FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

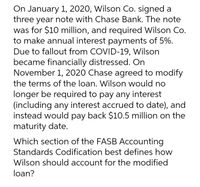

Transcribed Image Text:On January 1, 2020, Wilson Co. signed a

three year note with Chase Bank. The note

was for $10 million, and required Wilson Co.

to make annual interest payments of 5%.

Due to fallout from COVID-19, Wilson

became financially distressed. On

November 1, 2020 Chase agreed to modify

the terms of the loan. Wilson would no

longer be required to pay any interest

(including any interest accrued to date), and

instead would pay back $10.5 million on the

maturity date.

Which section of the FASB Accounting

Standards Codification best defines how

Wilson should account for the modified

loan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, Gibson Co. purchases equipment having a fair value of $200,000 by issuing a three-year, zero-interest-bearing note in the amount of $251,942. The effective interest rate on the note is 8%. How much interest should Gibson recognize on the note in the year ended December 31, 2020?arrow_forwardAt January 1, 2024, Mahmoud Industries, Incorporated, owed Second BancCorp $15 million under a 10% note due December 31, 2026. Interest was paid last on December 31, 2022. Mahmoud was experiencing severe financial difficulties and asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorp agreed to: a. Forgive the interest for 2023 and 2024. b. Reduce the remaining two years' interest payments to $1 million each and delay the first payment until December 31, 2025. c. Reduce the unpaid principal amount to $14 million. Required: Prepare the journal entries by Mahmoud Industries, Incorporated, necessitated by the restructuring of the debt at (1) January 1, 2024; (2) December 31, 2025; and (3) December 31, 2026. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.arrow_forwardOn December 31, 2017, Firth Company borrowed $62,092 from Paris Bank, signing a 5-year, $100,000 zero-interest-rate note. The note was issued to yield 10% interest. Unfortunately, during 2019, Firth began to experience financial difficulty. As a result, at December 31, 2019, Paris Bank determined that it was probable that it would collect only $75,000 at maturity. The market rate of interest on loans of this nature is now 11%.Instructions(a) Prepare the entry (if any) to record the impairment of the loan on December 31, 2019, by Paris Bank.(b) Prepare the entry on March 31, 2020, if Paris learns that Firth will be able to repay the loan under the original terms.arrow_forward

- On December 31 , 2018 Nicholas Co. is in financial difficulty and cannot pay a note due that day . It is a $3,300,000 8% issued at par note, payable to Key Bank. Key Bank agrees to accept from Nicholas equipment that has a fair value of 1,450,000, originally costing $2,400,000, with accumulated depreciation of $1,250,000. Key Bank also extends the maturity date to December 31, 2021, reduces the face amount of the note to $1,250,000, and reduces the interest rate to 6%, with interest payable at the end of each year. a. Nicholas should recognize a gain or loss on the transfer of the equipment of: b. At the end of each of the next three years Nicholas records the $ 75,000 interest paid to Key Bank as a: c. In determining the carrying value of the note at December 31, 2018 Key Bank uses an effective interest rate equal to: d. Key Bank records a loss on restructuring of: e. In recording the loss on restructuring, Key bank:arrow_forwardOn October 1, 2023, Marigold Corp. sold a harvesting machine to Bonita Industries. Instead of a cash payment, Bonita Industries gave Marigold a $170,000, two-year, 10% note; 10% is a realistic rate for a note of this type. The note required interest to be paid annually on October 1, beginning October 1, 2024. Marigold's financial statements are prepared on a calendar-year basis. (a) Your answer has been saved. See score details after the due date. Assuming that no reversing entries are used and that Bonita Industries fulfills all the terms of the note, prepare the necessary journal entries for Marigold for the entire term of the note. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Crarrow_forwardPharoah Inc. owes Waterway Bank $166,000 plus $16,300 of accrued interest. The debt is a 10-year, 10% note. During 2023, Pharoah's business declined due to a slowing regional economy. On December 31, 2023, the bank agrees to accept an old machine and cancel the entire debt. The machine has a cost of $302,000, accumulated depreciation of $185,000, and a fair value of $146,000. The bank plans to dispose of the machine at a cost of $6,000. Both Pharoah and Waterway Bank prepare financial statements in accordance with IFRS 9. (a) Prepare the journal entries for Pharpah and Waterway Bank to record this debt settlement. Assume Waterway Bank had previously recognized an allowance for doubtful accounts for the impairment prior to the settlement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date…arrow_forward

