FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

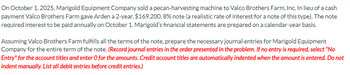

Transcribed Image Text:On October 1, 2025, Marigold Equipment Company sold a pecan-harvesting machine to Valco Brothers Farm, Inc. In lieu of a cash

payment Valco Brothers Farm gave Arden a 2-year, $169,200, 8% note (a realistic rate of interest for a note of this type). The note

required interest to be paid annually on October 1. Marigold's financial statements are prepared on a calendar-year basis.

Assuming Valco Brothers Farm fulfills all the terms of the note, prepare the necessary journal entries for Marigold Equipment

Company for the entire term of the note. (Record journal entries in the order presented in the problem. If no entry is required, select "No

Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not

indent manually. List all debit entries before credit entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Anxious Company acquired two items of machinery. On December 31, 2020, Anxious Company purchased a machine for non-interest bearing note requiring ten payments of P500,000. The first payment was made on December 31, 2021, and the others are due annually on December 31. The prevailing rate of interest for this type of note at date of issuance was 12%. The present value of ordinary annuity of 1 @ 12% is 5.33 for nine periods and 5.65 for ten periods. On December 31, 2020, Anxious Company acquired used machinery by issuing the seller a two-year, noninterest bearing note for P3,000,000. In recent borrowing, the entity has paid a 12% interest for this type of note. The present value of 1 @ 12% for 2 years is 0.80 and the present value of an ordinary annuity of 1 @ 12% for 2 years is 1.69. What is the total cost of machiery?arrow_forwardOn January 1, 2021, Glanville Company sold goods to Otter Corporation. Otter signed an installment note requiring payment of $21,500 annually for five years. The first payment was made on January 1, 2021. The prevailing rate of interest for this type of note at date of issuance was 10%. Glanville should record sales revenue in January 2021 of: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $107,500 $81,502 $89,652 None of these answer choices are correct.arrow_forwardOn January 1, 20x9, Fairness Company sold a tract of land that was acquired years ago for P 3,000,000. Fairness received a three year 15% interest bearing note for P 6,000,000 in exchange for the land, but the current market rate of interest for comparable notes is 10%. The note is payable in equal annual instalments of P 2,000,000 every December 31 starting December 31, 20x9. a. Compute for the carrying value of the note on January 1, 20x9b. Compute for the gain or loss on salec. Compute for the interest income recognized in 20x11.d. Compute for the carrying value of the note in December 31, 20x10e. Prepare all entries.arrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education