On January 1, 2021, Casey Corporation exchanged $3,210,000 cash for 100 percent of the outstanding voting stock of Kennedy Corporation. Casey plans to maintain Kennedy as a wholly owned subsidiary with separate legal status and

At the acquisition date, Casey prepared the following fair-value allocation schedule:

| Fair value of Kennedy (consideration transferred) | $ | 3,210,000 | |||

| Carrying amount acquired | 2,600,000 | ||||

| Excess fair value | $ | 610,000 | |||

| to buildings (undervalued) | $ | 393,000 | |||

| to licensing agreements (overvalued) | (193,000 | ) | 200,000 | ||

| to |

$ | 410,000 | |||

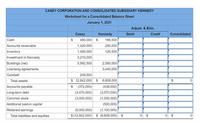

Immediately after closing the transaction, Casey and Kennedy prepared the following postacquisition balance sheets from their separate financial records (credit balances in parentheses).

| Accounts | Casey | Kennedy | |||||

| Cash | $ | 480,000 | $ | 166,500 | |||

| 1,420,000 | 295,000 | ||||||

| Inventory | 1,490,000 | 126,500 | |||||

| Investment in Kennedy | 3,210,000 | 0 | |||||

| Buildings (net) | 5,992,500 | 2,580,000 | |||||

| Licensing agreements | 0 | 3,440,000 | |||||

| Goodwill | 249,500 | 0 | |||||

| Total assets | $ | 12,842,000 | $ | 6,608,000 | |||

| Accounts payable | $ | (372,000 | ) | $ | (438,000 | ) | |

| Long-term debt | (3,470,000 | ) | (3,570,000 | ) | |||

| Common stock | (3,000,000 | ) | (1,000,000 | ) | |||

| Additional paid-in capital | 0 | (500,000 | ) | ||||

| (6,000,000 | ) | (1,100,000 | ) | ||||

| Total liabilities and equities | $ | (12,842,000 | ) | $ | (6,608,000 | ) | |

Prepare an acquisition-date consolidated

Answer and calculations are given below

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Please Compute the Goodwill on the Acquisition Data. That is all of the Information that is needed for the question Also Please make sure it is correctarrow_forwardBracebridge Incorporated and Muskoka Incorporated exchanged equipment, with MuskokaIncorporated also giving Bracebridge Incorporated $450,000 as part of the exchange. The transactionlacks commercial substance. A summary of the exchange (which occurred on December 31, 2020) is asfollows:Equipment Originally Owned byBracebridge IncorporatedEquipment Originally Owned byMuskoka IncorporatedAppraised Value $12,000,000 $11,500,000Cost $14,000,000 $13,500,000Accumulated Depreciation(at December 31, 2020) $6,500,000 $7,000,000Requireda) Prepare all required journal entries in good form on the books of both BracebridgeIncorporated and Muskoka Incorporated. b) Repeat part (a) but assume the transaction has commercial substance.arrow_forwardThe following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone $ 500,000 $ 300,000 1,000,000 not given 500,000 230,000 Inventory Sales 800,000 Investment income Cost of goods sold Operating expenses 400,000 300,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $78,000 that was unrecorded on its accounting records and had a four-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $130,000 to Allister for $180,00o. Of this amount, 10 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021: Amounts Inventory Sales Cost of goods sold Operating expenses Net income attributable…arrow_forward

- ProForm acquired 70 percent of ClipRite on June 30, 2020, for $910,000 in cash. Based on ClipRite’s acquisition-date fair value, an unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $10,000 per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assessed at $390,000 at the acquisition date. The 2021 financial statements are as follows: *see image ClipRite sold ProForm inventory costing $72,000 during the last six months of 2020 for $120,000. At year-end, 30 percent remained. ClipRite sold ProForm inventory costing $200,000 during 2021 for $250,000. At year-end, 10 percent is left. Determine the consolidated balances for the following: SalesCost of Goods SoldOperating ExpensesDividend IncomeNet Income Attributable to Noncontrolling InterestInventoryNoncontrolling Interest in Subsidiary, 12/31/21arrow_forwardProForm acquired 70 percent of ClipRite on June 30, 2023, for $1,400,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $640,000 was recognized and is being amortized at the rate of $16,000 per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assessed at $600,000 at the acquisition date. The 2024 financial statements are as follows Itens sales Cost of goods sold Operating expenses Dividend income Net income Retained earnings, 1/1/24 Net Income Dividends declared Retained earnings, 12/31/24 Cash and receivables Inventory Investment in cliptite Fixed assets Accumulated depreciation Totals Liabilities Common stock Retained earnings, 12/31/24 Totals Proform $ (910,000) 590,000 210,000 (63,000) $ (173,000) $ (2,000,000) (173,000) 210,000 Sales Cost of goods sold Operating expenses Dividend income Net income attributable to noncontrolling interest Inventory Noncontrolling interest in subsidiary, 12/31/24 $…arrow_forwardHouse Corporation has been operating profitably since its creation in 1960. At the beginning of 2016, House acquired a 70 percent ownership in Wilson Company. At the acquisition date, House prepared the following fair-value allocation schedule: Consideration transferred for 70% interest in Wilson $ 707,000 Fair value of the 30% noncontrolling interest 303,000 Wilson business fair value $ 1,010,000 Wilson book value 790,000 Excess fair value over book value $ 220,000 Assignments to adjust Wilson’s assets to fair value: To buildings (20-year remaining life) $ 60,000 To equipment (4-year remaining life) (20,000 ) To franchises (10-year remaining life) 40,000 80,000 To goodwill (indefinite life) $ 140,000 House regularly buys inventory from Wilson at a markup of 25 percent more than cost. House's purchases during 2016 and 2017 and related ending inventory…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education