FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

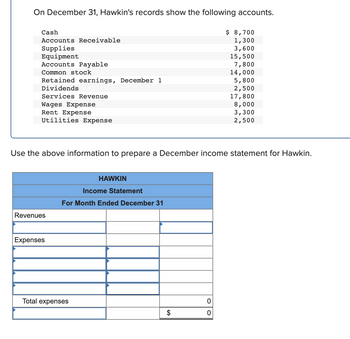

Transcribed Image Text:On December 31, Hawkin's records show the following accounts.

Cash

Accounts Receivable

Supplies

Equipment

Accounts Payable

Common stock

Retained earnings, December 1

Dividends

Services Revenue

Wages Expense

Rent Expense

Utilities Expense

Use the above information to prepare a December income statement for Hawkin.

Revenues

Expenses

HAWKIN

Income Statement

For Month Ended December 31

Total expenses

$

$ 8,700

1,300

3,600

15,500

7,800

14,000

5,800

2,500

17,800

8,000

3,300

2,500

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements of New World, Incorporated, provide the following information for the current year: December 31 January 1 Accounts receivable $ 288,000 $ 391,500 Inventory $ 281,250 $ 267,000 Prepaid expenses $ 73,200 $ 70,500 Accounts payable (for merchandise) $ 259,800 $ 251,550 Accrued expenses payable $ 66,150 $ 79,950 Net sales $ 3,172,500 Cost of goods sold $ 1,672,500 Operating expenses (including depreciation of $64,000) $ 382,500 What is New World's net cash flow from operating activities for the current year?arrow_forwardYear-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Inventory Prepaid rent Current Year 1 Year Ago 2 Years Ago $ 26,725 77,457 $ 31,858 95,459 8,436 240,403 30,967 41,290 43,529 52,503 73,671 8,200 220,389 3,372 193,642 $ 312,800 $ 42,115 69,129 162,500 Machinery, net Total assets $ 448,480 $ 386,621 Liabilities and Equity Accounts payable $ 110,555 Long-term notes payable 83,471 $ 65,992 88,034 Common stock 162,500 Retained earnings 91,954 162,500 70,095 39,056 Total liabilities and equity $ 448,480 $ 386,621 $ 312,800 Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute times interest earned for the current year and one year ago. Current Year 1 Year Ago Times Interest Earned Choose Numerator: / Choose Denominator: I II 11 Times interest earned times timesarrow_forwardAccounts receivable analysis. The following data are taken from the financial statement of sigmon Inc. Terms of all sales are 2/ 10, n / 45. Accounts receivable the end of the year $725,000 20y3 $ 650,000 20y2 $600,000 20y 1 Sales on account 5,637,500 20y 3 4,687,500 20y 2 A. 20y 2 and 20 y3, determine (1) the accounts receivable turnover and (2) the number of days sales in receivable. Round interim calculations to the nearest dollar final answer to one decimal place assume a 365-day year. 1. Accounts receivable turnover 20y3 2. Number of days sales in receivable 20y2 B. The collection of accounts receivable has_______ this can be seen in both the_______ in accounts receivable turnover and the_______ in the collection period.arrow_forward

- The following financial statements apply to Adams Company: ADAMS COMPANY Income Statements for the Years Ending December 31 Year 1 $180,400 Revenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Total expenses Net income Assets Current assets Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles Total assets Liabilities and Stockholders Equity Liabilities Current liabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities $ 220,800 Stockholders equity Common stock (49,000 shares) 124, 600 20,200 10,000 2.100 20,400 177,300 $ 43,500 ADAMS COMPANY Balance Sheets As of December 31 F Retained earnings Total stockholders equity Total liabilities and stockholders' equity 102, 100 18.200 9,000 2,100 17,600 149,000 $ 31,400 $ 5,100 1,800 36,000 101, 200 4,800 148,900 107,000 20,600 $ 276,500 $38,200 16,500…arrow_forwardOperating activities: Net earnings Non-cash items Add: Depreciation LAURENT COMPANY Statement of Cash Flows For the year 31 December 20X8 Changes to working ital: Add: Decrease in accounts receivable Less: Increase in accounts payable Less: Increase in inventory Investing activities: Decrease in long-term bank loan Purchase of long-term investment Financing activities: Sold long-term investment Paid cash dividend Net change in cash Opening cash Closing cash Chemisie ہےarrow_forwardAt December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity For Year Ended December 31 Sales Cost of goods sold Other operating expenses Current Year Interest expense Income tax expense Total costs and expenses Net income Earnings per share $ 31,880 88,776 116, 174 9,763 283, 158 $ 529,751 $ 127,951 100,589 162,500 138,711 $529,751 For both the current year and one year ago, compute the following ratios: $ 420,092 213,490 11,707 8,953 Current Year 1 Year Ago The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: $ 688,676 $36,900 63,296 86,176 9,686 260,624 $ 456,682 654,242 $34,434 $ 2.12 2 Years Ago $36,930 50,235 $ 75,636 105, 037 163,500 $ 49,240 81,607 162,500 83,453 112,509 $ 456,682 $ 376,800 54, 576 4,186 230,873 $…arrow_forward

- The following selected account balances were taken from Buckeye Company's general ledger at January 1, 2025 and December 31, 2025: Accounts payable Accounts receivable Common stock Inventory January 1 $ 42,000 $ 25,000 $110,000 $ 25,000 $ 60,000 $ 83,000 $ 30,000 $ 19,000 Sales revenue Cost of goods sold Salaries expense Net income December 31 $ 36,000 $ 17,000 $180,000 $ 28,000 $ 73,000 $122,000 $ 46,000 $ 13,000 Land Notes payable Retained earnings Salaries payable Buckeye Company's 2025 income statement is given below: $420,000 $269,000 $ 93,000 $ 58,000 Calculate the amount of cash paid to suppliers for purchases of inventory during 2025.arrow_forwardOn January 1, 2021, the general ledger of TNT Fireworks includes the following account balances: Accounts Debit Credit Cash $ 59,000 Accounts Receivable 25,600 Allowance for Uncollectible Accounts $ 2,500 Inventory Notes Receivable (5%, due in 2 years) 36,600 15,600 Land 158,000 Accounts Payable 15,100 Common Stock 223,000 Retained Earnings 54,200 $294,800 Totals $294,800 During January 2021, the following transactions occur: January 1 Purchase equipment for $19,800. The company estimates a residual value of $1,800 and a six-year service life. January 4 Pay cash on accounts payable, $9,800. January 8 Purchase additional inventory on account, $85,900. January 15 Receive cash on accounts receivable, $22,30O. January 19 Pay cash for salaries, $30,100. January 28 Pay cash for January utilities, $16,800. January 30 Sales for January total $223,000. All of these sales are on account. The cost of the units sold is $116,500. Information for adjusting entries: a. Depreciation on the equipment…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education