FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

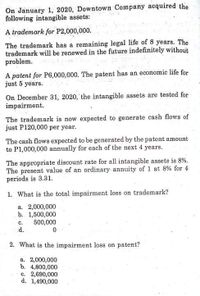

Transcribed Image Text:On January 1, 2020, Downtown Company acquired the

following intangible assets:

A trademark for P2,000,000.

The trademark has a remaining legal life of 8 years. The

trademark will be renewed in the future indefinitely without

problem.

A patent for P6,000,000. The patent has an economic life for

just 5 years.

On December 31, 2020, the intangible assets are tested for

impairment.

The trademark is now expected to generate cash flows of

just P120,000 per year.

The cash flows expected to be generated by the patent amount

to P1,000,000 annually for each of the next 4 years.

The appropriate discount rate for all intangible assets is 8%.

The present value of an ordinary annuity of 1 at 8% for 4

periods is 3.31.

1. What is the total impairment loss on trademark?

a. 2,000,000

b. 1,500,000

500,000

d.

с.

2. What is the impairment loss on patent?

a. 2,000,000

b. 4,800,000

c. 2,690,000

d. 1,490,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2018, Batman Company ( an IFRS reporter) acquired equipment at a cost of $620,000. The balance of accumulated depreciation is $340,000. The sum of the discounted future cash flows expected from the use of this asset is $290,000 and the asset's current fair value is $250,000 before considering costs of disposal of $5,000. What is the recoverable amount?arrow_forwardOn January 1, Year 1, Lowing Company acquired a patent from Generics Research Corporation for $3 million. The legal life of the patent is 20 years, but Lowing expects to use it for 5 years. Pawson Company has committed to purchase the patent from Lowing for $500,000 at the end of that 5-year period. Lowing uses the straight-line method to amortize intangible assets with finite useful lives. What is the amount of amortization expense each year?arrow_forwardOn January 2, 2023, Lotus Spa purchased fixtures for $57,600 cash, expecting the fixtures to remain in service for nine years. Lotus Spa has depreciated the fixtures on a straight-line basis, with $9,000 residual value. On April 30, 2025, Lotus Spa sold the fixtures for $39,500 cash. Record both depreciation expense for 2025 and sale of the fixtures on April 30, 2025. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Apr. 30 Accounts and Explanation Debit Credit Before recording the sale of the fixtures, let's calculate any gain or loss on the sale of the fixtures. (Enter a loss with a minus sign or parentheses.) Fair value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss) Now, record the sale of the fixtures on April 30, 2025. Date Apr. 30 Accounts and Explanation Debit Creditarrow_forward

- On January 1, 2014, Borstad Company purchased equipment for $1,150,000. It is depreciating the equipment over 25 years using the straight-line method and a zero residual value. Late in 2019, because of technological changes in the industry and reduced selling prices for its products, Borstad believes that its equipment may be impaired and will have a remaining useful life of 8 years. Borstad estimates that the equipment will produce cash inflows of $450,000 and will incur cash outflows of $341,000 each year for the next 8 years. It is not able to determine the fair value of the equipment based on a current selling price. Borstad’s discount rate is 10%. Required: 1. Prepare schedules to determine whether, at the end of 2019, the equipment is impaired and, if so, the impairment loss to be recognized. 2. Prepare the journal entry to record the impairment. 3. Next Level How would your answer to Requirement 1 change if the discount rate was 14% and the cash flows were expected…arrow_forwardOn January 2, 2025, Ivanhoe Co. bought a trademark from Rice, Inc. for $1641000. An independent research company estimated that the remaining useful life of the trademark was 10 years. Its unamortized cost on Rice's books was $1969200. Ivanhoe expects that the trademark will produce 25% of its cash flows in year 1, 20% in year 2, 15% in year 3, and 10% in the remaining years. In Ivanhoe's 2025 income statement, what amount should be reported as amortization expense? Select answer from the options below - $410250 $318200 $273500 $164100arrow_forwardCarter Company has provided information on intangible assets as follows. A patent was purchased from Ford Company for $2,000,000 on January 1, 2019. Carter estimated the remaining useful life of the patent to be 10 years. The patent was carried in Ford's accounting records at a net book value of $2,000,000 when Ford sold it to Carter. During 2020, a franchise was purchased from Polo Company for $480,000. In addition, 5% of revenue from the franchise must be paid to Polo. Revenue from the franchise for 2020 was $2,500,000. Carter estimates the useful life of the franchise to be 10 years and takes a full year's amortization in the year of purchase. Carter incurred research and development costs in 2020 as follows. Materials and equipment $142,000 Personnel 189,000 Indirect costs 102,000 $433,000 Carter estimates that these costs will be recouped by December 31, 2023. The materials and equipment purchased have no alternative uses. On January 1, 2020, because of…arrow_forward

