FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

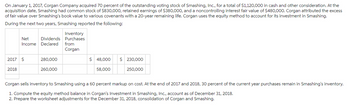

Transcribed Image Text:On January 1, 2017, Corgan Company acquired 70 percent of the outstanding voting stock of Smashing, Inc., for a total of $1,120,000 in cash and other consideration. At the

acquisition date, Smashing had common stock of $830,000, retained earnings of $380,000, and a noncontrolling interest fair value of $480,000. Corgan attributed the excess

of fair value over Smashing's book value to various covenants with a 20-year remaining life. Corgan uses the equity method to account for its investment in Smashing.

During the next two years, Smashing reported the following:

Net

Income

2017 S

2018

Inventory

Purchases

Dividends

Declared from

280,000

260,000

Corgan

$ 48,000

58,000

$ 230,000

250,000

Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2017 and 2018, 30 percent of the current year purchases remain in Smashing's inventory.

1. Compute the equity method balance in Corgan's Investment in Smashing, Inc., account as of December 31, 2018.

2. Prepare the worksheet adjustments for the December 31, 2018, consolidation of Corgan and Smashing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Plaza, Incorporated, acquires 80 percent of the outstanding common stock of Stanford Corporation on January 1, 2024, in exchange for $941, 800 cash. At the acquisition date, Stanford's total fair value, including the noncontrolling interest, was assessed at $1,177,250. Also at the acquisition date, Stanford's book value was $546, 100. Several individual items on Stanford's financial records had fair values that differed from their book values as follows: Items Book Value Fair Value Trade names (indefinite life) $ 300, 900 $ 360, 900 Property and equipment (net, 8-year remaining life) 233, 600 262, 400 Patent (14-year remaining life) 120, 900 154, 500 For internal reporting purposes, Plaza, Incorporated, employs the equity method to account for this investment. The following account balances are for the year ending December 31, 2024, for both companies. Accounts Plaza Stanford Revenues $ (795, 100) $ (782,600) Cost of goods sold 439, 600 331, 000 Depreciation expense 186, 400 29, 200…arrow_forwardABC Inc. purchased 35,000 voting shares out of 123 Inc.'s 50,000 outstanding voting shares for $350,000 on January 1, 2020. On the date of acquisition, 123's common shares and retained earnings were valued at $120,000 and $180,000, respectively. 123's book values approximated its fair values on the acquisition date with the exception of a patent and a trademark, neither of which had been previously recorded. The fair values of the patent and trademark on the date of acquisition were $30,000 and $20,000 respectively. On January 2, 2020, ABC sold 7,000 shares of 123 on the open market for $57,750. ABC Inc. uses the equity method to account for its investment in 123 Inc. What is the carrying value of the trademark after the sale? A. $12,600 B. $18,000 C. $20,000 D. $30,000arrow_forwardOn January 1, 2018, Cameron Inc. bought 20% of the outstanding common stock of Lake Construction Companyfor $300 million cash. At the date of acquisition of the stock, Lake’s net assets had a fair value of $900 million.Their book value was $800 million. The difference was attributable to the fair value of Lake’s buildings and itsland exceeding book value, each accounting for one-half of the difference. Lake’s net income for the year endedDecember 31, 2018, was $150 million. During 2018, Lake declared and paid cash dividends of $30 million. Thebuildings have a remaining life of 10 years.Required:1. Prepare all appropriate journal entries related to the investment during 2018, assuming Cameron accounts forthis investment by the equity method.2. Determine the amounts to be reported by Cameron:a. As an investment in Cameron’s 2018 balance sheetarrow_forward

