FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

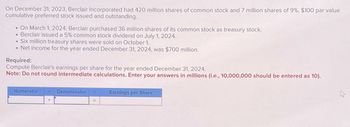

Transcribed Image Text:On December 31, 2023, Berclair Incorporated had 420 million shares of common stock and 7 million shares of 9%, $100 par value

cumulative preferred stock issued and outstanding.

On March 1, 2024, Berclair purchased 36 million shares of its common stock as treasury stock.

• Berclair issued a 5% common stock dividend on July 1, 2024.

Six million treasury shares were sold on October 1.

.Net income for the year ended December 31, 2024, was $700 million.

Required:

Compute Berclair's earnings per share for the year ended December 31, 2024.

Note: Do not round intermediate calculations. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

Numerator 4. Denominator

Earnings per Share

=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On December 31, 2023, Berclair Incorporated had 540 million shares of common stock and 21 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Berclair purchased 24 million shares of its common stock as treasury stock. • Berclair issued a 5% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $1,050 million. • Also outstanding at December 31 were 84 million incentive stock options granted to key executives on September 13, 2019. • The options were exercisable as of September 13, 2023, for 84 million common shares at an exercise price of $75 per share. • During 2024, the market price of the common shares averaged $100 per share. • The options were exercised on September 1, 2024. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible…arrow_forwardsssssarrow_forwardOn December 31, 2023, Berclair Incorporated had 280 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. • On March 1, 2024, Berclair purchased 56 million shares of its common stock as treasury stock. ● ● Berclair issued a 5% common stock dividend on July 1, 2024. Four million treasury shares were sold on October 1. Net income for the year ended December 31, 2024, was $350 million. Also outstanding at December 31 were 30 million incentive stock options granted to key executives on September 13, 2019. • The options were exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. During 2024, the market price of the common shares averaged $70 per share. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities have been adjusted for any stock split or stock…arrow_forward

- Year 2023 - Wyly Corp. experienced the following events related to its common stock and preferred stock during 2023. Jan 15, issued 100,000 more shares of its $2 Par Value common stock for $15 per share. On March 1, declared dividends of $450,000 on common stock payable on November 1, to stockholders of record as of July 1. On September 15, declared dividends on its $10 Par Value 4% preferred stock payable on November 1, to stockholders of record as of October 1. There are 250,000 preferred stock shares outstanding. Year 2024 - On January 3, 2024, Wyly repurchased, as treasury stock, 2,000 shares of common stock at $13 per share. One month later Wyly repurchased another 3,000 shares of common stock at $12.50 per share. To raise needed cash, Wyly re-sold 3,200 shares of the treasury stock at $14 per share on Oct 15, 2024. Wyly uses the FIFO method when re-selling treasury stock. Requirements: Record the 2023 common stock and preferred stock issues and dividends in the general…arrow_forwardsavitaarrow_forwardMemanarrow_forward

- 1. Rahman Company began 2022 with 690,000 shares of common stock outstanding. On September 1, 2022 there was a 2 for 1 stock split. On November 1, 2022, the company repurchased 270,000 shares of treasury stock. 2. Net Income for 2022 was $18,990,000 and the corporate tax rate is 25%. 3. 4% convertible preferred stock was outstanding all year. Each share has a par value of $100 and the total par value is $18,000,000. Each preferred share is convertible into 3 shares of common stock. 4. In 2015, 8% bonds (maturing in 10 years) were issued at 98. The discount is being amortized on a straight-line basis. The bonds have a $1,000 par value each for a total par value of $12,000,000. Each bond is convertible into 2 shares of common stock. 5. On March 1, 2022, Rahman had a second issuance of convertible bonds at their stated rate of 9%. Each $1,000 bond is convertible into 6 shares of common stock. The total par is $15,000,000. 6.…arrow_forwardOn December 31, 2023, Dow Steel Corporation had 780,000 shares of common stock and 48,000 shares of 10%, noncumulative, nonconvertible preferred stock Issued and outstanding. • Dow Issued a 5% common stock dividend on May 15 and paid cash dividends of $580,000 and $87,000 to common and preferred shareholders, respectively, on December 15, 2024. • On February 28, 2024, Dow sold 68,000 common shares. • In keeping with its long-term share repurchase plan, 5,000 shares were retired on July 1. • Dow's net Income for the year ended December 31, 2024, was $3,000,000. The Income tax rate is 25%. Required: Compute Dow's earnings per share for the year ended December 31, 2024. Note: Do not round intermediate calculations. Except for per share amounts, enter your answers in thousands (1.e., 10,000 should be entered as 10). Round "Earnings per share" answer to 2 decimal places. Numerator Denominator Earnings per sharearrow_forwardOn December 31, 2023, Dow Steel Corporation had 680,000 shares of common stock and 308,000 shares of 8%, noncumulative, nonconvertible preferred stock issued and outstanding. • Dow issued a 4% common stock dividend on May 15 and paid cash dividends of $480,000 and $77,000 to common and preferred shareholders, respectively, on December 15, 2024. • On February 28, 2024, Dow sold 54,000 common shares. • In keeping with its long-term share repurchase plan, 4,000 shares were retired on July 1. • Dow's net income for the year ended December 31, 2024, was $2,500,000. • The income tax rate is 25%. • Also, as a part of a 2023 agreement for the acquisition of Merrill Cable Company, another 20,000 shares (already adjusted for the stock dividend) are to be issued to former Merrill shareholders on December 31, 2025, if Merrill's 2025 net income is at least $580,000. • In 2024, Merrill's net income was $710,000. • As part of an incentive compensation plan, Dow granted incentive stock options to…arrow_forward

- On December 31, 2023, Berclair Incorporated had 600 million shares of common stock and 17 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. • On March 1, 2024, Berclair purchased 120 million shares of its common stock as treasury stock. Berclair issued a 6% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $850 million. • Also outstanding at December 31 were 72 million incentive stock options granted to key executives on September 13, 2019. • The options were exercisable as of September 13, 2023, for 72 million common shares at an exercise price of $60 per share. . During 2024, the market price of the common shares averaged $90 per share. The options were exercised on September 1, 2024. Required: Compute Berclair's basic and diluted earings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible…arrow_forwardOn December 31, 2023, Berclair Incorporated had 600 million shares of common stock and 17 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. • . On March 1, 2024, Berclair purchased 120 million shares of its common stock as treasury stock. Berclair issued a 6% common stock dividend on July 1, 2024. • Four million treasury shares were sold on October 1. • Net income for the year ended December 31, 2024, was $850 million. Also outstanding at December 31 were 72 million incentive stock options granted to key executives on September 13, 2019. The options were exercisable as of September 13, 2023, for 72 million common shares at an exercise price of $60 per share. During 2024, the market price of the common shares averaged $90 per share. The options were exercised on September 1, 2024. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities…arrow_forwardI need help with the following problem and explain working clearly , please.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education