- Blue Cells Can contain On December 31, 2017, Short Co. is in financial difficulty and cannot pay a note due that day. It is a $2,000,000 face value note with $200,000 accrued interest payable to Bryan, Inc. The original market rate of interest on the note was 12.58613%. Bryan agrees to forgive the accrued interest, extend the maturity date (two years) to December 31, 2019, and reduce the interest rate to 4%. The present value of the restructured cash flows is $1,712,000 (using the original market rate). Do NOT add rows to the spreadsheet! Discount Cash Premium Interest payable Par Interest expense Discount on bond payable Yes Bonds payable No Loss on redemption Gain on redemptin Cash Interest payable Interest receivable Notes payable Gain on restructuring Loss on restructuring Discount on Note payable Premium on Note payable…arrow_forwardOn December 31, 2023, Green Bank enters into a debt restructuring agreement with Teal Mountain Inc., which is now experiencing financial trouble. The bank agrees to restructure a $2.1-million, 10% note receivable issued at par by the following modifications: 1. Reducing the principal obligation from $2.1 million to $2.00 million Extending the maturity date from December 31, 2023, to December 31, 2026 3. Reducing the interest rate from 10% to 8% 2. Teal Mountain pays interest at the end of each year. On January 1, 2027, Teal Mountain pays $2.00 million in cash to Green Bank. Teal Mountain prepares financial statements in accordance with IFRS 9. (b) Prepare an entry at December 31, 2023, based on the results of your calculation. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry…arrow_forwardParton owes $3 million that is due on March 5, 2021. The company borrows $2,600,000 on February 25, 2021(5-year note) and uses the proceeds to pay down the $3 million note. How much of the $3 million note is classified as long-term in the February 28, 2021 financial statements?arrow_forward

- At January 1, 2018, Brainard Industries, Inc., owed Second BancCorp $12 million under a 10% note due December 31, 2020. Interest was paid last on December 31, 2016. Brainard was experiencing severe financial difficultiesand asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorpagreed to:a. Forgive the interest accrued for the year just ended.b. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment untilDecember 31, 2019.c. Reduce the unpaid principal amount to $11 million.Required:Prepare the journal entries by Brainard Industries, Inc., necessitated by the restructuring of the debt at (1) January1, 2018; (2) December 31, 2019; and (3) December 31, 2020.arrow_forwardAt January 1, 2024, Mahmoud Industries, Incorporated, owed Second BancCorp $12 million under a 10% note due December 31, 2026. Interest was paid last on December 31, 2022. Mahmoud was experiencing severe financial difficulties and asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorp agreed to: Forgive the interest accrued for the year just ended. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment until December 31, 2025. Reduce the unpaid principal amount to $11 million. Required: Prepare the journal entries by Mahmoud Industries, Incorporated, necessitated by the restructuring of the debt at (1) January 1, 2024; (2) December 31, 2025; and (3) December 31, 2026.arrow_forwardOn December 31, 2020, Stellar Company signed a $ 1,022,000 note to Pearl Bank. The market interest rate at that time was 11%. The stated interest rate on the note was 9%, payable annually. The note matures in 5 years. Unfortunately, because of lower sales, Stellar’s financial situation worsened. On December 31, 2022, Pearl Bank determined that it was probable that the company would pay back only $ 613,200 of the principal at maturity. However, it was considered likely that interest would continue to be paid, based on the $ 1,022,000 loan.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education