FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

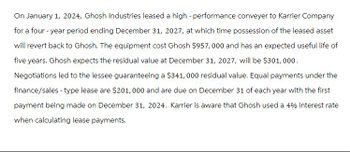

Transcribed Image Text:On January 1, 2024, Ghosh Industries leased a high-performance conveyer to Karrier Company

for a four-year period ending December 31, 2027, at which time possession of the leased asset

will revert back to Ghosh. The equipment cost Ghosh $957,000 and has an expected useful life of

five years. Ghosh expects the residual value at December 31, 2027, will be $301, 000.

Negotiations led to the lessee guaranteeing a $341, 000 residual value. Equal payments under the

finance/sales - type lease are $201,000 and are due on December 31 of each year with the first

payment being made on December 31, 2024. Karrier is aware that Ghosh used a 4% interest rate

when calculating lease payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define Lease

VIEW Step 2: Prepare journal entries on 1st January 2024 to record the lease

VIEW Step 3: Prepare journal entries in the books of the lessee (Karrier Company) as of 31/12/2024

VIEW Step 4: Prepare journal entries in the books of the lessor (Ghosh Industries) as of 31/12/2024

VIEW Solution

VIEW Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that Win Co. is considering disposing of equipment that cost $74,582.00 and has $52,207.40 of accumulated depreciation to date. Win Co. can sell the equipment through a broker for $30,681.00 less 5% commission. Alternatively, But Co. has offered to lease the equipment for five years for a total of $48,245.00. Win will incur repair, insurance, and property tax expenses estimated at $9,671.00. At lease end, the equipment is expected to have no residual value. Determine the net differential income from the lease alternative. a. $29,146.95 b. $48,245.00 c. $9,427.05 d. $16,199.40arrow_forwardBlossom's Drillers erects and places into service an off-shore oil platform on January 1, 2025, at a cost of $8,160,000. Blossom estimates it will cost $1,007,000 to dismantle and remove the platform at the end of its useful life in 10 years, which the company is legally required to do. (The fair value at January 1, 2025, of the dismantle and removal costs is $430,000.) Prepare the entry to record the asset retirement obligation. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Creditarrow_forwardOn December 31. 2021. Rhone-Metro Industries leased equipment to Western Soya Co. for a four-year period ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost Rhone-Metro $365,760 and has an expected useful life of six years. Its normal sales, price is $365,760. The lessee-guaranteed residual value at December 31, 2025, is $25,000. Equal payments under the lease are $ 100,000 and are due on December 31 of each year. The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 12%. Western Soya knows the interest rate implicit in the lease payments is 10%. Both companies use straight-line depreciation or amortization. Required: Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2025, assuming the equipment is returned to Rhone-Metro and the actual residual value on that date is $1,500.arrow_forward

- On January 1, 2021, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2024, at which time possession of the leased asset will revert back to Aqua. The equipment cost Aqua $430,152 and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2024, to be $66,000. Negotiations led to Maywood guaranteeing a $94,000 residual value. Equal payments under the lease are $132,000 and are due on December 31 of each year with the first payment being made on December 31, 2021. Maywood is aware that Aqua used a 7% interest rate when calculating lease payments. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. & 2. Prepare the appropriate entries for Maywood on January 1, 2021 and December 31, 2021, related to the lease. (If no entry is required for a transaction/event, select "No journal entry required" in the…arrow_forwardMunabhaiarrow_forwardTo raise working capital, ABC Company sold its storage building to Best Bank on January 1, 2021, for $950,000 and immediately leased the building back. The operating lease is for the next 10 years of the building’s estimated 20-year remaining useful life. The building has a fair value of $950,000 and a book value of $660,000 (its original cost was $1,000,000). The annual lease payments of $120,000 are payable to Best Bank each December 31, beginning from December 31, 2021. The lease has an implicit rate of 8%. Let's assume that both ABC Company and Best Bank use the straight-line depreciation method for fixed assets with zero residual value. Information of Time Value (i) present value of an ordinary annuity of $1 (n=10, i=8%) = 6.71008 (ii) present value of an annuity due of $1 (n=10, i=8%) = 7.24689 (iii) present value of $1 (n=10, i=8%) = 0.46319 Required: Prepare the appropriate entries for ABC Company on January 1, 2021 and December 31, 2021, to record the transaction and…arrow_forward

