FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

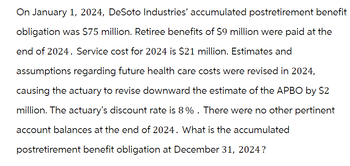

Transcribed Image Text:On January 1, 2024, DeSoto Industries' accumulated postretirement benefit

obligation was $75 million. Retiree benefits of $9 million were paid at the

end of 2024. Service cost for 2024 is $21 million. Estimates and

assumptions regarding future health care costs were revised in 2024,

causing the actuary to revise downward the estimate of the APBO by $2

million. The actuary's discount rate is 8% . There were no other pertinent

account balances at the end of 2024. What is the accumulated

postretirement benefit obligation at December 31, 2024?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2024 and 2025.* A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $180,000 for 2024 and $230,000 for 2025. Year-end funding is $190,000 for 2024 and $200,000 for 2025. No assumptions or estimates were revised during 2024. *We assume the estimated return was based on the actual return on similar investments at the Inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025: Note: Enter your answers in thousands (l.e., 200,000 should be entered as 200). Enter a llability as a negative amount. 1.…arrow_forwardStanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2024 and 2025. A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $240,000 for 2024 and $330,000 for 2025. Year-end funding is $250,000 for 2024 and $260,000 for 2025. No assumptions or estimates were revised during 2024. "We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025. Note: Enter your answers in thousands (i.e., 200,000 should be entered as 200). Enter a liability as a negative amount. 1.…arrow_forwardThe PBO was $100 million at the beginning of the year and $114 million at the end of the year. At the end of the year, pension benefits paid by the trustee were $6 million and there were no pension-related OCI account. The actuary's discount rate was 5%. What was the amount of the service cost for the year? (Enter your answer in million, round to the nearest million, without dollar sign, ex. 123 or -123).arrow_forward

- The projected benefit obligation was $400 million at the beginning of the year and $429 million at the end of the year. At the end of the year, pension benefits paid by the trustee were $18 million and there were no pension-related other comprehensive income accounts. The actuary’s discount rate was 5%. What was the amount of the service cost for the year?arrow_forwardFrazier Refrigeration amended its defined benefit pension plan on December 31, 2018, to increase retirement benefits earned with each service year. The consulting actuary estimated the prior service cost incurred by making theamendment retroactive to prior years to be $110,000. Frazier’s 100 present employees are expected to retire at therate of approximately 10 each year at the end of each of the next 10 years.Required:1. Using the service method, calculate the amount of prior service cost to be amortized to pension expense ineach of the next 10 years.2. Using the straight-line method, calculate the amount of prior service cost to be amortized to pension expensein each of the next 10 years.arrow_forwardKath Company's pension plan began on 1/1/20. During 2020 it earned $21 more on its assets than it expected and changes in actuarial assumptions caused the PBO to increase by $13. In 2021, actual earnings on plan assets was $9 and expected return was $14. During 2021, actuaries determined that life expectancies are longer than originally estimated, causing the PBO to change by $12. Gain/loss did not need to be amortized in 2020 or 2021. What is unamortized gain or loss on 12/31/21? Provide a dollar amount and circle gain or loss.arrow_forward

- The projected benefit obligation was $80 million at the beginning of the year and $85 million at the end of the year. Service cost for the year was $10 million. At the end of the year, there were no pension-related other comprehensive income accounts. The actuary’s discount rate was 5%. What was the amount of the retiree benefits paid by the trustee?arrow_forwardVishunuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education