FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please given correct answer general accounting

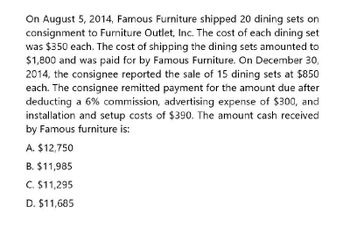

Transcribed Image Text:On August 5, 2014, Famous Furniture shipped 20 dining sets on

consignment to Furniture Outlet, Inc. The cost of each dining set

was $350 each. The cost of shipping the dining sets amounted to

$1,800 and was paid for by Famous Furniture. On December 30,

2014, the consignee reported the sale of 15 dining sets at $850

each. The consignee remitted payment for the amount due after

deducting a 6% commission, advertising expense of $300, and

installation and setup costs of $390. The amount cash received

by Famous furniture is:

A. $12,750

B. $11,985

C. $11,295

D. $11,685

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On June 1, DD Company shipped twenty five DVD to BB View Store on consignment. The DVD is to be sold at an advertised price of P200 per item. The cost of each DVD to the consignor is P100. The consignor paid P75 to ship the merchandise. Commission is to be 25% of sales price. During the month, two DVD were returned. On June 30, BB View Store remitted the amount due to consignor after deducting commission of P400. The cost of inventory on consignment amounted to:arrow_forwardDuring April, Firestone purchased-goods from BF Goodrich. The sequence of events was as follows: April 1: Firestone orders 2,500 tires from BF Goodrich. BF Goodrich agrees to sell the wheels for $200 each on account under shipping terms FOB shipping point and payment terms 5/10, n45. The tires initially cost BF Goodrich $125 each on February 17th. J.B. Hunt Trucking Company will be responsible for transporting the inventory for $2,125. All shipping costs must be paid on the day of shipment. April 4: BF Goodrich loads the 2,500 tires into JB Hunt's truck. April 8: Firestone receives the shipment of tires. April 25: Firestone pays BF Goodrich for the tires previously purchased. A Accounts Payable Cash B Cash 500,000 500,000 Accounts Receivable 500,000 Event April 1 April 4 April 8 April 25 500,000 Buyer Inventory Seller Accounts Payable C Inventory Cash Accounts Receivable Sales Revenue 500,000 D Cost of Goods Sold Inventory 2,125 500,000 2,125 500,000 500,000 Required: For each Buyer…arrow_forwardThe Wilson Publishing Company ships 4-volume sets of Management Encyclopedia to book dealers on consignment. The sets are to be sold at an advertised price of P4,950. The estimated cost per set is P2,500. Consignees are allowed a commission of 30% of the sales price and are to be reimbursed for the cartage relating to consigned goods. On December 8, 2009, 100 sets were sent to the Cora Book Store on consignment. The consignor estimated that packing charges of P850 were related to the books shipped. The shipment cost paid by the consignor was P2,000. The consignee paid P300 for the cartage on sets received. Sixty sets were sold on December 31. Both consignee and consignor take physical inventories and adjust and close their books at year end. Required: 1. Prepare an account sales to be submitted by the consignee at the end of December. 2. Give the journal entries for December on the books of the consignee 3. Give the journal entries for December on the books of the consignorarrow_forward

- The CC Manufacturing Company delivered ten DVD players to CLTV Company on consignment. These DVD player cost P3,000 each and are to be sold at P5,000 each. The CC Manufacturing Co. paid shipment cost of P2,500. CLTV Co. submitted an account sales stating that it had returned one unit and was remitting P21,900. This amount represents the total amount due to CC Manufacturing Co. after deducting the following from the selling price of the DVD player sold: Commission : 20% of selling price Advertising . . P1,000 Delivery and installation .... Cartage on consigned goods . P500 P600 The profit (loss) on consignment realized by CC Manufacturing Company is:arrow_forwardOn March 30, Century Link received an invoice dated March 28 from ACME Manufacturing for 63 televisions at a cost of $135 each. Century received a 10/5/2 chain discount. Shipping terms were FOB shipping point. ACME prepaid the 4 $83 freight. Terms were EOM. When Century received the goods, 3 sets were defective. Century returned these 10 sets to ACME. On April 8, Century sent a $235 partial payment. Century will pay the balance on May 6. What is Century's final payment on May 6? Assume no taxes. Note: Do not round intermediate calculations. Round your answer to the nearest cent. Final paymentarrow_forwardOn March 30, Century Link received an invoice dated March 28 from ACME Manufacturing for 59 televisions at a cost of $125 each. Century received a 12/2/5 chain discount. Shipping terms were FOB shipping point. ACME paid the $119 freight. Terms were 3/10 EOM. When Century received the goods, 2 sets were defective. Century returned these sets to ACME. On April 8, Century sent a $ 250 partial payment. Century will pay the balance on May 6. What is Century's final payment on May 6? Assume no taxes. Note: Round your intermediate calculations and final answers to the nearest cent.arrow_forward