- Oregon Machinery Company (OMC) has decided to acquire a screw machine. One alternative is to lease the machine on a three-year contract for a lease payment of $22,000 per year with payments to be made at the beginning of each year. The lease would include maintenance. The second alternative is to purchase the machine outright for $97,000, financing the investment with a bank loan for the net purchase price and amortizing the loan over a three-year period at an interest rate of 12% per year (annual payment = $40, 386). Under the borrow-to-purchase arrangement, the company would have to maintain the machine at an annual cost of $6,000, payable at year-end. The machine falls into the seven-year MACRS classification, and it has a salvage value of $45,000, which is the expected market value at the end of year 3. After three years, the company plans to replace the machine regardless of whether it leases or buys. The tax rate is 40%, and the MARR is 15%.(a) What is OMC's PW cost of…arrow_forwardDuring 2024, Nash constructed a small manufacturing facility specifically to manufacture one particular accessory. Nash paid the construction contractor $5,279,000 cash (which was the total contract price) and placed the facility into service on January 1, 2025. Because of technological change, Nash anticipates that the manufacturing facility will be useful for no more than 10 years. The local government where the facility is located required that, at the end of the 10-year period, Nash remediate the facility so that it can be used as a community center. Nash estimates the cost of remediation will be $632,900. Nash uses straight-line depreciation with $0 salvage value for its plant asset and a 12% discount rate for asset retirement obligations. (a) Your answer is correct. Prepare the journal entries to record the January 1, 2025, transactions. Use the Plant Assets account for the tanker depot. (Credit account titles are automatically indented when the amount is entered. Do not indent…arrow_forwardVan Frank Telecommunications has a patent on a cellular transmission process. The company has amortized thepatent on a straight-line basis since 2014, when it was acquired at a cost of $9 million at the beginning of thatyear. Due to rapid technological advances in the industry, management decided that the patent would benefit thecompany over a total of six years rather than the nine-year life being used to amortize its cost. The decision wasmade at the beginning of 2018.Required:Prepare the year-end journal entry for patent amortization in 2018. No amortization was recorded during the year.arrow_forward

- Keating Co. is considering disposing of equipment with a cost of $74,000 and accumulated depreciation of $51,800. Keating Co. can sell the equipment through a broker for $33,000, less a 7% broker commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $49,000. Keating will incur repair, insurance, and property tax expenses estimated at $12,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is Oa. $4,417 Ob. $7,572 Oc. $9,465 Od. $6,310 Previous Next 7:36 PM 12/13/2020 CP DELLarrow_forwardStowe Construction Company is considering selling excess machinery with a book value of $281,500 (original cost of $400,300 less accumulated depreciation of $118,800) for $274,900, less a 5% brokerage commission. Alternatively, the machinery can be leased for a total of $285,500 for 5 years, after which it is expected to have no residual value. During the period of the lease, Stowe Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $24,900. Question Content Area a. Prepare a differential analysis dated March 21 to determine whether Stowe Construction Company should lease (Alternative 1) or sell (Alternative 2) the machinery. If required, use a minus sign to indicate a loss. Differential AnalysisLease (Alt. 1) or Sell (Alt. 2) MachineryMarch 21 Line Item Description LeaseMachinery(Alternative 1) SellMachinery(Alternative 2) DifferentialEffects(Alternative 2) Revenues $Revenues $Revenues $Revenues Costs Costs Costs Costs…arrow_forwardOn January 1, 2021, Central Industries leased a high-performance conveyer to Dynamic Company for a four-year period ending December 31, 2021, at which time possession of the leased asset will revert back to Central. The equipment cost Central $1,912,000 and has an expected useful life of five years. Central expects the residual value at December 31, 2025, will be $600,000. Negotiations led to the lessee guaranteeing a $680,000 residual value. Equal payments under the finance/sales-type lease are due on December 31 of each year with the first payment being made on December 31, 2021. Dynamic is aware that Central used a 5% interest rate when calculating lease payments.What is the amount that the lessee will record as Right-of-use-Asset and Lease Liability ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education