FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

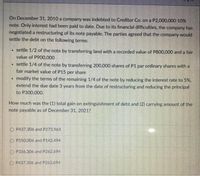

Transcribed Image Text:On December 31, 2010 a company was indebted to Creditor Co. on a P2,000,000 10%

note. Only interest had been paid to date. Due to its financial difficulties, the company has

negotiated a restructuring of its note payable. The parties agreed that the company would

settle the debt on the following terms:

settle 1/2 of the note by transferring land with a recorded value of P800,000 and a fair

value of P900,000

• settle 1/4 of the note by transferring 200,000 shares of P1 par ordinary shares with a

fair market value of P15 per share

modify the terms of the remaining 1/4 of the note by reducing the interest rate to 5%,

extend the due date 3 years from the date of restructuring and reducing the principal

to P300,000.

How much was the (1) total gain on extinguishment of debt and (2) carrying amount of the

note payable as of December 31, 2021?

O P437,306 and P273,963

O P550,006 and P142,494

O P336.306 and P262,694

O P437,306 and P262.694

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2021, Bonita Industries sold property to Sandhill Company. There was no established exchange price for the property, and Sandhill gave Bonita a $4500000 zero-interest-bearing note payable in 5 equal annual installments of $900000, with the first payment due December 31, 2021. The prevailing rate of interest for a note of this type is 9%. The present value of the note at 9% was $3500730 at January 1, 2021. What should be the balance of the Discount on Notes Payable account on the books of Sandhill at December 31, 2021 after adjusting entries are made, assuming that the effective-interest method is used? $713252. $684204. $999270. $0.arrow_forwardOn December 31 , 2018 Nicholas Co. is in financial difficulty and cannot pay a note due that day . It is a $3,300,000 8% issued at par note, payable to Key Bank. Key Bank agrees to accept from Nicholas equipment that has a fair value of 1,450,000, originally costing $2,400,000, with accumulated depreciation of $1,250,000. Key Bank also extends the maturity date to December 31, 2021, reduces the face amount of the note to $1,250,000, and reduces the interest rate to 6%, with interest payable at the end of each year. a. Nicholas should recognize a gain or loss on the transfer of the equipment of: b. At the end of each of the next three years Nicholas records the $ 75,000 interest paid to Key Bank as a: c. In determining the carrying value of the note at December 31, 2018 Key Bank uses an effective interest rate equal to: d. Key Bank records a loss on restructuring of: e. In recording the loss on restructuring, Key bank:arrow_forwardwhat is notes recievable for On December 31;2025, Blue Inc. rendered services to Beghun Corporation at an agreed price of $106,641, accepting $41,800 down and agreeing to accept the balance in four equal installments of $20,900 receivable each December 31 . An assumed interest rate of 11% is imputed. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Current Attempt in Progress The following information is available for Marin Company. Raw materials inventory Work in process inventory Finished goods inventory Materials purchased Direct labor Manufacturing overhead Sales revenue (a) January 1, 2022 $17,600 eTextbook and Media 11,400 22,700 2022 $126,000 184,800 151,200 764,400 December 31, 2022 $25,200 14,500 17,640 Compute cost of goods manufactured. (Assume that all raw materials used were direct materials.) MARIN COMPANY Cost of Goods Manufactured Schedule QUO Attempte:0 of 3 used Submit Answerarrow_forwardBhupatbhaiarrow_forwardCoronado Corporation has elected to use the fair value option for one of its notes payable. The note was issued at an effective rate of 12% and has a carrying value of $13,000. At year - end, Coronado's borrowing rate (credit risk) has declined; the fair value of the note payable is now $14,600. (a) Determine the unrealized holding gain or loss on the note. (Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Unrealized holding gain or loss $enter the unrealized holding gain or loss in dollars eTextbook and Media List of Accounts Attempts: 0 of 6 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above.arrow_forward

- At January 1, 2018, Brainard Industries, Inc., owed Second BancCorp $12 million under a 10% note due December 31, 2020. Interest was paid last on December 31, 2016. Brainard was experiencing severe financial difficultiesand asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorpagreed to:a. Forgive the interest accrued for the year just ended.b. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment untilDecember 31, 2019.c. Reduce the unpaid principal amount to $11 million.Required:Prepare the journal entries by Brainard Industries, Inc., necessitated by the restructuring of the debt at (1) January1, 2018; (2) December 31, 2019; and (3) December 31, 2020.arrow_forwardOn January 1, 2025, Vaughn Co. sold equipment in exchange for an $930000 zero-interest-bearing note due on January 1, 2028. The prevailing rate of interest for a note of this type at January 1, 2025 was 10%. The present value of $1 at 10% for three periods is 0.75131. What amount of interest revenue should be reported in Vaughn's 2026 income statement? O $93000 $69872 O $0 O $76859arrow_forwardAt January 1, 2024, Mahmoud Industries, Incorporated, owed Second BancCorp $12 million under a 10% note due December 31, 2026. Interest was paid last on December 31, 2022. Mahmoud was experiencing severe financial difficulties and asked Second BancCorp to modify the terms of the debt agreement. After negotiation Second BancCorp agreed to: Forgive the interest accrued for the year just ended. Reduce the remaining two years’ interest payments to $1 million each and delay the first payment until December 31, 2025. Reduce the unpaid principal amount to $11 million. Required: Prepare the journal entries by Mahmoud Industries, Incorporated, necessitated by the restructuring of the debt at (1) January 1, 2024; (2) December 31, 2025; and (3) December 31, 2026.arrow_forward

- 9arrow_forwardOn December 31, 2025, American Bank enters into a debt restructuring agreement with Teal Company, which is now experiencing financial trouble. The bank agrees to restructure a 12%, issued at par, $3,300,000 note receivable by the following modifications: Reducing the principal obligation from $3,300,000 to $2,220,000. Extending the maturity date from December 31, 2025, to January 1, 2029. Reducing the interest rate from 12% to 10%. Teal pays interest at the end of each year. On January 1, 2029, Teal Company pays $2,220,000 in cash to American Bank. (a) Can Teal Company record a gain under this term modification? If yes, compute the gain for Teal Company. If no, enter amount as 0. The gain for Teal Company $arrow_forwardDown Company has an overdue Notes Payable to City Bank of P8,000,000 and recorded accrued interest of P640,000 based on 8% interest rate. This rate of interest is presumed to be the market rate at the time of debt restructuring. As a result of a settlement on December 31, 2012, City Bank agreed to these restructuring arrangements: reduce the principal obligation to P6,000,000; forgive the P640,000 accrued interest; extend the maturity date to December 31, 2014; and annual interest of 10% is to be paid on December 31, 2013 and 2014.What is Down Company’s gain on debt restructuring? (Round off present value factors to four decimal places) a. P 2,640,000 b. P 2,426,220 c. P 1,440,000 d. P 0arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education