FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

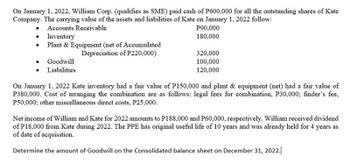

Transcribed Image Text:On January 1, 2022, William Corp. (qualifies as SME) paid cash of P600,000 for all the outstanding shares of Kate

Company. The carrying value of the assets and liabilities of Kate on January 1, 2022 follow:

Accounts Receivable

Inventory

•

Plant & Equipment (net of Accumulated

Depreciation of P220,000)

Goodwill

Liabilities

P90,000

180,000

320,000

100,000

120,000

On January 1, 2022 Kate inventory had a fair value of P150,000 and plant & equipment (net) had a fair value of

P380,000. Cost of arranging the combination are as follows: legal fees for combination, P30,000; finder's fee,

P50,000; other miscellaneous direct costs, P25,000.

Net income of William and Kate for 2022 amounts to P188,000 and P60,000, respectively. William received dividend

of P18,000 from Kate during 2022. The PPE has original useful life of 10 years and was already held for 4 years as

of date of acquisition.

Determine the amount of Goodwill on the Consolidated balance sheet on December 31, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Purple Corp. purchased all of the listed assets and liabilities of Sudden Corp. for $1,600,000. The following assets and liabilities were purchased:Book Value Fair MarketValueAccounts receivables $ 140,000 $ 140,000 Inventory 168,000 256,000 Property, plant, and equipment (net) 820,000 1,040,000 Patent 0 276,000 Liabilities (170,000 ) (170,000 )________________________________________ Required:1. What is the appropriate amount that would be recorded for goodwill? 2. Prepare the journal entry for the acquisition. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardhow much is the goodwill to be reported on january 31, 2022 ?arrow_forwardOn January 2, 2030, Esko Corp. acquired all the net assets of Tolits Inc. Esko Corp. paid P6,000,000 for the net assets of Tolits Inc. On this date, the following accounts of Tolits, Inc. are as follows: Cash – P150,000; Accounts Receivable – P1,600,000; Inventories – P600,000; Property, plant, and equipment – P2,600,000; Accounts Payable – P1,400,000. On the date of acquisition, it was determined that the fair values of inventories and property, plant, and equipment were P660,000 and P3,400,000, respectively. Esko Corp. has estimated a restructuring provision of P500,000 representing costs of exiting the activity of Tolits Inc., cost of terminating the employees of Tolits Inc. Compute the goodwill or gain from acquisition. * a. P 2,950,000 b. P 1,590,000 c. P 2,090,000 d. P 2,450,000 pls. answer it asap thank you:)arrow_forward

- Hw.138.arrow_forwardAction, Inc. acquired the following assets and assumed the related liabilities of Slacker Corp. in a transaction completed on February 16, 2023: Accounts receivable, net Inventories Property, plant & equipment Non-amortizable intangible assets Carrying value for Slacker Current liabilities Noncurrent liabilities $ 11,000 $ 50,000 $ 100,000 $ 200,000 Fair Value $ 10,000 $ 50,000 $ 150,000 $ 225,000 $ (40,000) $(200,000) $ (40,000) $(200,000) Action paid $205,000 in cash for all of the above from Slacker. a) Determine if Action must record any goodwill. Show any calculations. b) Record the acquisition in Action's general journal on Feb. 16, 2023. Show: any calculations. c) Prepare any adjusting entry for amortization required as of the fiscal year end, December 31, 2023. If no amortization is required, explain why.arrow_forwardA-5arrow_forward

- Northern Equipment Corporation purchased all the outstanding common stock of Pioneer Equipment Rental tor $5,550,000 in cash. The book values and fair values of Pioneer's assets and liabilities were: Fair Value 600,000 4,750,000 210,000 (800,000) $ 4,760,000 Book Value $ 700,000 4,050,000 Accounts Receivable Buildings Equipment Accounts Payable 120,000 (800,000) $ 4,070,000 Net assets Required: 1. Calculate the amount Northern Equipment should report for goodwill. Goodwill 2. Record Northern Equipment's acquisition of Pioneer Equipment Rental. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the acquisition of Pioneer Equipment Rental. Note: Enter debits before credits. Transaction General Journal Debit Credit 1arrow_forwardThe following balance sheets have been prepared on December 31, Year 13 for Albert Corp. and Becky Inc.Balance Sheets Albert & Becky Cash $30,000 & $50,000Accounts Receivable $180,000 & $100,000Inventory $70,000 & $30,000Investment in Becky $100,000Property, Plant and Equipment* $600,000 & $140,000Accumulated Depreciation ($280,000) & ($40,000)Total Assets $700,000 & $280,000 * Includes landCurrent Liabilities $120,000 & $30,000Long-Term Debt $400,000 & $20,000Common shares $90,000 & $40,000Retained Earnings $90,000 & $190,000Liabilities and Equity $700,000 & $280,000Additional Information: Albert uses the cost method to account for its 50% interest in Becky, which it acquired on January 1, Year 10 for $100,000. On that date, Becky's retained earnings were $20,000 and common shares $40,000. The acquisition differential was fully amortized by the end of Year 13. Albert sold Land to Becky during Year 12 and recorded a $15,000 gain on the…arrow_forwardNorthern Equipment Corporation purchased all the outstanding common stock of Pioneer Equipment Rental for $5,600,000 in cash. The book values and fair values of Pioneer’s assets and liabilities were Book Value Fair ValueAccounts Receivable $ 750,000 $ 650,000Buildings 4,100,000 4,800,000Equipment 110,000 200,000Accounts Payable (750,000) (750,000)Net assets $ 4,210,000 $ 4,900,000Required:1. Calculate the amount Northern Equipment should report for goodwill.2. Record Northern Equipment’s acquisition of Pioneer Equipment Rental.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education