FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

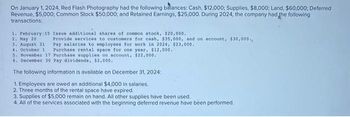

Transcribed Image Text:On January 1, 2024, Red Flash Photography had the following balances: Cash, $12,000; Supplies, $8,000; Land, $60,000; Deferred

Revenue, $5,000; Common Stock $50,000; and Retained Earnings, $25,000. During 2024, the company had the following

transactions:

1. February 15 Issue additional shares of common stock, $20,000.

2. May 20

3. August 31

4. October 1

Provide services to customers for cash, $35,000, and on account, $30,000.

Pay salaries to employees for work in 2024, $23,000.

Purchase rental space for one year, $12,000.

5. November 17 Purchase supplies on account, $22,000.

6. December 30 Pay dividends, $2,000..

The following information is available on December 31, 2024:

1. Employees are owed an additional $4,000 in salaries.

2. Three months of the rental space have expired.

3. Supplies of $5,000 remain on hand. All other supplies have been used.

4. All of the services associated with the beginning deferred revenue have been performed.

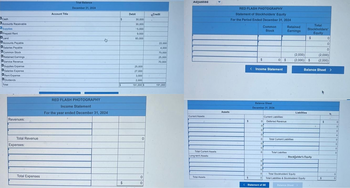

Transcribed Image Text:Cash

Accounts Receivable

Supplies

Prepaid Rent

Land

Accounts Payable

Salaries Payable

Common Stock

Retained Earnings

Service Revenue

Supplies Expense

Salaries Expense

Rent Expense

Dividends

Total

Revenues:

Total Revenue

Expenses:

Total Expenses

Account Title

Trial Balance

December 31, 2024

RED FLASH PHOTOGRAPHY

Income Statement

For the year ended December 31, 2024

S

$

$

Debit

30,000

30,000

$5.000

9,000

60,000

25,000

27,000

3,000

2,000

191,000 $

0

0

0

>Credit

22,000

4,000

70,000

25,000

70,000

191,000

Aajustea

Current Assets:

Total Current Assets

Long-term Assets:

Total Assets

Assets

RED FLASH PHOTOGRAPHY

Statement of Stockholders' Equity

For the Period Ended December 31, 2024

$

$

$

<Income Statement

Balance Sheet

December 31, 2024

Current Liabilities:

0 Deferred Revenue

of

0

a

0

0

0

0

0

Common

Stock

0

0

0

0

0

0

0 $

< Statement of SE

Retained

Earnings

Total Current Liabilities

Total Liabilites

Total

Stockholders'

Equity

(2,000)

(2,000) $

Liabilities

$

Total Stockholders' Equity

Total Liabilities & Stockholders' Equity

Balance Sheet >

Stockholder's Equity

Balance Sheet >

4

0

$

0

(2,000)

(2,000)

$

0

0

0

0

0

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Summit Apparel has the following accounts at December 31: Common Stock, $1 par value, 1,400,000 shares issued; Additional Paid-in Capital, $17.40 million; Retained Earnings, $10.40 million; and Treasury Stock, 54,000 shares, $1.188 million. Prepare the stockholders' equity section of the balance sheet. (Amounts to be deducted should be indicated by a minus sign. Enter your answer in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) SUMMIT APPAREL Balance Sheet (Stockholders' Equity Section) December 31 Stockholders' equity: Total Paid-in Capital Total Stockholders' Equityarrow_forwardThe following selected transactions occurred during Trio Networks Corporation’s first year of operations: 2020 Jan. 15 Issued 2,000 common shares to the corporation’s promoters in exchange for their efforts in creating it. Their efforts are estimated to be worth $32,000. Feb. 21 17,500 common shares were issued for cash of $13 per share. Mar. 9 6,000 preferred shares were issued for cash totalling $113,100. Aug. 15 55,000 common shares were issued in exchange for land, building, and equipment with appraised values of $320,000, $425,000, and $117,000, respectively. Required:Prepare journal entries.arrow_forwardA company issues 50,000 shares of common stock to retire 15-year bonds payable. This transaction would be reported on the statement of cash flows in O a. the cash flows from investing activities section O b. the cash flows from operating activities section O c. a separate section at the bottom O d. the cash flows from financing activities sectionarrow_forward

- Please help me with this (:arrow_forwardSubject: accountingarrow_forward31. Closed the credit balance of the income summary account, $269,400. 2. Journalize the entries to record the transactions, and post to the eight selected Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. listed. Also prepare T accounts for the following: Paid-In Capital from Sale cf July 1. Declared a 4% stock dividend on common stock, to be capitalized at the 1. Enter the January 1 balances in T accounts for the stockholders' equity accounts FROBLEM 12-4B Btries for selected oporate transactions Objectives 4, 5, 7, 8 Shoshone Enterprises Inc. manufactures bathroom fixtures. The stockholders' equity accounts of Shoshone Enterprises Inc., with balances on January 1, 2006, are as follows: Common Stock, $20 stated value (100,000 shares authorized, 75,000 shares issued) Paid-In Capital in Excess of Stated Value Retained Earnings.. Treasury Stock (5,000 shares, at cost) $1,500,000 180,000 725,000 140,000 ADNET ASS The following selected transactions occurred…arrow_forward

- Newly formed S&J Iron Corporation has 143,000 shares of $7 par common stock authorized. On March 1, Year 1, S&J Iron issued 12,000 shares of the stock for $10 per share. On May 2, the company issued an additional 23,500 shares for $22 per share. S&J Iron was not affected by other events during Year 1. Required a. Record the transactions in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. b. Determine the amount S&J Iron would report for common stock on the December 31, Year 1, balance sheet. c. Determine the amount S&J Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would S&J Iron report on the December 31, Year 1, balance sheet? Complete this question by entering your answers in the tabs below. Req A…arrow_forwardSpicer Inc. showed the following alphabetized list of adjusted account balances at December 31, 2023. Assume that the preferred shares are non-cumulative. Accounts Payable Accounts Receivable Accumulated depreciation, Equipment Accumulated depreciation, Warehouse Cash Cash Dividends Common Shares Equipment Income Tax Expense Land Notes Payable, due in 2026 Operating Expenses Preferred Shares Retained Earnings Revenue Warehouse Current assets $ 26,760 40,200 11,140 22,280 9,400 20,600 Required: Prepare a classified balance sheet at December 31, 2023. (Enter all amounts as positive values.) Assets 122,000 79,400 41,600 127,600 34,600 110,200 40,200 28,720 282,100 138,800 SPICER INC. Balance Sheet December 31, 2023 Karrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education