(A) Bridgeport Co. sells $534,000 of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2023. The bonds yield 12%. Give entries through December 31, 2021.

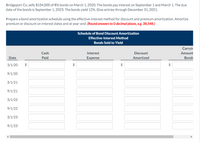

Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548.)

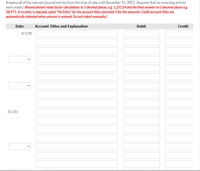

(B) Prepare all of the relevant

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- On July 1, 2018, Volunteer Inc. issued bonds with a $500,000 face value at 108.0 and the 5-year bonds have a 10% interest rate in a market with a rate of 8%. Interest is payable annually and the effective-interest method is used for amortization. Prepare journal entries for the following transactions.arrow_forwardTony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date Cash Paid InterestExpense Increase inCarrying Value CarryingValue 01/01/2021 332,789 06/30/2021 17,500 19,967 2,467 335,256 12/31/2021 17,500 20,115 2,615 337,871 06/30/2022 17,500 20,272 2,772 340,643 12/31/2022 17,500 20,439 2,939 343,582 06/30/2023 17,500 20,615 3,115 346,697 12/31/2023 17,500 20,803 3,303 350,000 THA issued the bonds for: Multiple Choice $350,000. $332,789. $455,000. Cannot be determined from the given information.arrow_forwardTony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date Cash Paid InterestExpense Increase inCarrying Value Carrying value 01/01/2021 $341,728 06/30/2021 $14,400 $17,086 $2,686 344,414 12/31/2021 14,400 17,221 2,821 347,235 06/30/2022 14,400 17,362 2,962 350,197 12/31/2022 14,400 17,510 3,110 353,307 06/30/2023 14,400 17,665 3,265 356,572 12/31/2023 14,400 17,828 3,428 360,000 THA buys back the bonds for $345,005 immediately after the interest payment on 12/31/2021 and retires them. What gain or loss, if any, would THA record on this date? Multiple Choice $3,277 loss. $2,230 gain. $14,995 gain. No gain or loss.arrow_forward

- Bonds with a stated interest rate of 9% and a face value totaling $610,000 were issued for $634 400 on January 1.2021 whe market interest rate was 8%. The company uses effective-interest bond amortization Required: Determine the carrying value of the bonds at December 31, 2022. (Round your answer to nearest whole dolar) Carrying Valuearrow_forwardEllis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market rate is 6% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments.arrow_forwardOn January 1, 2018, Paradiso Company issued 1,000 of its 8%, $1,000 bonds at 93. Interest is payable semiannually on June 30 and December 31. The bonds will mature on December 31, 2027. If the company uses straight-line amortization, determine the amount of interest expense for 2018. answer is 87,000 how do you get there?arrow_forward

- ony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date cash paid Interest Expense Increase in carrying value carrying value 01/01/2021 $218,690 06/30/2021 $11,500 $13,121 $1,621 220,311 12/31/2021 11,500 13,219 1,719 222,030 06/30/2022 11,500 13,322 1,822 223,852 12/31/2022 11,500 13,431 1,931 225,783 06/30/2023 11,500 13,547 2,047 227,830 12/31/2023 11,500 13,670 2,170 230,000 THA issued the bonds for: Multiple Choice $230,000. $218,690. $299,000. Cannot be determined from the given information.arrow_forwardOn September 30, 2023, when the market interest rate is 9 percent, Score Ltd. issues $8,000,000 of 11-percent, 20-year bonds for $9,472,126. The bonds pay 30. Score Ltd, amortizes bond premium by the effective-interest method. Required 1. Prepare an amortization table for the first four semi-annual interest periods. Score amortizes a bond premium by the effective-interest method. 2. Record the issuance of the bonds on September 30, 2023, the accrual of interest on December 31, 2023, and the semi-annual interest payment on March 3 Requirement 1. Prepare an amortization table for the first four semi-annual interest periods. (Round your answers to the nearest whole dollar.) B: Interest Expense (4.5% of Preceding Bond Carrying Amount) A: Interest Payment Semi-annual Interest (5.5% of Maturity Period Values) Issue date. March 31, 2024 September 30, 2024 March 31, 2025 September 30, 2025 440,000 440,000 440,000 440,000 426,245 C: Premium Amortization (A-B) 13,755 D: Unamortized Premium…arrow_forwardWhat gain or loss, if any, would X2 record in this date?arrow_forward

- Ellis Company issues 8.0%, five-year bonds dated January 1, 2021, with a $530,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $540,871. The annual market rate is 7.5% on the issue date. Required: 1. Compute the total bond interest expense over the bonds' life. 2. Prepare an effective interest amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments. Please need answer for all with working please answer do not waste time or question by holding attempt if you can otherwise skiparrow_forwardOn January 1, 2019, Company C issues $200,000 of its 6% bonds which mature in 10 years. Interest is paid annually on December 31. The market (effective) rate of interest is 4%. If the bond sells as 88.2, what the amount of interest expense reported on the Income Statement for 2019 (hint: prepare an amortization schedule)arrow_forwardHernandez company issued $380,000, 7%, 10-year bonds on January 1, 2022, for $407,968. this price resulted in an effective-interest rate of 6% on the bonds. interest is payable annually on January 1. hernandex]z uses the effective-interest method to amortize bond premium or discount. prepare the journal entry to record the accrual interest and the premium amortization on December 31, 2022.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education