- CSGNR Inc. purchased 100,000 units costing P1,000,000, and paid P10,000 freight for its shipment. After a day, the company consigned these goods to OIEE Inc. stating that the consignee is entitled to10% of the revenue from all sold units. The shipment from the consignor to the consignee amounted toP5,000 with payment terms freight collect. With a standard retail price of P19, the consignee remitted a total of P1,306,000. Other notable expenses paid by the consignee on the consignor’s behalf wereP12,000 advertising expense, P3,000 delivery charges to customers, P7,800 installation fee on the customer’s premises. How much was the cost of goods still out on consignment? A. 220,000 B. 221,100 C. 222,200 D. 223,300arrow_forwardas show in the picarrow_forwardOn March 30, Century Link received an invoice dated March 28 from ACME Manufacturing for 67 televisions at a cost of $150 each. Century received a 15/7/4 chain discount Shipping terms were FOB shipping point. ACME prepaid the $127 freight. Terms were 2/10 EOM. When Century received the goods, 2 sets were defective. Century returned these sets to ACME. On April 8, Century sent a $195 partial payment. Century will pay the balance on May 6. What is Century's final payment on May 6? Assume no taxes. (Do not round intermediate calculations. Round your answer to the nearest cent.) Answer is complete but not entirely correct. Final payment 7,406 29 Xarrow_forward

- On March 30, Century Link received an invoice dated March 28 from ACME Manufacturing for 54 televisions at a cost of $148 each. Century received a 15/3/3 chain discount. Shipping terms were FOB shipping point. ACME prepaid the $99 freight. Terms were 410 EOM. When Century received the goods, 4 sets were defective. Century returned these sets to ACME. On April 8, Century sent a $265 partial payment. Century will pay the balance on May 6. What is Century's final payment on May 6? Assume no taxes. Note: Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardPatty Corp., a public company, delivers 3,200 units to a customer on 1 April for $80/unit. Patty Corp. has a return policy where they allow any customer to return any unused product within 45 days and receive a full refund. The cost of each product is $64. Based on historical experience Patty estimates that customer will return 2% of the units sold. Patty expects to be able to resell any returned goods. Assume that 50 products are returned on 2 May. No additional units are returned by 15 May (the end of the return period). Required: Prepare the journal entries related to the sale of products. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 Prepare the journal entry required on 1 April to record the sale: Note: Enter debits before credits. Date 1 April General Journal Debit Creditarrow_forwardOn June 16, 2013, llano Co. sold merchandise to PascualCo. for 6k terms 2/10, n/30. Shipping costs were 600. Pascual Co, received the goods and llano Co.'s invoice on June 17. On June 24, Pascual Co. sent the payment to llano Co., which llano Co. received on June 25. Both llano Co. and Pascual Co. use the periodic inventory system. The following are several arrangements regarding the shipping costs: a. Shipping terms are FOB shipping point, freight prepaid. Llano paid the shipping costs on June 16 and added the 600 cost to the invoice sent to Pascual. Pascual remitted 6480 on June 24.: 1. Prepare the entries for llano Co. to record sale and freight payment and the cash receipt. 2. Prepare the entries for Pascual Co. to record the purchase, (with shipping cost added to the invoice from Ilano) and the cash remittance b. Shipping terms are FOB destination, freight collect. Pascual Co. paid the shipping costs on June 17 and deducted the 600 from the amount owed to llano Co. A copy…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education