FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

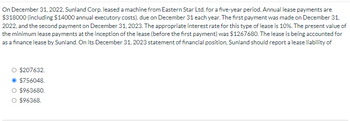

Transcribed Image Text:On December 31, 2022, Sunland Corp. leased a machine from Eastern Star Ltd. for a five-year period. Annual lease payments are

$318000 (including $14000 annual executory costs), due on December 31 each year. The first payment was made on December 31,

2022, and the second payment on December 31, 2023. The appropriate interest rate for this type of lease is 10%. The present value of

the minimum lease payments at the inception of the lease (before the first payment) was $1267680. The lease is being accounted for

as a finance lease by Sunland. On its December 31, 2023 statement of financial position, Sunland should report a lease liability of

O $207632.

Ⓒ$756048.

O $963680.

O $96368.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A lease agreement that qualifies as a finance lease calls for annual lease payments of $40,000 over a six-year lease term (also the asset's useful life), with the first payment on January 1, the beginning of the lease. The interest rate is 7% Required: a. Complete the amortization schedule for the first two payments. b. If the lessee's fiscal year is the calendar year, what would be the amount of the lease liability that the lessee would report in its balance sheet at the end of the first year? What would be the interest payable? Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. EVA of $1, PVA of $1. EVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Required A Required B Complete the amortization schedule for the first two payments. Note: Enter all amounts as positive values. Round your answers to the nearest whole dollar. Date Lease Payment Effective Interest January 1, Year 1 January 1, Year 1 January 1, Year 2…arrow_forwardFederated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. . The lease agreement specified annual payments of $34,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. . The company had the option to purchase the machine on December 30, 2026, for $43,000 when its fair value was expected to be $58,000, a sufficient difference that exercise seems reasonably certain. . The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 12%. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease llability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare…arrow_forwardSTL enters into a 5-year lease of an item of plant on January 1, 2022. The annual rentals are P11.5 million, with the first installment paid on December 31, 2022. The present value of minimum lease payments are 50 million and the interest rate implicit in the lease is 5% per annum. Calculate the liability to be recognized in the Statement of Financial Position at December 31, 2023.arrow_forward

- On January 1, 2025, Haystack, Inc. leased equipment to Silver Point Company. The equipment had a cost and fair value of $780,000. The 5-year lease calls for equal annual payments at the beginning of each year. The equipment has an expected useful life of 5 years. The rate implicit in the lease is 8% but the lessee's incremental borrowing rate is 10%. What are the equal annual lease payments the lessor will charge? (Round to whole dollars) L The present value of an ordinary annuity at: 10% for 5 periods is 3.79079 8% for 5 periods is 3.99271 The present value of an annuity due at: 10% for 5 periods is 4.16986 8% for 5 periods is 4.31213 The present value of a single sum of $1 at: 10% for 5 periods is .62092 8% for 5 periods is .68058 O A. $181,972 OB. $180,885 OC. $175,820 OD. $195,356 O E. $162,795arrow_forwardA lease agreement that qualifies as a finance lease calls for annual lease payments of $36,000 over a four-year lease term (also the asset's useful life), with the first payment on January 1, the beginning of the lease. The interest rate is 5%. Required: Determine the present value of the lease upon the lease's inception. Create a partial amortization table through the second payment on January 1, Year 2. If the lessee's fiscal year is the calendar year, what would be the amounts related to the lease that the lessee would report in its income statement for the first year ended December 31 (ignore taxes)?arrow_forwardOn December 31, 2021, Lang Corporation leased a ship from Fort Company for an eight-year period expiring December 30, 2029. Equal annual payments of $100,000 are due on December 31 of each year, beginning with December 31, 2021. The lease is properly classified as a finance lease on Lang 's books. The present value at December 31, 2021 of the eight lease payments over the lease term discounted at 10% is $586,843. Required: Prepare the journal entry that Lang should record on December 31, 2021.arrow_forward

- A lease agreement that qualifies as a finance lease calls for annual lease payments of $26,269 over a six-year lease term (also the asset’s useful life), with the first payment on January 1, the beginning of the lease. The interest rate is 5%. Required: Complete the amortization schedule for the first two payments. If the lessee’s fiscal year is the calendar year, what would be the amount of the lease liability that the lessee would report in its balance sheet at the end of the first year? What would be the interest payable?arrow_forwardOn June 1, 2021, Florida National leased a building. The lease agreement calls for Florida National to make lease payments of $3,618.18 each month for the next two years, with the first lease payment beginning June 30. The company’s normal borrowing rate is 8%.Required:1. Calculate the present value of the lease payments. Round to the nearest whole dollar. (Hint: Use a financial calculator or Excel)2. Record the lease on June 1, 2021.arrow_forwardOn January 1, 2020, Mountain Inc. leases a machine used in its operations. The annual lease payment is $10,000 due on December 31 of 2020, 2021, and 2022. The fair value of the machine on January 1, 2020 is $26,730. The machine has no residual value. Mountain could borrow on a three-year collateralized loan at 6%. If the lease is accounted for as a finance lease, the total expenses related to this lease contract that Mountain Inc. will report in its income statement for the year ending December 31, 2020 is Select one: a. $10,600 b. $10,514 c. $10,717 d. $10,000arrow_forward

- A lease agreement that qualifies as a finance lease calls for annual lease payments of $50,000 over a six-year lease term (also the asset's useful life), with the first payment at January 1, the beginning of the lease. The interest rate is 5%. The lessor's fiscal year is the calendar year. The lessor manufactured this asset at a cost of $235,000. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: a. Determine the price at which the lessor is "selling" the asset (present value of the lease payments). b. Create a partial amortization table through the second payment on January 1, 2017. c. What would be the increase in earnings that the lessor would report in its income statement for the year ended December 31, 2016 (ignore taxes)? Complete this question by entering your answers in the tabs below. Required A Required B Required C What would be the increase in earnings that the lessor would report in its…arrow_forwardA finance lease agreement calls for quarterly lease payments of $5,400 over a 15-year lease term, with the first payment on July 1, the beginning of the lease. The annual interest rate is 12%. Both the present value of the lease payments and the cost of the asset to the lessor are $151,000.arrow_forwardOn January 1, 2020, Most Inc. leases a machine used in its operations. The annual lease payment is $20,000 due on December 31 of 2020, 2021, 2022, and 2023. The fair value of the machine on January 1, 2020 is $69,302. The machine has no residual value. Most could borrow on a four-year collateralized loan at 6%. If the lease is accounted for as a finance lease, Most’s December 31, 2020 balance sheet would show a right-to-use asset and a finance lease liability of Select one: a. Right-to-use asset $51,976; Finance lease liability $ 53,460 b. Right-to-use asset $53,460; Finance lease liability $ 55,273 c. Right-to-use asset $60,000; Finance lease liability $ 60,000 d. Right-to-use asset $49,355; Finance lease liability $ 57,343arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education