Concept explainers

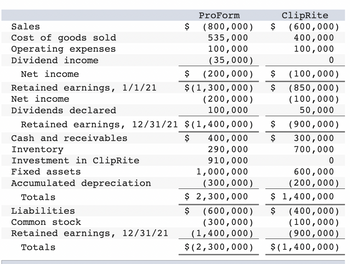

ProForm acquired 70 percent of ClipRite on June 30, 2020, for $910,000 in cash. Based on ClipRite’s acquisition-date fair value, an unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $10,000 per year. No

*see image

ClipRite sold ProForm inventory costing $72,000 during the last six months of 2020 for $120,000. At year-end, 30 percent remained. ClipRite sold ProForm inventory costing $200,000 during 2021 for $250,000. At year-end, 10 percent is left.

Determine the consolidated balances for the following:

Sales

Cost of Goods Sold

Operating Expenses

Dividend Income

Net Income Attributable to Noncontrolling Interest

Inventory

Noncontrolling Interest in Subsidiary, 12/31/21

Step by stepSolved in 2 steps

- Mighty Company purchased a 60 percent interest in Lowly Company on January 1, 2017, for $567,600 in cash. Lowly's book value at that date was reported as $760,000 and the fair value of the noncontrolling interest was assessed at $378,400. Any excess acquisition-date fair value over Lowly's book value is assigned to trademarks to be amortized over 20 years. Subsequently, on January 1, 2018, Lowly acquired a 20 percent interest in Mighty. The price of $440,000 was equivalent to 20 percent of Mighty's book and fair value. Neither company has paid dividends since these acquisitions occurred. On January 1, 2018, Lowly's book value was $992,000, a figure that rises to $1,054,500 (common stock of $300,000 and retained earnings of $754,500) by year-end. Mighty's book value was $2.20 million at the beginning of 2018 and $2.30 million (common stock of $1 million and retained earnings of $1,300,000) at December 31, 2018. No intra-entity transactions have occurred and no additional stock has been…arrow_forwardam. 152.arrow_forwardProForm acquired 60 percent of ClipRite on June 30, 2020, for $1,140,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $400,000 was recognized and is being amortized at the rate of $15,000 per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assessed at $760,000 at the acquisition date. The 2021 financial statements are as follows: Sales Cost of goods sold Operating expenses Dividend income Net income Retained earnings, 1/1/21 Net income Dividends declared Retained earnings, 12/31/21 Cash and receivables Inventory Investment in ClipRite Fixed assets Accumulated depreciation Totals Liabilities Common stock Retained earnings, 12/31/21 Totals Sales Cost of Goods Sold ProForm (900,000) 585,000 200,000 (48,000) $ (163,000) $ $ 500,000 390,000 1,140,000 2,000,000 (700,000) $ 3,330,000 $ (667,000) (400,000) (2,263,000) $ (3,330,000) Sales Cost of goods sold Operating expenses Dividend income Net income…arrow_forward

- Protrade Corporation acquired 80 percent of the outstanding voting stock of Seacraft Company on January 1, 2020, for $468,000 in cash and other consideration. At the acquisition date, Protrade assessed Seacraft's identifiable assets and liabilities at a collective net fair value of $585,000, and the fair value of the 20 percent noncontrolling interest was $117,000. No excess fair value over book value amortization accompanied the acquisition. The following selected account balances are from the individual financial records of these two companies as of December 31, 2021: Protrade Seacraft $ 700,000 $ 420,000 320,000 227,000 156,000 800,000 Sales Cost of goods sold Operating expenses Retained earnings, 1/1/21 Inventory Buildings (net) Investment income 352,000 364,000 Not given Each of the following problems is an independent situation: 8. a. Assume that Protrade sells Seacraft inventory at a markup equal to 60 percent of cost. Intra-entity transfers were $96,000 in 2020 and $116,000 in…arrow_forwardDomesticarrow_forwardAshvinarrow_forward

