Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

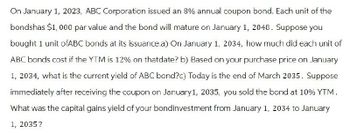

Transcribed Image Text:On January 1, 2023, ABC Corporation issued an 8% annual coupon bond. Each unit of the

bondshas $1,000 par value and the bond will mature on January 1, 2048. Suppose you

bought 1 unit ofABC bonds at its issuance.a) On January 1, 2034, how much did each unit of

ABC bonds cost if the YTM is 12% on thatdate? b) Based on your purchase price on January

1, 2034, what is the current yield of ABC bond?c) Today is the end of March 2035. Suppose

immediately after receiving the coupon on January 1, 2035, you sold the bond at 10% YTM.

What was the capital gains yield of your bondinvestment from January 1, 2034 to January

1, 2035?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ideal Living Company has 8.5 percent bonds outstanding that are paid semi-annually and has the YTM of 10 percent. The bonds pay interest on December 1 and June 1. Assume a 30/360 basis. What are the clean price and accrued interest if today's date is April 1, 2022? The bonds will be matured on December 1, 2030. Face value of the bond is $1,000.arrow_forwardOn July 1, 2020, Most Inc. issued $1,000,000 face value, 8% semiannual coupon bonds maturing in 10 years. The bonds pay interest on June 30 and December 31 of each year. The bonds were initially priced to yield 10% compounded semiannually. The bonds were issued for $875,378. What is the carrying value of these bonds on December 31, 2020 Select one: a. $835,378 b. $879,147 c. $1,000,000 d. $925,239 e. $893,225arrow_forwardOn April 1, 2014, Fredriksen Corp. sold a $700 million bond issue to finance the purchase of a new distribution facility. These bonds were issued in $1,000 denominations with a maturity date of April 1, 2034. The bonds have a coupon rate of 8.00% with interest paid semiannually. Required: a) Determine the value today April 1, 2024 of one of these bonds to an investor who requires a 12 percent return on these bonds. Why is the value today different from the par value? b) Assume that the bonds are selling for $925.00. Determine the current yield and the yield-to-maturity. Explain what these terms mean. c) Explain what layers or textures of risk play a role in the determination of the required rate of return on Fredriksen's bonds.arrow_forward

- On March 13, 2030, you purchase a $1000 par value corporate bond that has a 12% and makes semiannual payments. The bond last paid a coupon on February 15, 2030 and is due to pay its next coupon on August 15, 2030. Assume that the bond’s day-count convention is the standard one for corporate bonds and note that 2030 is not a leap year. What is the accrued interest on this bond?arrow_forwardA bond that has a face value of $2,000 and coupon rate of 4.30% payable semi-annually was redeemable on July 1, 2021. Calculate the purchase price of the bond on February 10, 2015 when the yield was 5.05% compounded semi-annually.arrow_forwardA bond that has a face value of $1,500 and coupon rate of 3.20% payable semi-annually was redeemable on July 1, 2021. Calculate the purchase price of the bond on February 10, 2015 when the yield was 3.70% compounded semi-annually. $0.00arrow_forward

- On January 31, 2022 you purchased a newly issued 5.6% coupon bond issued by the Dana Corporation for $1,023.56. The bond is noncallable and matures January 31, 2048. You decide to sell the bond April 30, 2023 when the bond’s yield to maturity was 4.82 percent. Based on a 30/360 day-count method, how much will you receive from the sale of the bond (including accrued interest)? Consider the December 31, 2022 and 2021 balance sheet for the Jasper Company and the income statement for the year ended December 31, 2022: JASPER COMPANY Balance Sheets as of December 31, 2022 and 2021 Assets 2022 2021 Cash $ 405 $310 Accounts receivable 3,055 2,640 Inventory 3,850 3,275 Property, plant, and equipment (net) 10,670 10,960 Total $17,980 $17,185 Liabilities and Stockholder’s Equity 2022 2021 Accounts payable $ 2,570 $ 2,720 Current portion of long-term debt payable 0 100…arrow_forwardOn February 9, 2015, Hunter-Gratzner, Inc. issued a 10 year bond (with a typical $1000 face value) that had an annual coupon value of $42. We will assume that the 2022 coupon has just been redeemed. Initially (in 2015), the bond was sold at the premium price of $1,037. On February 9, 2022, this bond was selling for $972. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 1.75% on February 9, 2015, which reflected market expectations about future rates of inflation. The market rate of interest for a riskless corporate bond, of this maturity (i.e., a U.S. Treasury security), was 2.05% on February 9, 2022, which reflects market expectations about future rates of inflation. Question: What was the yield to maturity for this bond on February 9, 2015? [To 2 decimal places.]arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education