FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

On December 31, 2020, Roe Company leased a machine from Colt Company for a five-year period Equal annual payments under the lease P1,050,000 including P50,000 annual executory cost and are due on December 31 of each year. The first payment was made on December 31, 2020, and the second payment was made on December 31, 2021. The five lease payments are discounted at 10% over the lease term. The present value of minimum lease payments at the inception of the lease and before the first annual payment was P4,170.000.On December 31, 2021, what amount should be reported as lease liability?

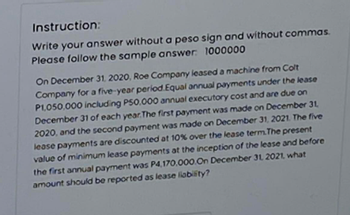

Transcribed Image Text:Instruction:

Write your answer without a peso sign and without commas.

Please follow the sample answer: 1000000

On December 31, 2020, Roe Company leased a machine from Colt

Company for a five-year period Equal annual payments under the lease

P1,050,000 including P50,000 annual executory cost and are due on

December 31 of each year. The first payment was made on December 31,

2020, and the second payment was made on December 31, 2021. The five

lease payments are discounted at 10% over the lease term. The present

value of minimum lease payments at the inception of the lease and before

the first annual payment was P4,170.000.On December 31, 2021, what

amount should be reported as lease liability?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ball Company leased machinery to Denver Company on July 1, 2021, for a ten-year period expiring June 30, 2031. Equal annual payments under the lease are $250,000 and are due on July 1 of each year. The first payment was made on July 1, 2021. The rate of interest used by Harter and Stine is 9%. The lease receivable before the first payment is $1,750,000 and the cost of the machinery on Ball’s accounting records was $1,550,000. Assuming that the lease is appropriately recorded as a sale for accounting purposes by Ball, what amount of interest revenue would Ball record for the year ended December 31, 2021? a. $67,500 b. $135,000 c. $157,500 d. $0arrow_forwardOn December 31, 2021, Lang Corporation leased a ship from Fort Company for an eight-year period expiring December 30, 2029. Equal annual payments of $100,000 are due on December 31 of each year, beginning with December 31, 2021. The lease is properly classified as a finance lease on Lang 's books. The present value at December 31, 2021 of the eight lease payments over the lease term discounted at 10% is $586,843. Required: Prepare the journal entry that Lang should record on December 31, 2021.arrow_forwardOn January 1, 2020, Mountain Inc. leases a machine used in its operations. The annual lease payment is $10,000 due on December 31 of 2020, 2021, and 2022. The fair value of the machine on January 1, 2020 is $26,730. The machine has no residual value. Mountain could borrow on a three-year collateralized loan at 6%. If the lease is accounted for as a finance lease, the total expenses related to this lease contract that Mountain Inc. will report in its income statement for the year ending December 31, 2020 is Select one: a. $10,600 b. $10,514 c. $10,717 d. $10,000arrow_forward

- On January 1, 2020, Most Inc. leases a machine used in its operations. The annual lease payment is $20,000 due on December 31 of 2020, 2021, 2022, and 2023. The fair value of the machine on January 1, 2020 is $69,302. The machine has no residual value. Most could borrow on a four-year collateralized loan at 6%. If the lease is accounted for as a finance lease, Most’s December 31, 2020 balance sheet would show a right-to-use asset and a finance lease liability of Select one: a. Right-to-use asset $51,976; Finance lease liability $ 53,460 b. Right-to-use asset $53,460; Finance lease liability $ 55,273 c. Right-to-use asset $60,000; Finance lease liability $ 60,000 d. Right-to-use asset $49,355; Finance lease liability $ 57,343arrow_forwardA finance lease agreement calls for quarterly lease payments of $5,376 over a 10-year lease term, with the first payment on July 1, the beginning of the lease. The annual interest rate is 8%. Both the present value of the lease payments and the cost of the asset to the lessor are $150,000. Required: Prepare a partial amortization table up to the October 1 payment. What would be the amount of interest expense (revenue) the lessee (lessor) would record in conjunction with the second quarterly payment on October 1?arrow_forwardRajiv Industries leased exercise equipment to Woodson Gyms on July 1, 2024. Rajiv recorded the lease receivable at $810,000, the present value of lease payments discounted at 10% and fair value of the equipment. The lease called for ten annual lease payments of $120,000 due at the beginning of each year. The first payment was received on July 1, 2024. Rajiv had manufactured the equipment at a cost of $750,000. With this lease agreement, control is considered to be transferred to the lessee at the beginning of the lease. What is the total increase in earnings (pretax) on Rajiv’s 2024 income statement?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education