FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

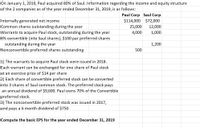

Transcribed Image Text:On January 1, 2019, Paul acquired 80% of Saul. Information regarding the income and equity structure

of the 2 companies as of the year ended December 31, 2019, is as follows:

Paul Corp Saul Corp

$72,000

12,000

Internally generated net income

Common shares outstanding during the year

Warrants to acquire Paul stock, outstanding during the year

8% convertible (into Saul shares), $100 par preferred shares

$114,000

25,000

4,000

1,000

outstanding during the year

1,200

Nonconvertible preferred shares outstanding

500

1) The warrants to acquire Paul stock were issued in 2018.

Each warrant can be exchanged for one share of Paul stock

at an exercise price of $14 per share

2) Each share of convertible preferred stock can be converted

into 3 shares of Saul common stock. The preferred stock pays

an annual dividend of $9,600. Paul owns 70% of the Convertible

preferred stock.

3) The nonconvertible preferred stock was issued in 2017,

and pays a 6 month dividend of $750

Compute the basic EPS for the year ended December 31, 2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, Stellar Industries had stock outstanding as follows. 6% Cumulative preferred stock, $100 par value, issued and outstanding 9,300 shares $930,000 Common stock, $10 par value, issued and outstanding 220,000 shares 2,200,000 To acquire the net assets of three smaller companies, Stellar authorized the issuance of an additional 160,800 common shares. The acquisitions took place as shown below. Date of Acquisition Shares Issued Company A April 1, 2020 48,000 Company B July 1, 2020 82,800 Company C October 1, 2020 30,000 On May 14, 2020, Stellar realized a $93,600 (before taxes) insurance gain on discontinued operations. On December 31, 2020, Stellar recorded income of $282,000 from continuing operations (after tax).Assuming a 20% tax rate, compute the earnings per share data that should appear on the financial statements of Stellar Industries as of December 31, 2020. (Round answer to 2 decimal places, e.g. $2.55.)arrow_forwardon 1/1/2019 X CO acquired 80% of Y common stock for $150,000 in the same day the Y net assets was $ 140,000 ,in the same date the fair value of assets and liabilities were equal .year ended 31/12/2019 Y reported income $50,000 , declared dividend $30,000 , X using equity methods what is non- controlling interest balance on 1/1/2019 Select one: a. 37,500 b. 10,000 c. 47,500 d. 50,000arrow_forwardon 1/1/2019 X CO acquired 80% of Y common stock for $150,000 in the same day the Y net assets was $ 140,000 , in the same date the fair value of assets and liabilities were equal .year ended 31/12/2019 Y reported income $50,000 , declared dividend $30,000 , X using equity methods what is non- controlling interest balance on 1/1/2019 Select one: a. 37,500 b. 47,500 c. 50,000 d. 10,000 Next page ere to search hp 近arrow_forward

- On January 1, 2020, Stellar Industries had stock outstanding as follows. 6% Cumulative preferred stock, $100 par value, issued and outstanding 9,300 shares $930,000 Common stock, $10 par value, issued and outstanding 220,000 shares 2,200,000 To acquire the net assets of three smaller companies, Stellar authorized the issuance of an additional 160,800 common shares. The acquisitions took place as shown below. Date of Acquisition Shares Issued Company A April 1, 2020 48,000 Company B July 1, 2020 82,800 Company C October 1, 2020 30,000 On May 14, 2020, Stellar realized a $93,600 (before taxes) insurance gain on discontinued operations. On December 31, 2020, Stellar recorded income of $282,000 from continuing operations (after tax).Assuming a 20% tax rate, compute the earnings per share data that should appear on the financial statements of Stellar Industries as of December 31, 2020. Stellar IndustriesIncome Statement…arrow_forwardOn January 1, 2020, Splish Industries had stock outstanding as follows. 6% Cumulative preferred stock, $100 par value, issued and outstanding 9,600 shares $960,000 Common stock, $10 par value, issued and outstanding 181,000 shares 1,810,000 To acquire the net assets of three smaller companies, Splish authorized the issuance of an additional 159,600 common shares. The acquisitions took place as shown below. Date of Acquisition Shares Issued Company A April 1, 2020 49,200 Company B July 1, 2020 79,200 Company C October 1, 2020 31,200 On May 14, 2020, Splish realized a $90,000 (before taxes) insurance gain on discontinued operations. On December 31, 2020, Splish recorded income of $312,000 from continuing operations (after tax).Assuming a 20% tax rate, compute the earnings per share data that should appear on the financial statements of Splish Industries as of December 31, 2020. (Round answer to 2 decimal places, e.g. $2.55.) Splish Industries Income…arrow_forwardFollowing are separate financial statements of Michael Company and Aaron Company as of December 31, 2021 (credit balances indicated by parentheses). Michael acquired all of Aaron’s outstanding voting stock on January 1, 2017, by issuing 20,000 shares of its own $1 par common stock. On the acquisition date, Michael Company’s stock actively traded at $23.50 per share. Michael Company12/31/21 Aaron Company12/31/21 Revenues $ (610,000 ) $ (370,000 ) Cost of goods sold 270,000 140,000 Amortization expense 115,000 80,000 Dividend income (5,000 ) 0 Net income $ (230,000 ) $ (150,000 ) Retained earnings, 1/1/21 $ (880,000 ) $ (490,000 ) Net income (above) (230,000 ) (150,000 ) Dividends declared 90,000 5,000 Retained earnings, 12/31/21 $ (1,020,000 ) $ (635,000 ) Cash $ 110,000 $ 15,000 Receivables 380,000 220,000 Inventory 560,000 280,000 Investment in Aaron Company 470,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education