FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

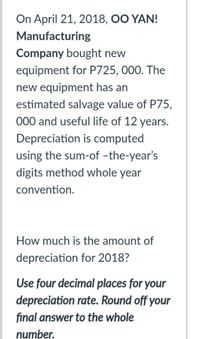

Transcribed Image Text:On April 21, 2018, OO YAN!

Manufacturing

Company bought new

equipment for P725, 000. The

new equipment has an

estimated salvage value of P75,

000 and useful life of 12 years.

Depreciation is computed

using the sum-of -the-year's

digits method whole year

convention.

How much is the amount of

depreciation for 2018?

Use four decimal places for your

depreciation rate. Round off your

final answer to the whole

number.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Company purchases equipment on January 1, Year 1, at a cost of $600,000. The asset is expected to have a service life of 12 years and a salvage value of $54,000. Compute the amount of depreciation for each of Years 1 through 3 using the straight-line depreciation method. (Round answers to 0 decimal places, e.g. 5,125.) Depreciation for Year 1 $enter a dollar amount rounded to 0 decimal places Depreciation for Year 2 $enter a dollar amount rounded to 0 decimal places Depreciation for Year 3 $enter a dollar amount rounded to 0 decimal places Compute the amount of depreciation for each of Years 1 through 3 using the sum-of-the-years'-digits method. Depreciation for Year 1 $enter a dollar amount Depreciation for Year 2 $enter a dollar amount Depreciation for Year 3 $enter a dollar amount Part 3 Compute the amount of depreciation for each of Years 1 through 3 using the…arrow_forwardKingbird, Inc. acquires a delivery truck at a cost of $57,000 on January 1, 2022. The truck is expected to have a salvage value of $13,500 at the end of its 4-year useful life. Compute annual depreciation for the first and second years using the straight-line method. Annual depreciation expense Year 1 Year 2arrow_forwardOn January 1, 2017 the Ivanhoe company records show equipment 38000 and accumulated depreciation 13840. The depreciation resulted from using The straight line method with our useful life of 10 years and a salvage value of 3400. On this date the company concludes that the equipment has are remaining useful life of only 4 years with the same salvage value. Calculate the revised annual depreciation.arrow_forward

- Gotham Company purchased a new machine on October 1, 2025, at a cost of $90,000. The company estimated that the machine has a salvage value of $8,000. The machine is expected to be used for 70,000 working hours during its 10-year life. (a) Compute depreciation using declining-balance using double the straight-line rate for 2025 and 2026. (Round answers to 2 decimal places, eg 2,152.75.) Depreciation using the declining-balance method $ 2025 2026 $arrow_forwardSplish Company purchased equipment for $246,000 on October 1, 2025. It is estimated that the equipment will have a useful life of 8 years and a salvage value of $15,600. Estimated production is 36,000 units and estimated working hours are 20,000. During 2025, Splish uses the equipment for 530 hours and the equipment produces 1,100 units. Compute depreciation expense under each of the following methods. Splish is on a calendar-year basis ending December 31. (Round rate per hour and rate per unit to 2 decimal places, e.g. 5.35 and final answers to O decimal places, e.g. 45,892.) (a) (b) (c) Straight-line method for 2025 (e) Activity method (units of output) for 2025 Activity method (working hours) for 2025 (d) Sum-of-the-years'-digits method for 2027 Double-declining-balance method for 2026 $ $ $ $ GA $ GAarrow_forwardSplish Company purchases equipment on January 1, Year 1, at a cost of $612,000. The asset is expected to have a service life of 12 years and a salvage value of $55,080. (a) Compute the amount of depreciation for each of Years 1 through 3 using the straight-line depreciation method. (Round answers to O decimal places, e.g. 5,125.) Your answer is correct. Depreciation for Year 2 (b) Depreciation for Year 1 Depreciation for Year 3 (c) eTextbook and Media Depreciation for Year 1 Your answer is correct. Depreciation for Year 2 Depreciation for Year 3 $ eTextbook and Media $ $ Compute the amount of depreciation for each of Years 1 through 3 using the sum-of-the-years-digits method. Depreciation for Year 2 $ $ $ Depreciation for Year 1 $ 46,410 $ 46,410 Depreciation for Year 3 $ 46,410 85.680 78.540 Compute the amount of depreciation for each of Years 1 through 3 using the double-declining-balance method. (Round depreciation rate to 2 decimal places, e.g. 15.84% and final answers to 0 decimal…arrow_forward

- A plant asset was purchased on January 1 for $59000 with an estimated salvage value of $9000 at the end of its useful life. The current year's Depreciation Expense is $5000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $30000. The remaining useful life of the plant asset is O 10.0 years. O 11.8 years. ○ 4.0 years. O 6.0 years.arrow_forwardOn May 1, 2025, Crane Company purchased factory equipment for $739700. The asset's useful life in hours is estimated to be 190000. The estimated salvage value is $35000 and the estimated useful life in years is 9. The machine was used for 19000 hours in the first year. If the activity method is used, what is depreciation expense for 2025? (Round the depreciation rate to 4 decimal places e.g. 15.2578.) $52200 $70469 $78300 O $74269arrow_forwardabc company purchased an equipment on september 1, 2015 for $230000. the salvage value of the equipment is $10000 and the estimated useful life is 10 years. what is the book value of the equipment at december 31 2016, if the company uses sum of years digits method to record depreciationarrow_forward

- UMPI Corporation purchased a new machine for production on 1/1/18. The cost of the machine was $175,000. The salvage value was estimated to be $25,000. Its useful life was estimated to be 5 years and its working hours was estimated at 25,000 hours. The hours used 2018 thru 2023 were 5,750, 5,000, 4,250, 5,500, 4,500, respectively. Year-end is December 31st. Fully depreciate the equipment through the full 5 years. Instructions: Compute the depreciation expense under each of the following methods below. Record the journal entry for each year to record the depreciation expense. 5.1 Straight-Line method 5.2 Activity method 5.3 Double-Declining Balance methodarrow_forwardssarrow_forwardOn April 1, 2016, Cyclone's Backhoe Co. purchases a trencher for $288,000. The machine is expected to last five years and have a salvage value of $44,000. Compute depreciation expense for both years ending December 2016 and 2017 assuming the company uses the straight-line method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education