- On July 1, 2021, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $835,275 in cash and equity securities. The remaining 30 percent of Atlanta's shares traded closely near an average price that totaled $357,975 both before and after Truman's acquisition. In reviewing its acquisition, Truman assigned a $140,000 fair value to a patent recently developed by Atlanta, even though it was not recorded within the financial records of the subsidiary. This patent is anticipated to have a remaining life of five years. The following financial information is available for these two companies for 2021. In addition, the subsidiary's income was earned uniformly throughout the year. The subsidiary declared dividends quarterly.arrow_forwardOn January 1, 2021, Ackerman Company acquires 80% of Seidel Company for $2,054,400 in cash consideration. The remaining 20 percent noncontrolling interest shares had an acquisition-date estimated fair value of $513,600. Seidel's acquisition-date total book value was $2,040,000. The fair value of Seidel's recorded assets and liabilities equaled their carrying amounts. However, Seidel had two unrecorded assets- a trademark with an indefinite life and estimated fair value of $294,000 and several customer relationships estimated to be worth $216,000 with four-year remaining lives. Any remaining acquisition-date fair value in the Seidel acquisition was considered goodwill. During 2021, Seidel reported $206,400 net income and declared and paid dividends totaling $60,000. Also in 2021, Ackerman reported $420,000 net income, but neither declared nor paid dividends. a. What amount should Ackerman assign to the 20 percent noncontrolling interest of Seidel at the acquisition date? b. How much of…arrow_forwardOn July 1, 2021, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $792,400 in cash and equity securities. The remaining 30 percent of Atlanta’s shares traded closely near an average price that totaled $339,600 both before and after Truman’s acquisition. In reviewing its acquisition, Truman assigned a $125,500 fair value to a patent recently developed by Atlanta, even though it was not recorded within the financial records of the subsidiary. This patent is anticipated to have a remaining life of five years. The following financial information is available for these two companies for 2021. In addition, the subsidiary’s income was earned uniformly throughout the year. The subsidiary declared dividends quarterly. Truman Atlanta Revenues $ (768,485 ) $ (536,000 ) Operating expenses 418,000 378,000 Income of subsidiary (46,515 ) 0 Net income $ (397,000 ) $ (158,000 ) Retained earnings, 1/1/21 $…arrow_forward

- On January 1, 2017, Harrison, Inc., acquired 90 percent of Starr Company in exchange for$1,125,000 fair-value consideration. The total fair value of Starr Company was assessed at $1,200,000. Harrison computed annual excess fair-value amortization of $8,000 based on the difference between Starr’s total fair value and its underlying book value. The subsidiary reported net income of $70,000 in 2017 and $90,000 in 2018 with dividend declarations of $30,000 each year. Apart from its investment in Starr, Harrison had net income of $220,000 in 2017 and $260,000 in 2018. What is the balance of the non controlling interest in Starr at December 31, 2018?arrow_forwardOn January 1, 2017, Doone Corporation acquired 60 percent of the outstanding voting stock of Rockne Company for $312,000 consideration. At the acquisition date, the fair value of the 40 percent noncontrolling interest was $208,000 and Rockne's assets and liabilities had a collective net fair value of $520,000. Doone uses the equity method in its internal records to account for its investment in Rockne. Rockne reports net income of $150,000 in 2018. Since being acquired, Rockne has regularly supplied inventory to Doone at 25 percent more than cost. Sales to Doone amounted to $210,000 in 2017 and $310,000 in 2018. Approximately 35 percent of the inventory purchased during any one year is not used until the following year. a. What is the noncontrolling interest's share of Rockne's 2018 income? b. Prepare Doone's 2018 consolidation entries required by the intra-entity inventory transfers. Complete this question by entering your answers in the tabs below. Required A Required B What is the…arrow_forwardOn January 1, 2020, QuickPort Company acquired 90 percent of the outstanding voting stock of NetSpeed, Inc., for $1,125,000 in cash and stock options. At the acquisition date, NetSpeed had common stock of $1,170,000 and Retained Earnings of $58,500. The acquisition-date fair value of the 10 percent noncontrolling interest was $125,000. QuickPort attributed the $21,500 excess of NetSpeed's fair value over book value to a database with a five-year remaining life. During the next two years, NetSpeed reported the following: Net Income Dividends Declared 2020 $ 30,100 $ 4,300 2021 43,000 4,300 On July 1, 2020, QuickPort sold communication equipment to NetSpeed for $27,500. The equipment originally cost $30,500 and had accumulated depreciation of $5,400 and an estimated remaining life of three years at the date of the intra-entity transfer. Compute the equity method balance in QuickPort's Investment in NetSpeed, Inc., account as of December 31, 2021.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education