FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

On Dec 31, 2011, Yellow HArdware has inventory of $25,000. The owner wants to increase inventory on hand to $35,000 on Dec 31 2012. If net sales for 2012 are expected to be 150,000 and the gross profit is expected to be 35% of net sales, compute the net cost of merchandise the owner should expect to purchase during 2012.

Expert Solution

arrow_forward

Step 1

The cost of goods sold refer to the cost of producing the goods which are sold during the year. The amount of purchases is calculated by deducting beginning inventory from the cost of goods sold and adding ending inventory to it.

arrow_forward

Step 2

Net sales: $150,000

Gross profit: ($150,000×35%) = $52,500

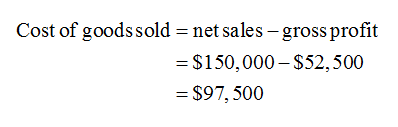

Cost of goods sold is calculated as follows:

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Want Answersarrow_forwardAnother way to look at the concept of inventory turnover is by measuring sales per square foot. Taking the average inventory at retail and dividing it by the number of square feet devoted to a particular product will give you average sales per square foot. When you multiply this figure by the inventory turnover rate, you get the annual sales per square foot.arrow_forwardi need the answer quicklyarrow_forward

- A local college bookstore has a beginning inventory costing $80,000 and an ending inventory costing $84,000. Sales for the year were $300,000. Assume the bookstore markup rate on selling price is 70%. Based on the selling price, what is the inventory turnover at cost?arrow_forward1) The dress shirt department began this season with an opening inventory of $380,000 at retail ($250,000 at cost). So far, the department buyer has made new purchases of $420,000 at retail ($280,000 at cost). What is the cumulative markup% for the total merchandise handled including both the opening inventory and the purchases? (You may want to use the following grid to help your calculation.) Cost Retail MU% Opening inventory Purchases STD Total Merchandise Handled 2) The jewelry department had the opening inventory of $12,000 at cost with a markup of 55%. During the season, the department has purchased additional merchandise worth 45,000 at retail on which a 49% markup was applied. What is the cumulative markup of this department in dollars and percentage? (You may want to use the grid below to help your calculation.) Cost Retail MU% Opening Inventory Purchases Total Merchandise Handled (a) $Cumulative markup = (b) Cumulative markup% =arrow_forwardOn January 1, 2024, the Brunswick Hat Company adopted the dollar-value LIFO retail method. The following data are available for 2024: Cost Retail Beginning inventory $ 72,900 $ 135,000 Net purchases 102,150 232,000 Net markups 5,000 Net markdowns 10,000 Net sales 200,000 Retail price index, 12/31/2024 1.08 Required: Calculate the estimated ending inventory and cost of goods sold for 2024 using the information provided. Ending inventory at retail:_________ Ending inventory at cost:__________ Cost of goods sold:_______________arrow_forward

- Autok Fabricators, Inc. has 10 units in beginning inventory costing $45 each. It purchased 90 more for $36each during the month. The company sold 80 units during the month. Autok used a periodic inventorysystem.Calculate cost of goods sold using:a) FIFOb) Weighted-average costc) LIFOarrow_forwardRahularrow_forwardSuppose The Style Fashions, a specialty retailer, had these records for evening gowns during 2018: (Click the icon to view inventory data.) Assume that The Style sold 120 gowns during 2018 and uses the LIFO method to account for inventory. The Style's income tax rate is 35%. Read the requirements. Requirement 1. Compute The Style's cost of goods sold for evening gowns in 2018. Unit price Total Units From beginning inventory From purchase in February From purchase in June From purchase in December LIFO cost of goods sold Requirement 2. Compute what cost of goods sold would have been if The Style had purchased enough inventory in December-at $1,325 per evening gown-to keep year-end inventory at the same level it was at the beginning of the year. Cost of goods sold without LIFO liquidation 18 $ 23 52 27 Units 950 1,225 1,275 1,325 $ 17,100 28,175 66,300 35,775 147,350 Unit price Totalarrow_forward

- Ma3. Monte Vista uses the perpetual inventory system. At the beginning of the quarter, Monte Vista has $48,000 in inventory. During the quarter the company purchases $10,600 of new inventory from a vendor, returned $1,000 of inventory to the vendor, and took advantage of discounts from the vendor of $380. At the end of the quarter the balance in inventory is $35,500. What is the cost of goods sold?arrow_forwardDuring 2012, a company sells 200 units of inventory for $50 each. The company has the following inventory purchase transactions for 2012: Date Transaction Units Unit Cost Total Cost Beginning Inventory $39 $1,950 3,800 2,960 Jan 1 50 May 5 Nov 3 Purchase 100 38 Purchase 80 37 Actual sales by the company include its entire beginning inventory, 80 units of inventory from the May 5 purchase, and 70 units from the November 3 purchase. Required: Calculate cost of goods sold and ending inventory for 2012 assuming the company uses: a) FIFO (First in, First out) b) LIFO (Last in, First out) c) Average Cost d) Explain the impact of these different methods in the recognition of Cost of goods sold and Ending Inventory in the financial statement of the company.arrow_forwardYou sold $8,000 of inventory for $10,000 on terms 2/10,n/30. If your customer pays the bill on day five, which of the following are true statements relating to just the day five transaction? Remember that the larger number in a transaction will be the revenue and the smaller one will be the cost of goods sold. A. You will debit cash for $10,000 B. You will credit inventory for $200 C. You will debit discounts for $200 D. You will debit cash for $9,800 E. You will label this transaction as paid bill F. You will label this transaction as a cash entry Select all that apply.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education