FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

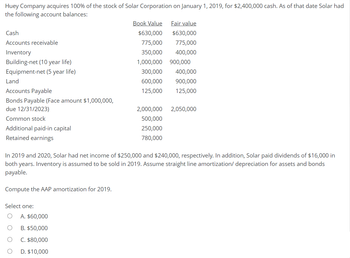

Transcribed Image Text:Huey Company acquires 100% of the stock of Solar Corporation on January 1, 2019, for $2,400,000 cash. As of that date Solar had

the following account balances:

Cash

Accounts receivable

Inventory

Building-net (10 year life)

Equipment-net (5 year life)

Land

Accounts Payable

Bonds Payable (Face amount $1,000,000,

due 12/31/2023)

Common stock

Additional paid-in capital

Retained earnings

Select one:

Book Value

$630,000

775,000

350,000

1,000,000 900,000

300,000

400,000

600,000

900,000

125,000 125,000

A. $60,000

B. $50,000

C. $80,000

D. $10,000

Fair value

$630,000

775,000

400,000

2,000,000

500,000

250,000

780,000

In 2019 and 2020, Solar had net income of $250,000 and $240,000, respectively. In addition, Solar paid dividends of $16,000 in

both years. Inventory is assumed to be sold in 2019. Assume straight line amortization/ depreciation for assets and bonds

payable.

Compute the AAP amortization for 2019.

2,050,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A contract is estimated to yield net annual returns for $ 14000 for years. To secure the contract, an immediate outlay of $70000 is required. Interest is 13 % compounded. Calculate the net present value (NPV) of the contract and determine whether the project should be accepted or rejected according to the net present value criterion.arrow_forwardWhen a lease qualifies as a finance lease, what amount is initially recorded as the cost of the right-of-use asset? A) The present value of the lease payments B) The sum of the gross (undiscounted) lease payments. O A O B « Previous Next Not saved Submit Quizarrow_forward6. When a capital lease is used to acquire general fixed assets, the governmental fund acquiring the fixed assets records a(n) at the a. expenditure, lease payment cost. b. fixed asset, lease payment cost. c. expenditure, present value of the minimum lease payments. d. fixed asset, present value of the minimum lease navments.arrow_forward

- On the balance sheet, the lease liability is measured as ________. Group of answer choices the present value of the lease payments less the present value of the guaranteed residual value (if any) the present value of the lease payments plus the future value of the guaranteed residual value (if any) the present value of the lease payments plus the present value of the guaranteed residual value if the lessee guarantees it(if any) the future value of the lease payments plus the future value of the guaranteed residual value (if any)arrow_forwardPLEASE HELP ME WITH THE ONES I GOT INCORRECT. THANK YOU.arrow_forwardDescribe about the lease expenses in a finance lease?arrow_forward

- Under IFRS, in computing the present value of the minimum lease payments, the lessee should:(a) use its incremental borrowing rate in all cases. (b) use either its incremental borrowing rate or the implicit rate of the lessor, whichever is higher, assuming that the implicit rate is known to the lessee. (c) use either its incremental borrowing rate or the implicit rate of the lessor, whichever is lower, assuming that the implicit rate is known to the lessee. (d) use the implicit rate of the lessor, unless it is impracticable to determine the implicit rate.arrow_forwardWhat is the composition of lease Payments?arrow_forward10arrow_forward

- The lessor expenses initial direct costs in the year of incurrence in a(n) direct-financing lease. sales-type lease. direct-financing lease and a sales-type lease. operating lease.arrow_forwardDiscuss the effectiveness of SFAS No. 13 in addressing the lease capitalizationproblem.arrow_forwardPart 1: New Lease Accounting – IFRS 16 Leases Effect Analysis. What are the top three industries most affected by IFRS 16 as measured by the present value of future payments for off-balance-sheet leases to total assets? Which leased assets propel them to the top three? Also, discuss the extent that smaller firms would be affected by IFRS 16. Which payments are to be included in the measurement of lease assets and lease liabilities? Also, discuss the pros and cons of excluding the following payments from the measurement. Variable lease payments linked to future use or sales Optional payments relating to lease-extension option when a lessee is not reasonably certain to exercise the option. Discuss the effects of the new accounting on the following items and ratios of lessees. Provide reason(s) behind all effects. EBITDA, operating profit, and profit before tax Operating cash flow, financing cash flow, and total cash flow Debt to equity, current ratio, and return on total assetsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education