- sarrow_forwardOn January 1, 2020, French Company acquired 60 percent of K-Tech Company for $306,000 when K-Tech’s book value was $406,000. The fair value of the newly comprised 40 percent noncontrolling interest was assessed at $204,000. At the acquisition date, K-Tech's trademark (10-year remaining life) was undervalued in its financial records by $80,000. Also, patented technology (5-year remaining life) was undervalued by $24,000. In 2020, K-Tech reports $28,000 net income and declares no dividends. At the end of 2021, the two companies report the following figures (stockholders’ equity accounts have been omitted): French CompanyCarrying Amounts K-Tech CompanyCarrying Amounts K-Tech CompanyFair Values Current assets $ 624,000 $ 304,000 $ 324,000 Trademarks 264,000 204,000 284,000 Patented technology 414,000 154,000 178,000 Liabilities (394,000 ) (124,000 ) (124,000 ) Revenues (904,000 ) (404,000 )…arrow_forwardOn January 1, 2024, Brooks Corporation exchanged $1,194,000 fair-value consideration for all of the outstanding voting stock of Chandler, Incorporated. At the acquisition date, Chandler had a book value equal to $1,150,000. Chandler’s individual assets and liabilities had fair values equal to their respective book values except for the patented technology account, which was undervalued by $216,000 with an estimated remaining life of six years. The Chandler acquisition was Brooks’s only business combination for the year. In case expected synergies did not materialize, Brooks Corporation wished to prepare for a potential future spin-off of Chandler, Incorporated. Therefore, Brooks had Chandler maintain its separate incorporation and independent accounting information system as elements of continuing value. On December 31, 2024, each company submitted the following financial statements for consolidation. Dividends were declared and paid in the same period. Accounts Brooks Corporation…arrow_forward

- On January 1, 2020, Palka, Inc., acquired 70 percent of the outstanding shares of Sellinger Company for $1,274,000 in cash. The price paid was proportionate to Sellinger’s total fair value, although at the acquisition date, Sellinger had a total book value of $1,540,000. All assets acquired and liabilities assumed had fair values equal to book values except for a patent (six-year remaining life) that was undervalued on Sellinger’s accounting records by $270,000. On January 1, 2021, Palka acquired an additional 25 percent common stock equity interest in Sellinger Company for $512,500 in cash. On its internal records, Palka uses the equity method to account for its shares of Sellinger. During the two years following the acquisition, Sellinger reported the following net income and dividends: 2020 2021 Net income $ 505,000 $ 626,000 Dividends declared 170,000 200,000 Show Palka’s journal entry to record its January 1, 2021, acquisition of an additional…arrow_forwardAt the beginning of 2022, Metatec Incorporated acquired Ellison Technology Corporation for $650 million. In addition to cash, receivables, and inventory, the following assets and their fair values were also acquired: Plant and equipment (depreciable assets) Patent Goodwill $ 155 million 45 million 120 million The plant and equipment are depreciated over a 10-year useful life on a straight-line basis. There is no estimated residual value. The patent is estimated to have a five-year useful life, no residual value, and is amortized using the straight-line method. At the end of 2024, a change in business climate indicated to management that the assets of Ellison might be impaired. The following amounts have been determined: Plant and equipment: Undiscounted sum of future cash flows Fair value Patent: Undiscounted sum of future cash flows Fair value Goodwill: Fair value of Ellison Technology Corporation Book value of Ellison's net assets (excluding goodwill) Book value of Ellison's net…arrow_forwardOn January 1, 2020, Palka, Inc., acquired 70 percent of the outstanding shares of Sellinger Company for $1,222,900 in cash. The price paid was proportionate to Sellinger’s total fair value, although at the acquisition date, Sellinger had a total book value of $1,470,000. All assets acquired and liabilities assumed had fair values equal to book values except for a patent (six-year remaining life) that was undervalued on Sellinger’s accounting records by $267,000. On January 1, 2021, Palka acquired an additional 25 percent common stock equity interest in Sellinger Company for $467,500 in cash. On its internal records, Palka uses the equity method to account for its shares of Sellinger. During the two years following the acquisition, Sellinger reported the following net income and dividends: 2020 2021 Net income $ 477,500 $ 592,500 Dividends declared 150,000 190,000 Show Palka’s journal entry to record its January 1, 2021, acquisition of an additional 25…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education