FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

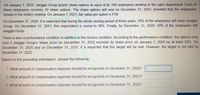

Transcribed Image Text:On January 1, 2020, Jangga Group grants share options to each of its 100 employees working in the sales department. Each of

these employees receives 10 share options. The share options will vest on December 31, 2022, provided that the employees

remain in the entity's employ. On January 1, 2021, fair value per option is P30.

On December 31, 2020, it is expected that during the whole vesting period of three years, 10% of the employees will leave Jangga

Group. On December 31, 2021, this expectation is revise to 30%. Finally, by December 31, 2020, 20% of the employees left

Jangga Group.

There is also a performance condition in addition to the service condition. According to the performance condition, the options only

vest if Jangga Group's share price on December 31, 2022 exceeds its share price on January 1, 2020 by at least 20%. On

December 31, 2020 and on December 31, 2021, it is expected that this target will be met. However, the target is not met by

December 31, 2022.

Based on the preceding information, answer the following:

1. What amount of compensation expense should be recognized on December 31, 2020?

2. What amount of compensation expense should be recognized on December 31, 2021?

3. What amount of compensation expense should be recognized on December 31, 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, AllClear Company issues 2,000 shares of restricted stock to its CEO, Jason Skyline. AllClear’s stock has a fair value of $30 per share on January 1, 2020. Additional information is as follows. The service period related to the restricted stock is five years. Vesting occurs if Skyline stays with the company for a five-year period. The par value of the stock is $10 per share. Prepare journal entries relating to the restricted stock in 2020. Assume that Jason Skyline leaves the company on April 1, 2021 (before any expense has been recorded during 2021). Prepare journal entry relating to the restricted stock in 2021, if necessary.arrow_forwardOn January 1, 2020 Sams Company granted Jim Norman, an employee, an option to buy 300 shares of Sams stock for $40 per share. The option is exercisable for 5 years from date of grant. Using a fair value option pricing model, total compensation expense is determined to be $4,800. The market value for each share of stock is $55 a share. The service period for the stock compensation is for two years beginning January 1, 2020. Record the journal entries for 2020 and 2021.arrow_forwardOn January 1, 2020, Prospero Games Inc. granted stock options to managers and key employees under which the managers and employees could purchase shares of the company for $35. Prospero set aside 40,000 shares for this purpose. The options are exercisable within a four-year period beginning January 1, 2022 by employees still with the company, and the options expire on December 31, 2025. The estimated value of the options on January 1, 2020 is $4.50 per share. On January 10, 2022, 16,000 of the options were exercised when the stock price was $44. On December 17, 2022, an additional 10,000 of the options were exercised when the stock price was $48. No further stock options were exercised. Required: Prepare all the journal entries required between January 1, 2020 and December 31, 2025.arrow_forward

- On January 1, 2019, an entity granted 10,000 share options to employees. The share optionsvest at December 31, 2020 provided the employees remain in service until then.The fair value of the share option cannot be estimated reliably. The par value per ordinaryshare is P100.The option price is P125 and the market value of the ordinary share is also P125 at the dateof grant. All share options vested on December 31, 2020 and no employees left the entity.The share options can be exercised starting January 1, 2021 and expire two years after. Allshare options are exercised on December 31, 2021. The share market prices are P150 onDecember 31, 2019, P180 on December 31, 2020 and P200 on December 31, 2021.Required:A. Prepare journal entries from 2019 to 2021arrow_forwardOn November 1, 2025, Columbo Company adopted a stock-option plan that granted options to key executives to purchase 30,000 shares of the company's $10 par value common stock. The options were granted on January 2, 2026, and were exercisable 2 years after the date of grant if the grantee was still an employee of the company. The options expired 6 years from date of grant. The option price was set at $40, and the fair value option-pricing model determines the total compensation expense to be $450,000. All of the options were exercised during the year 2029: 20,000 on January 3 when the market price was $67, and 10,000 on May 1 when the market price was $77 a share. Prepare journal entries relating to the stock option plan for the years 2026, 2027, and 2028. Assume that the employee performs services equally in 2026 and 2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is…arrow_forwardNadal Company has 20 executives to whom it grants compensatory share options on January 1, 2019. At that time, it grants each executive the right to purchase 120 shares of its $5 par common stock at $40 per share after a 3-year service period. The value of each option is estimated to be $8.50 on the grant date. Based on its average employee turnover rate each year, Nadal expects that 2 executives will not vest in the plan. At the end of 2021, Nadal confirms that the actual turnover was the same as expected. On January 5, 2022, 5 executives exercise their options. Required: Prepare Nadal’s journal entries for 2019 through 2022 in regard to its compensatory share option plan.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education