Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

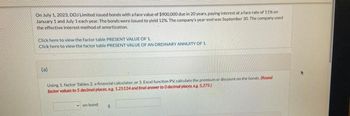

Transcribed Image Text:On July 1, 2023, DDJ Limited issued bonds with a face value of $900,000 due in 20 years, paying interest at a face rate of 11% on

January 1 and July 1 each year. The bonds were issued to yield 12%. The company's year-end was September 30. The company used

the effective interest method of amortization.

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ORDINARY ANNUITY OF 1.

(a)

Using 1. factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the premium or discount on the bonds. (Round

factor values to 5 decimal places, eg 1.25124 and final answer to O decimal places, eg 5,275)

on bond $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- On June 1, 2019, Bramble Company sold $3,120,000 in long-term bonds for $2,736,600. The bonds will mature in 10 years and have a stated interest rate of 8% and a yield rate of 10%. The bonds pay interest annually on May 31 of each year. The bonds are to be accounted for under the effective-interest method. Construct a bond amortization table for this problem to indicate the amount of interest expense and discount amortization at each May 31.arrow_forwardCrane Company redeemed $178,000 face value, 17.5% bonds on June 30, 2022, at 98. The carrying value of the bonds at the redemption date was $190,000. The bonds pay annual interest, and the interest payment due on June 30, 2022, has been made and recorded. Prepare the appropriate journal entry for the redemption of the bonds.arrow_forwardSheffield Company issued $400,000, 12%, 10-year bonds on January 1, 2022, for $423,557. This price resulted in an effective-interest rate of 11% on the bonds. Interest is payable annually on January 1. Sheffield uses the effective-interest method to amortize bond premium or discount. (a) Your answer is correct. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (b) Date Jan. 1, 2022 Account Titles and Explanation Cash Premium on Bonds Payable eTextbook and Media Date Bonds Payable List of Accounts Dec. 31, 2022 Your answer is partially correct. Account Titles and Explanation Interest Expense Premium on Bonds Payable Debit Prepare the journal entry to record the accrual of interest and the premium amortization on December 31, 2022. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.)…arrow_forward

- On January 1, 2018, Paradiso Company issued 1,000 of its 8%, $1,000 bonds at 93. Interest is payable semiannually on June 30 and December 31. The bonds will mature on December 31, 2027. If the company uses straight-line amortization, determine the amount of interest expense for 2018. A) $73,000. B) $82,000. C) $87,000. D) $89,000.arrow_forwardOn June 1,2024 , Blossom Bottle Company sold $3,720,000 in long-term bonds for $3,262,833. The bonds will mature in 10 years and have a stated interest rate of 8% and a yield rate of 10%. The bonds pay interest annually on May 31 of each year. The bonds are to be accounted for under the effective-interest method. (a) Construct a bond amortization table for this problem to indicate the amount of interest expense and discount amortization at each May 31. Include only the first four years. (Round answers to 0 decimal places, e.g. 25,000.) Date 61/24 531/25 531/26 531/27 5/31/28 Carrying Amount Debit Interest Expense Credit Bond Discount Bonds $ $ $arrow_forwardOn January 1, 2021, Crane Ltd. issued $640,000 of 5%, 5-year bonds. The bonds were issued to yield a market interest rate of 6%. Crane's year end is December 31. On January 1, 2023 immediately after making and recording the semi-annual interest payment, Crane redeemed the bonds. A partial bond amortization schedule is presented below. Semi-Annual Interest Interest Bond Interest Period Payment Expense Amortization Amortized Cost Jan. 1, 2021 $612,703 July 1, 2021 16,000 $18,381 $2,381 615,084 Jan. 1, 2022 16,000 18.453 2,453 617,537 July 1, 2022 16,000 18,526 2.526 620,063 Jan. 1, 2023 16,000 18,602 2,602 622,665 Prepare the journal entry to record the payment of interest on July 1, 2021 (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit July 1 (To record interest payment.) eTextbook and Media…arrow_forward

- Tamarisk Ltd. issued a $1,076,000, 10-year bond dated January 1, 2023. The bond was sold at 98.8% interest was payable on the bond on January 1 and July 1 each year. The company's year-end was December 31, and Tamarisk followed ASPE, and chose to use the straight-line amortization method. Prepare the journal entries for the given dates. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date || | | Account Titles and Explanation Debit Credit ||arrow_forwardChowan Corporation issued $136,000 of 7% bonds dated January 1, 2016, for $131,421.73 on January 1, 2016. The bonds are due December 31, 2019, were issued to yield 8%, and pay interest semiannually on June 30 and December 31. Chowan uses the effective interest method of amortization. Required: Prepare the journal entries to record the issue of the bonds on January 1, 2016, and the interest payments on June 30, 2016, December 31, 2016, and June 30, 2017. In addition, prepare a bond interest expense and discount amortization schedule for the bonds through June 30, 2017.arrow_forwardOn January 1, 2018, Paradiso Company issued 1,000 of its 8%, $1,000 bonds at 93. Interest is payable semiannually on June 30 and December 31. The bonds will mature on December 31, 2027. If the company uses straight-line amortization, determine the amount of interest expense for 2018. answer is 87,000 how do you get there?arrow_forward

- On July 1, 2018, Volunteer Inc. issued bonds with a $500,000 face value at 108.0 and the 5-year bonds have a 10% interest rate in a market with a rate of 8%. Interest is payable semi-annually and the effective-interest method is used for amortization. Prepare journal entries for the following transactions.arrow_forwardMcDorral Corporation issued $100,000 of 10%, 11-year bonds payable on January 1, 2020, for $92,480. The market interest rate when the bonds were issued was 12%. Interest is paid semi-annually on January 1 and July 1. The first interest payment is July 1, 2020. Using the effective-interest amortization method, how much interest expense will McDorral record on July 1, 2020? A. $5,000 OB. $5,228 C. $6,772 D. $6,000 O E. $5,549arrow_forwardOn January 1, 2022, Ehrlich Corporation issued 7%, 15-year bonds with a face amount of $4,800,000 . Instructions Prepare the following entries: record the issuance of the bonds on 1/1/22, assuming the bonds were issued at 102 record the issuance of the bonds on 1/1/22, assuming the bonds were issued at 100 prepare the entry for the redemption of the bonds at maturity calculate the total cost of borrowing for these bonds, assuming they are issued at 100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education