FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

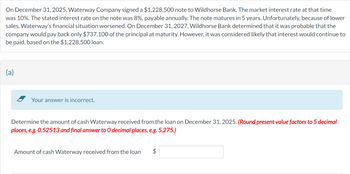

Transcribed Image Text:On December 31, 2025, Waterway Company signed a $1,228,500 note to Wildhorse Bank. The market interest rate at that time

was 10%. The stated interest rate on the note was 8%, payable annually. The note matures in 5 years. Unfortunately, because of lower

sales, Waterway's financial situation worsened. On December 31, 2027, Wildhorse Bank determined that it was probable that the

company would pay back only $737,100 of the principal at maturity. However, it was considered likely that interest would continue to

be paid, based on the $1,228,500 loan.

(a)

Your answer is incorrect.

Determine the amount of cash Waterway received from the loan on December 31, 2025. (Round present value factors to 5 decimal

places, e.g. 0.52513 and final answer to O decimal places, e.g. 5,275.)

Amount of cash Waterway received from the loan $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company sold goods to a customer in exchange for a 5-year, zero-interest-bearing note on January 1, 2021. The note has a face amount of $244,000. The company imputes a 10% interest rate on this zero-interest note transaction. Present value factor for 10% and 5 years, single sum is 0.62. What is the sales revenue the company should record related to this transaction? (Please do not use your own present value tables or financial calculator.) (Please do not round your answer in any part of the computation.)arrow_forwardOn December 31, 2020, London Bank granted a P5,000,000 loan to a borrower with 10% stated rate payable annually and maturing in 5 years. The loan was discounted at the market interest rate of 12%. Unfortunately, the financial condition of the borrower woresend because of lower revenue On December 31, 2022, the bank determined that the borrower would oay back only P3,000,000 of the principal at maturity. However, it was considered likely that interest would continue to be paid on the P5,000,000 loan. The present value of 1 at 12% is .57 for five periods and .71 for three periods. The present value of an ordinary annuity of 1 at 12% is 3.60 for five periods and 2.40 for three periods. 1. What is the amount of cash paid to the borrower on December 31, 2020? a. 4,400,000 b. 4,500,000 c. 5,000,000 d. 4,650,000 2. What is the carrying amount of the loan receivable on December 31, 2022? a. 4,650,000 b. 4,790,000 c. 4,772,960 d. 4,720,000 3. What is the impairment loss on loan…arrow_forwardExcel Corporation is experiencing financial difficulty and has met with their creditor (BMO) to explore their options related to a $1.5 million, 6% note payable that is outstanding. The note was issued on September 1, 2020 when the market rate of interest was 6%. There are two years remaining on the note and the current market rate of interest is 8%. Excel and BMO prepare financial statements in accordance with IFRS. For each of the following independent situations prepare the journal entry that both Excel and BMO would on their books. BMO agrees to accept Excel common shares valued at $1,000,000 as settlement of the debt. BMO agrees to accept land as settlement of the debt. The land is on the books of Excel for $500,000 and has a market value of $1,250,000. BMO agrees to modify the terms so that Excel is not paying any interest on the note for the remaining two years. BMO agrees to reduce the principal balance to $1,000,000 and requires interest only payments for the next two years…arrow_forward

- On May 1, 2023, People's Networks sold computer networking supplies to Florida Autos for $46,100. The cost of the supplies is $20,745. Instead of paying immediately, Florida Autos signed a note receivable with 8% annual interest, payable in eight months with the principle amount. People's Networks has a year end of October 31. Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. For transaction with two debits or credits, enter the debit accounts in alphabetical order followed by the credit accounts in alphabetical order. a) Record the journal entry when the sale is made; assume People's Networks uses the perpetual inventory system. Date May 1 May 1 Account Title and Explanation Notes Payable + Notes Receivable To record sales for notes receivable ◆ To record cost of goods sold ♦ + Debit Creditarrow_forwardOn December 31, 2017, Firth Company borrowed $62,092 from Paris Bank, signing a 5-year, $100,000 zero-interest-rate note. The note was issued to yield 10% interest. Unfortunately, during 2019, Firth began to experience financial difficulty. As a result, at December 31, 2019, Paris Bank determined that it was probable that it would collect only $75,000 at maturity. The market rate of interest on loans of this nature is now 11%.Instructions(a) Prepare the entry (if any) to record the impairment of the loan on December 31, 2019, by Paris Bank.(b) Prepare the entry on March 31, 2020, if Paris learns that Firth will be able to repay the loan under the original terms.arrow_forwardOn December 31, 2020, Oriole Company has $6,941,000 of short-term debt in the form of notes payable to Gotham State Bank due in 2021. On December 28, 2020, Oriole enters into a refinancing agreement with Gotham that will permit it to borrow up to 52% of the gross amount of its accounts receivable. Receivables are expected to range between a low of $5,949,000 in May to a high of $7,947,000 in October during the year 2021. The interest cost of the maturing short-term debt is 15%, and the new agreement calls for a fluctuating interest at 1% above the prime rate on notes due in 2025. Oriole’s December 31, 2020, balance sheet is issued on February 15, 2021.Prepare a partial balance sheet for Oriole at December 31, 2020, showing how its $6,941,000 of short-term debt should be presented. (Enter account name only and do not provide descriptive information.) ORIOLE COMPANYPartial Balance Sheetchoose the accounting period select…arrow_forward

