FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

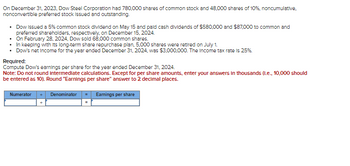

Transcribed Image Text:On December 31, 2023, Dow Steel Corporation had 780,000 shares of common stock and 48,000 shares of 10%, noncumulative,

nonconvertible preferred stock Issued and outstanding.

• Dow Issued a 5% common stock dividend on May 15 and paid cash dividends of $580,000 and $87,000 to common and

preferred shareholders, respectively, on December 15, 2024.

• On February 28, 2024, Dow sold 68,000 common shares.

• In keeping with its long-term share repurchase plan, 5,000 shares were retired on July 1.

• Dow's net Income for the year ended December 31, 2024, was $3,000,000. The Income tax rate is 25%.

Required:

Compute Dow's earnings per share for the year ended December 31, 2024.

Note: Do not round intermediate calculations. Except for per share amounts, enter your answers in thousands (1.e., 10,000 should

be entered as 10). Round "Earnings per share" answer to 2 decimal places.

Numerator

Denominator

Earnings per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On its Form 10-K for the year ended December 31, 2016, Ameri Bank Corp. reported information related to basic earnings per share.Fill in the missing information. Rounding instruction: Round answer a. to two decimal places.Round answer b., c., & d. to the nearest million.Round answer e. to three decimal places. $ millions, except per share amounts 2015 2014 2013 Net income $17,287 $4,833 d. Answer Preferred stock dividends $1,483 b. Answer $1,349 Net income applicable to common shareholders $15,804 c. Answer $9,993 Average common shares outstanding 10,462.282 10,527.818 e. Answer Basic earnings per share a. Answer $0.34 $0.94arrow_forwardAlgo Plc reported total revenue for 2019 of £1.3 million. Algo's 2019 shares outstanding were 1.4 million. The price/sales (P/S) ratio for Micro Plc, a close competitor of Algo, is 9.5. What could Algo's price per share be based on the data given (round it to two decimal points)?arrow_forwardPlease do not give solution in image formatarrow_forward

- The following information is available for Jase Company: Market price per share of common stock $25.00 Earnings per share on common stock 1.25 Which of the following statements is correct? a. The price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year. b. The market price per share and the earnings per share are not statistically related to each other. c. The price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. d. The price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year.arrow_forwardGiven the following price and dividend information, calculate the $1 invested equivalent. (Round to 4 decimals) Stock: MSFT Year Price Dividend 2017 $ 64.65 2018 $ 95.01 $ 1.72 2019 $ 104.43 $ 1.89 2020 $107.23 $ 2.09 2021 $231.96 $ 2.30 2022 $310.98 $ 2.54 2023 $ 247.81 $ 3.00arrow_forwardDetermine Fisher’s return on stockholders’ equity if its Year 1 earnings after tax are $9,000(000). Round your answer to two decimal places. %arrow_forward

- Please help. I have tried four times (after 5 attempts, I lose all points) to determine the weighted average number of shares that Concord would use in calculating earnings per share for the fiscal year ended: May 31, 2020 May 31, 2021 The answers I have tried but were incorrect were as follows: 2020 $1,262,200 2021 $1,429,467 2020 $1,408,000 2021 $2,153,500 2020 $1,249,733 2021 $1,376,800 2020 $1,320,000 2021 $1,889,500arrow_forwardShares purchased one year ago for $8790 are now worth $15,390. During the year, the shares paid dividends totalling $280. Calculate the shares’: (Do not round intermediate calculations and round your final answer to 2 decimal places.) a. Income yield b. Capital gain yield c. Rate of total returnarrow_forwardDirections: Determine values for the missing items. Round answers to one decimal. 2018 2017 Net Income (in millions) ? ? Weighted Average Shares Outstanding (in millions) Basic Number Shares ? 59.2 Diluted Number of Shares 64.8 ? Earnings Per Share Basic 1.50 1.09 Diluted 1.43 1.02 Assume no preferred stock or restricted stock unit dividends .arrow_forward

- Calculate the earnings per share (average of 420,000 shares outstanding for the year) for 2020. (Round answer to 2 decimal places, e.g. 2.55.) Earning per share $enter the earning per share in dollars rounded to 2 decimal places per share Matthias Medical manufactures hospital beds and other institutional furniture. The company’s comparative balance sheet and income statement for 2019 and 2020 follow. Matthias MedicalComparative Balance SheetAs of December 31 2020 2019 Assets Current assets Cash $397,220 $417,400 Accounts receivable, net 906,800 776,400 Inventory 743,000 681,000 Other current assets 381,300 247,000 Total current assets 2,428,320 2,121,800 Property, plant, & equipment, net 8,678,000 8,440,100 Total assets $11,106,320 $10,561,900 Liabilities and Stockholders’ Equity Current liabilities $2,934,700…arrow_forwardAnalyzing and Interpreting Stockholders' Equity and EPS Following is the stockholders' equity section of the balance sheet for The Procter & Gamble Company along with selected earnings and dividend data. For simplicity, balances for noncontrolling interests have been left out of income and shareholders' equity information. $ millions except per share amounts 2014 2013 Net earnings attributable to Procter & Gamble shareholders $11,156 $11,797 Common dividends 5,883 5,534 Preferred dividends 256 233 Basic net earnings per common share $3.82 $4.12 Diluted net earnings per common share $3.66 $3.93 Shareholders' equity: Convertible class A preferred stock, stated value $1 per share $1,195 $1,234 Common stock, stated value $1 per share 4,008 4,008 Additional paid-in capital 63,181 62,405 Treasury stock, at cost (shares held: 2014--1261.2; 2013--1243) (69,604) (67,278) Retained earnings 75,349 70,682 Accumulated other comprehensive income/(loss) (9,333) (2,054) Other (761) (996) Shareholders'…arrow_forwardNAME Herbalife Nutrition Herc Holdings Heritage Insurance Holdings HRTG Hersha Hospitality Trust CIA HT Hershey HSY HTZ SYMBOL CLOSE NET CHG 57.94 -1.39 26.86 -0.71 14.57 -0.38 Hertz Global Holdings Hess Corp. Hess Midstream Partners HLF HRI HES HESM Hewlett Packard Enterprise HPE 16.59 -0.16 106.24 0.80 -0.77 13.27 42.39 0.15 17.87 0.25 13.18 -0.28 VOLUME DIV YIELD P/E 1,149,773 60.41 389,826 72.99 81,929 19.15 732,879 24.16 1,145,889 114.63 52 WK 52 WK HIGH LOW 34.16 1.20 2.07 47.75 -1.71 24.16 3.10 3.35 12.85 0.24 1.65 22.01 -1.02 2,965,201 25.14 16.50 1.12 6.75 ...dd -5.42 89.10 2.89 2.72 22.00 -0.88 13.01 2.24 -2.78 35.59 1.00 2.36 ...dd 47,899 24.51 16.17 1.43 8.00 14.60 12.09 0.45 3.41 11.46 5,969,511 74.81 11,756,695 19.48 **** **** YTD %CHG Figure 2.8 Listing of stocks traded on the New York Stock Exchange Source: WSJ Online, January 4, 2019. 4.67 5.24 -0.23arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education