goods sold. The following data are available at the end of the year. Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales Cost $ 380,000 895,000 68,200 Beginning inventory Plus. Net purchases Freight-in Net markups Goods available for sale Less: Net markdowns Goods available for sale Cost-to-retail percentage Less: Net sales Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold Retail $ 520,000 1,290,000 Estimate ending Inventory and cost of goods sold using the conventional method. Note: Round ratio calculation to 2 decimal places (1.e., 0.1234 should be entered as 12.34%.) $ 56,000 26,000 1,240,000 Cost 380,000 $ 895,000 68,200 1,343,200 $ Retail 520,000 1,290,000 56,000 1,866,000 (26,000) 1,840,000 (1,240,000) 600,000 Cost to Retail Ratio 4arrow_forwardKiddie World uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the quarter ending September 30, 2021: Cost Retail Beginning inventory $ 320,000 $ 465,000 Net purchases 863,000 1,230,000 Freight-in 24,500 Net markups 50,000 Net markdowns 20,000 Net sales 1,210,000 Estimate ending inventory and cost of goods sold using the conventional method. (Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.))arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forward

- Laura's Department Store uses the average cost retail inventory method to determine its ending inventory. The accounting records for the current year for Laura's contained the following information: Cost Retail Purchases $71,200 $87,750 Beginning inventory 17,000 23,500 Sales 98,000 Net markups 6,500 Net markdowns 3,000 In addition, the accounting records for Laura's disclosed that purchases returns at cost and retail were $1,950 and $4,250, respectively. What is the cost-to-retail percentage to be used for ending inventory calculations? A 76.8% B 79.8% C 78.1% D 75.1%arrow_forwardYou have the following information for Bramble Inc. for the month ended June 30, 2022. Bramble uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $31 June 4 Purchase 135 34 June 10 Sale 110 61 June 11 Sale return 15 61 June 18 Purchase 55 37 June 18 Purchase return 10 37 June 25 Sale 65 67 June 28 Purchase 35 41arrow_forwardDetermine the Ending Inventory and Gross Profit using FIFO and LIFO for the quarter ending 3/31/XX for Company W (a widget reseller) based on the following information (Inventory on 1/14/XX = 0): Action Date Amount Cost Purchase 1/15/XX 150 Widgets $10 per Widget Purchase 2/15/XX 250 Widgets $11 per Widget Purchase 3/15/XX 600 Widgets $12 per Widget Total 1,000 Widgets Sell 3/20/XX 400 Widgets $20 per Widget Sell 3/25/XX 300 Widgets $20 per Widget 700 Widgets FIFO Inventory = LIFO Inventory = FIFO Gross Profit = LIFO Gross Profit =arrow_forward

- On June 30, Cullumber Fabrics has the following data pertaining to the retail inventory method. Goods available for sale: at cost $49,920, at retail $64,000; net sales $51,200; and ending inventory at retail $12,800. Compute the estimated cost of the ending inventory using the retail inventory method. Estimated cost of ending inventory $arrow_forwardsanjayarrow_forwardGiven the following, calculate: Cost of goods available for sale, the ending inventory at retail, the estimated cost of goods sold and estimated ending inventory using the gross profit method. Cost Beginning inventory: $ 29,000.00 Net Purchases: $ 3,900.00 Net sales at retail: $ 17,000.00 Gross profit on sale: 55% Required: Using the information above complete the highlighted cells in the chart: Cost of goods available for sale: Ending inventory at retail: Estimated cost of goods sold: Estimated ending inventory:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education