FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

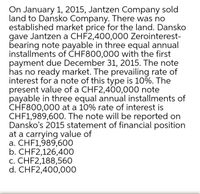

Transcribed Image Text:On January 1, 2015, Jantzen Company sold

land to Dansko Company. There was no

established market price for the land. Dansko

gave Jantzen a CHF2,400,000 Zerointerest-

bearing note payable in three equal annual

installments of CHF800,000 with the first

payment due December 31, 2015. The note

has no ready market. The prevailing rate of

interest for a note of this type is 10%. The

present value of a CHF2,400,000 note

payable in three equal annual installments of

CHF800,000 at a 10% rate of interest is

CHF1,989,600. The note will be reported on

Dansko's 2015 statement of financial position

at a carrying value of

a. CHF1,989,600

b. CHF2,126,400

c. CHF2,188,560

d. CHF2,400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Cells Can contain On December 31, 2017, Short Co. is in financial difficulty and cannot pay a note due that day. It is a $2,000,000 face value note with $200,000 accrued interest payable to Bryan, Inc. The original market rate of interest on the note was 12.58613%. Bryan agrees to forgive the accrued interest, extend the maturity date (two years) to December 31, 2019, and reduce the interest rate to 4%. The present value of the restructured cash flows is $1,712,000 (using the original market rate). Do NOT add rows to the spreadsheet! Discount Cash Premium Interest payable Par Interest expense Discount on bond payable Yes Bonds payable No Loss on redemption Gain on redemptin Cash Interest payable Interest receivable Notes payable Gain on restructuring Loss on restructuring Discount on Note payable Premium on Note payable…arrow_forwardOn January 1, 2018, Apple Company sold delivery equipment costing P1,000,000 with accumulated depreciation of P150,000 in exchange for a 3-year, P1,800,000 noninterest bearing note receivable due on December 31, 2020. The prevailing market rate of interest for this type of note is 12%. How much is the gain or loss on sale of delivery equipment in 2018?arrow_forwardAt January 1, 2018, Brainard Industries, Inc., owed Second BancCorp $12 million under a 10% note due December 31, 2020. Interest was paid last on December 31, 2016. Brainard was experiencing severe financial difficultiesand asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorpagreed to:a. Forgive the interest accrued for the year just ended.b. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment untilDecember 31, 2019.c. Reduce the unpaid principal amount to $11 million.Required:Prepare the journal entries by Brainard Industries, Inc., necessitated by the restructuring of the debt at (1) January1, 2018; (2) December 31, 2019; and (3) December 31, 2020.arrow_forward

- On Jan. 1, 20x4, Bernie Bird Co. sold a building, which had a carrying amount of P350,000, receiving a P125,000 down payment and, as additional consideration, a P400,000 noninterest bearing note due on January 1, 20x7. There was no established exchange price for the building, and the note had no ready market. The prevailing rate of interest for a note of this type at January 1, 20x4, was 10%. What amount of interest income should be included in the entity’s 20x4, income statement? a. 0 b. 35,053 c. 30,053 d. 40,109arrow_forward9arrow_forward16. On January 1, 2012, the Dolce Corporation issued a three-year, non-interest bearing note with face value of P3,000,000 for a piece of land purchased from Jardine Corporation. The note is payable in annual installments of P1,000,000 every December 31, starting on December 31, 2012. The land has an equivalent cash price of P2,400,000, a price that provides the note an effective interest rate of 12%. What is the interest expense for the year ending December 31, 2012? * a. P360,000 b. P288,000 c. P240,000 d. P168,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education