FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

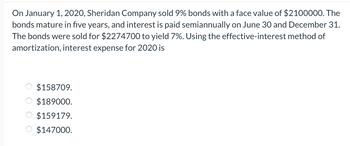

Transcribed Image Text:On January 1, 2020, Sheridan Company sold 9% bonds with a face value of $2100000. The

bonds mature in five years, and interest is paid semiannually on June 30 and December 31.

The bonds were sold for $2274700 to yield 7%. Using the effective-interest method of

amortization, interest expense for 2020 is

$158709.

$189000.

$159179.

$147000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ellis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date. Required: 1. Calculate the total bond interest expense over the bonds' life. 2. Prepare a straight-line amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the total bond interest expense over the bonds' life. Total bond interest expense over life of bonds: Amount repaid: payments of Par value at maturity Total repaid Less amount borrowed Total bond interest expense $ 0 0arrow_forwardOn January 1, 2018, Splash City issues $470,000 of 7% bonds, due in 20 years, with interest payable semiannually on June 30 and December 31 each year. The market interest rate on the issue date is 8% and the bonds issued at $423,487. Required: 1. Using an amortization schedule, show that the bonds have a carrying value of $425,566 on December 31, 2019. (Round Interest expense to nearest whole dollar.) Date Cash Paid 01/01/18 6/30/18 12/31/18 6/30/19 12/31/19 Interest Expense Increase in Carrying Value Carrying Value Required informationarrow_forwardSheridan Company received proceeds of $812000 on 10-year, 8% bonds issued on January 1, 2019. The bonds had a face value of $770000, pay interest annually on December 31, and have a call price of 102. Sheridan uses the straight-line method of amortization. What is the amount of interest expense Sheridan will report with relation to these bonds for the year ended December 31, 2020? O $49000 O $61600 O $64960 $57400arrow_forward

- On January 1, 2025, Shamrock Corporation issued $680,000 of 9% bonds, due in 8 years. The bonds were issued for $643,152, and pay interest each July 1 and January 1. Shamrock uses the effective-interest method. Prepare the company's journal entries for (a) the January 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Assume an effective-interest rate of 10%. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. (a) (b) (c) Date Jan. 1, 2025 July 1, 2025 Dec. 31, 2025 Account Titles and Explanation Debit Crearrow_forwardOn January 1, 2020, Ehrlich Corporation issued 7%, 15-year bonds with a face amount of $5,000,000 .InstructionsPrepare the following entries: Round to the nearest dollar when necessary.a. record the issuance of the bonds on 1/1/20, assuming the bonds were issued at 102b. prepare the entry for the interest accrual and amortization on 12/31/20.c. calculate the balance of the unamortized premium and the carrying value of the bond at 12/31/20. Show your calculations.d. record the issuance of the bonds on 1/1/20, assuming the bonds were issued at 100e. prepare the entry for the redemption of the bonds at maturityarrow_forwardA company issues $16700000, 5.8%, 20-year bonds to yield 6% on January 1, 2020. Interest is paid on June 30 and December 31. The proceeds from the bonds are $16313983. Using effective-interest amortization, how much interest expense will be recognized in 2020?arrow_forward

- On January 1, 2020, High Shots issued $250,000 of 11% ten-year bonds at 104. Issuance costs amounted to $3,000. Bond premium is amortized on straight-line basis. On July 1, 2026, 40% of the bonds were called at 104. Required: Record the retirement of the bonds. Ignore interest and use straight-line amortization.arrow_forwardOn January 1, 2018, Paradiso Company issued 1,000 of its 8%, $1,000 bonds at 93. Interest is payable semiannually on June 30 and December 31. The bonds will mature on December 31, 2027. If the company uses straight-line amortization, determine the amount of interest expense for 2018. answer is 87,000 how do you get there?arrow_forwardSheffield Corp. issues $6000000 face value of bonds at 96 on January 1, 2019. The bonds are dated January 1, 2019, pay interest semiannually at 8% on June 30 and December 31, and mature in 10 years. Straight-line amortization is used for discounts and premiums. On September 1, 2022, $3600000 of the bonds are called at 102 plus accrued interest. What gain or loss would be recognized on the called bonds on September 1, 2022? OO $216000 loss. $360000 loss. $271500 loss. $163200 loss.arrow_forward

- On January 1, 2020, Joe Construction issued $350,000, 3-year bonds for $320,000. The stated rateof interest was 7% and interest is paid annually on December 31.1. Calculate the amount of discount that will be amortized each period. Discount/period:2. Calculate the amount of interest expense for each period.Interest/period:3. Complete the amortization table below for Joe Constructions bonds. Joe ConstructionAmortization for BondsPeriod Cash Payment (credit)Interest Expense(debit)Discount onBondsPayable(Credit)Discount onBondsPayableBalance Book ValueAt issue $ - $ - $ - $ 320,00012/31/202012/31/202112/31/2022arrow_forwardOn January 1, 2021, Tiny Tim Industries had outstanding $1,000,000 of 9% bonds with a book value of $965,500. The indenture specified a call price of $982,000. The bonds were issued previously at a price to yield 11% and interest payable semi-annually on July 1 and January 1. Tiny Tim called the bonds (retired them) on July 1, 2021. What is the amount of the loss on early extinguishment?arrow_forwardOn March 1, 2022, Havenford Corporation issued $240,000, 4 year, 6% bond. Interest is to be paid semi-annually September 1 and March 1. The market rate for similar bonds was 5% at the time the bonds were sold. Havenford Corporation has a April 30 year end and uses the effective interest method to amortize any discount or premium.On September 2, 2024, Havenford redeemed 48% of the face value of these bonds at 101 and retired them.1. Calculate the PV of the bonds 2. Complete the amortization table using the effective interest method. 3. Record the following journal entries in the table below. i) Prepare the journal entry to record the issuance of the bond. ii) Prepare the journal entry to accrue the bond interest at corporate year end. iii) Prepare the journal entry to record the first interest payment. iv) Prepare the journal entry for the retirement of the bonds. Please do it properly correctly and with all the steps or calculations Kindly do it right i need a special expert for this…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education