- On January 1, 2014, Borstad Company purchased equipment for $1,150,000. It is depreciating the equipment over 25 years using the straight-line method and a zero residual value. Late in 2019, because of technological changes in the industry and reduced selling prices for its products, Borstad believes that its equipment may be impaired and will have a remaining useful life of 8 years. Borstad estimates that the equipment will produce cash inflows of $390,000 and will incur cash outflows of $281,000 each year for the next 8 years. It is not able to determine the fair value of the equipment based on a current selling price. Borstad’s discount rate is 14%. Required: 1. Prepare schedules to determine whether, at the end of 2019, the equipment is impaired and, if so, the impairment loss to be recognized. 2. Prepare the journal entry to record the impairment. 3. Next Level How would your answer to Requirement 1 change if the discount rate was 18% and the cash flows were expected…arrow_forwardTycoon Corporation acquired a building on January 1, 2016 at a cost of P50,000,000. The building has an estimated life of 10 years and residual value of P5,000,000. The building was revalued on January 1, 2020 and the revaluation revealed replacement cost of P80,000,000, residual value of P2,000,000 and revised total life of 12 years. The revaluation surplus as of December 31, 2020 is: P16.8 million P14.0 million P15.4 million P14.7 millionarrow_forwardOn January 1, 2014, Borstad Company purchased equipment for $1,150,000. It is depreciating the equipment over 25 years using the straight-line method and a zero residual value. Late in 2019, because of technological changes in the industry and reduced selling prices for its products, Borstad believes that its equipment may be impaired and will have a remaining useful life of 8 years. Borstad estimates that the equipment will produce cash inflows of $450,000 and will incur cash outflows of $342,000 each year for the next 8 years. It is not able to determine the fair value of the equipment based on a current selling price. Borstad’s discount rate is 14%. Required: 1. Prepare schedules to determine whether, at the end of 2019, the equipment is impaired and, if so, the impairment loss to be recognized. 2. Prepare the journal entry to record the impairment. 3. Next Level How would your answer to Requirement 1 change if the discount rate was 18% and the cash flows were expected…arrow_forward

- On January 2, 2019, Whistler Company purchased land for $450,000, from which it is estimated that 400,000 tons of ore could be extracted. It estimates that the present value of the cost necessary to restore the land is $80,000, after which it could be sold for $30,000. During 2019, Whistler mined 80,000 tons and sold 50,000 tons. During 3020, Whistler mined 100,000 tons and sold 120,000 tons. At the beginning of 2021, Whistler spent an additional $100,000, which increased the reserves by 60,000 tons. In 2021, Whistler mined 140,000 tons and sold 130,000 tons. Whistler uses a FIFO cost flow assumption. Required: 1. Calculate the depletion included in the income statement an ending inventory for 2019, 2020, and 2021. Round the depletion rate to 2 decimal places.2. Prepare the natural resources section of the balance sheet on December 31, 2019, 2020, and 2021, assuming that an accumulated depletion account is used. 3.Assume Whistler's discount rate was 8%. What is the balance in the asset…arrow_forwardTruffle Inc. acquired a patent on January 1, 2015 for $7,800,000. It was expected to have a 10 year life and no residual value. Truffle uses straight-line amortization for its patents. On December 31, 2018, the expected future cash flows from the patent are $518,000 per year for the next six years. The present value of these cash flows, discounted at Truffle’s market interest rate, is $2,120,000. What amount, if any, of impairment loss will be reported on Truffle’s 2018 income statement?arrow_forwardRoland Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2019 for $10,000,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2020, new technology was introduced that would accelerate the obsolescence of Roland’s equipment. Roland’s controller estimates that expected future net cash flows on the equipment will be $6,300,000 and that the fair value of the equipment is $5,600,000. Roland intends to continue using the equipment, but it is estimated that the remaining useful life is 4 years. Roland uses straight-line depreciation. Instructions a. Prepare the journal entry (if any) to record the impairment at December 31, 2020. b. Prepare any journal entries for the equipment at December 31, 2021. The fair value of the equipment at December 31, 2021, is estimated to be $5,900,000. c. Repeat the requirements for (a) and (b), assuming that Roland intends to dispose of the equipment and that it…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education