- Lowlife Company defaulted on a $250,000 loan that was due on December 31, 2021. The bank has agreed to allow Lowlife to repay the $250,000 by making a series of equal annual payments beginning on December 31, 2022.Required:Calculate the amount at which Barrett should record the note payable and corresponding merchandise purchased on January 1, 2021.1. Calculate the required annual payment if the bank’s interest rate is 10% and four payments are to be made.2. Calculate the required annual payment if the bank’s interest rate is 8% and five payments are to be made.3. If the bank’s interest rate is 10%, how many annual payments of $51,351 would be required to repay the debt?4. If three payments of $104,087 are to be made, what interest rate is the bank charging Lowlife?arrow_forwardOn December 31 , 2018 Nicholas Co. is in financial difficulty and cannot pay a note due that day . It is a $3,300,000 8% issued at par note, payable to Key Bank. Key Bank agrees to accept from Nicholas equipment that has a fair value of 1,450,000, originally costing $2,400,000, with accumulated depreciation of $1,250,000. Key Bank also extends the maturity date to December 31, 2021, reduces the face amount of the note to $1,250,000, and reduces the interest rate to 6%, with interest payable at the end of each year. a. Nicholas should recognize a gain or loss on the transfer of the equipment of: b. At the end of each of the next three years Nicholas records the $ 75,000 interest paid to Key Bank as a: c. In determining the carrying value of the note at December 31, 2018 Key Bank uses an effective interest rate equal to: d. Key Bank records a loss on restructuring of: e. In recording the loss on restructuring, Key bank:arrow_forwardExcel Corporation is experiencing financial difficulty and has met with their creditor (BMO) to explore their options related to a $1.5 million, 6% note payable that is outstanding. The note was issued on September 1, 2020 when the market rate of interest was 6%. There are two years remaining on the note and the current market rate of interest is 8%. Excel and BMO prepare financial statements in accordance with IERS. For each of the following independent situations prepare the journal entry that both Excel and BMO would on their books. a. BMO agrees to accept Excel common shares valued at $1,000,000 as settlement of the debt. 5. BMO agrees to accept land as settlement of the debt. The land is on the books of Excel for $500,000 and has a market value of $1,250,000. c. BMO agrees to modify the terms so that Excel is not paying any interest on the note for the remaining two years. d. BMO agrees to reduce the principal balance to $1,000,000 and requires interest only payments for the next…arrow_forward

- On December 31, 2020, Monty Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Monty Co. agreed to accept a $296,600 zero-interest-bearing note due December 31, 2022, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 12%. Monty is much more creditworthy and has various lines of credit at 6%. Prepare the journal entry to record the transaction of December 31, 2020, for the Monty Co. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Date Account Titles and Explanation Dec. 31, 2020 eTextbook and Media List of Accounts Assuming Monty Co's fiscal year-end is December 31, prepare the journal entry for December 31, 2021. (Round…arrow_forwardOn December 31, 2020, Larkspur Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Larkspur Co. agreed to accept a $ 252,100 zero-interest-bearing note due December 31, 2022, as payment in full. Hayduke is somewhat of a credit risk and typically borrows funds at a rate of 10%. Larkspur is much more creditworthy and has various lines of credit at 6%.Click here to view factor table. https://education.wiley.com/content/Kieso_Intermediate_Accounting_17e/media/simulations/interest_rate_tables.pdfarrow_forwardLowlife Company defaulted on a $200,000 loan that was due on December 31, 2024. The bank has agreed to allow Lowlife to repay the $200,000 by making a series of equal annual payments beginning on December 31, 2025. Required: 1. Calculate the required annual payment of the bank's Interest rate is 10% and four payments are to be made. 2. Calculate the required annual payment of the bank's Interest rate is 8% and five payments are to be made. 3. If the bank's Interest rate is 10%, how many annual payments of $28,156 would be required to repay the debt? 4. If three payments of $72,070 are to be made, what interest rate is the bank charging Lowlife? Note: For all requirements, Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the required annual payment if the bank's interest rate is 10% and four payments…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education