FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

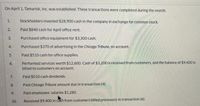

Transcribed Image Text:On April 1, Tamarisk, Inc. was established. These transactions were completed during the month.

1.

Stockholders Invested $28,900 cash in the company in exchange for common stock.

2.

Paid $840 cash for April office rent.

3.

Purchased office equipment for $3,300 cash.

4.

Purchased $370 of advertising in the Chicago Tribune, on account.

Paid $510 cash for office supplies.

6.

Performed services worth $12,600. Cash of $3,200 is received from customers, and the balance of $9.400 is

billed to customers on account.

7.

Paid $510 cash dividends.

8.

Paid Chicago Tribune amount due in transaction (4).

9.

Paid employees' salaries $1.280.

10.

Received $9,400 in cah from customers billed previously in transaction (6).

5.

Transcribed Image Text:Assets

Cash

+ Accounts Receivable

+ Supplies

(1)

%24

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

%24

eTextbook and Media

From an analysis of the Retalned Earnings columns, compute the net income or net loss for April. (Enter negative

amounts using either a negative sign preceding the number e.s. -45 or parentheses es. (45).)

Net Income / (Loss) for April

eTextbook and Media

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sviarrow_forwardThe following are the transactions relating to the formation of Gray Mowing Services Inc. and its first month of operations. a. The firm was organized and the initial stockholders invested cash of $720. b. The company borrowed $1,080 from a relative of one of the initial stockholders; a short-term note was signed. c. Two zero-turn lawn mowers costing $576 each and a professional trimmer costing $156 were purchased for cash. The original list price of each mower was $732, but a discount was received because the seller was having a sale. d. Gasoline, oil, and several packages of trash bags were purchased for cash of $108. e. Advertising flyers announcing the formation of the business and a newspaper ad were purchased. The cost of these items, $204, will be paid in 30 days. f. During the first two weeks of operations, 47 lawns were mowed. The total revenue for this work was $846; $558 was collected in cash, and the balance will be received within 30 days. g. Employees were paid $504 for…arrow_forwardMetlock, Inc. was started on May 1. A summary of May transactions is presented as follows. 1. Stockholders invested $ 13,500 cash in the business in exchange for common stock. 2. Purchased equipment for $ 6,000 cash. 3. Paid $ 400 cash for May office rent. 4. Paid $ 600 cash for supplies. 5. Incurred $ 350 of advertising costs in the Beacon News on account. 6. Received $ 4,100 in cash from customers for repair service. 7. Declared and paid a $ 1,400 cash dividend. 8. Paid part-time employee salaries $ 1,100. 9. Paid utility bills $ 130. 10. Performed repair services worth $ 990 on account. 11. Collected cash of $ 100 for services billed in transaction (10). Prepare a tabular analysis of the transactions. Revenue is called Service Revenue. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset,…arrow_forward

- Park & Company was recently formed with a $6,400 investment in the company by stockholders in exchange for common stock. The company then borrowed $3,400 from a local bank, purchased $1,140 of supplies on account, and also purchased $6,400 of equipment by paying $2,140 in cash and signing a promissory note for the balance. Based on these transactions, the company's total assets are: Multiple Choice $9,800. $15,200. $12,800. $11,940.arrow_forwardE2-13 (Algo) Recording Journal Entries LO2-4 Jameson Corporation was organized on May 1. The following events occurred during the first month. a. Received $72,000 cash from the five investors who organized Jameson Corporation. Each investor received 110 shares of $10 par value common stock. b. Ordered store fixtures costing $11,000. c. Borrowed $10,000 cash and signed a note due in two years. d. Purchased $18,000 of equipment, paying $1,100 in cash and signing a six-month note for the balance. e. Lent $1,500 to an employee who signed a note to repay the loan in three months. f. Received and paid for the store fixtures ordered in (b). Required: Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 Record the receipt of $72,000 cash from five investors who each received 110 shares of $10 par value common stock. Note: Enter…arrow_forwardAssume Down, Incorporated, was organized on May 1 to compete with Despair, Incorporateda company that sells de - motivational posters and office products. Down, Incorporated, encountered the following events during its first month of operations.a. Received $40,000 cash from the investors who organized Down, Incorporatedb. Borrowed $19,000 cash and signed a note due in two years.c. Ordered equipment costing $22,000.d. Purchased $10,000 in equipment, paying $3,000 in cash and signing a six-month note for the balance.e. Received the equipment ordered in (c), pald for half of it, and put the rest on account. Pleaae tell me the cash and equipmentarrow_forward

- Krespy Corp. has a cash balance of $7,500 before the following transactions occur:- received customer payments of $965 supplies purchased on account $435 services worth $850 performed, 25% is paid in cash the rest will be billed corporation pays $275 for an ad in the newspaper bill is received for electricity used $235. dividends of $2,500 are distributed What is the balance in cash after these transactions are journalized and posted?arrow_forwardHello, I need help pleasearrow_forwardCreate journal entries for each of the following transactions The company issues capital stock for $90,000. The company borrows $40,000 from the bank. The company pays its rent for one year in advance, $18,000. The company buys inventory for $30,000 on account. The company sells inventory costing $20,000 for $40,000 on account. The company pays its employees $1,000 for services rendered. The company buys inventory for $50,000 cash. The company sells inventory costing $40,000 for $80,000 cash. The company collects $20,000 from customers on account. The company pays $25,000 on account. One month of rent has expired. Dividends of $2,000 are paid.arrow_forward

- Bearings & Brakes Corporation (B&B) was incorporated as a private company. The company's accounts included the following at June 30: Accounts Payable $82,000 Buildings 610,000 Cash 101,000 Common Stock 280,000 Equipment 170,000 Land 499,000 Notes Payable (long-term) 4,000 Retained Earnings Supplies 1,021,000 7,000 During the month of July, the company had the following activities: 1. Issued 4,000 shares of common stock for $400,000 cash. 2. Borrowed $115,000 cash from a local bank, payable in four years. 3. Bought a building for $188,000; paid $77,000 in cash and signed a three-year note for the balance. 4. Paid cash for equipment that cost $101,000. 5. Purchased supplies for $101,000 on account. Required: 1. Analyze transactions (a)-(e) to determine their effects on the accounting equation. (Enter any decreases to account ba a minus sign.) a. b. C. d. e. Cash Assets Liabilities Accounts Supplies Buildings Equipment Payable Notes Payable (long-term) Stockholders Equity Common Stock 53…arrow_forwardAlex Vera organized Succulent Epress at the beginning of February 20Y4. During February, Succulent Express entered into the following transactions: a. Terry Mason invested $30,000 in Succulent Express in exchange for common stock. b. Paid $5,400 on February 1 for an insurance premium on a one-year policy. c. Purchased supplies on account, $1,800. d. Received fees of $57,000 during February. e. Paid expenses as follows: wages, $21,600; rent, $6,400; utilities, $2,800; and miscellaneous, $3,200. f. Paid dividends of $8,000. Part 2: Record the adjustments at the end of February to record the insurance expense and supplies expense. There was $300 of supplies on hand as of February 28. Identify the adjustment for insurance as (a1) and supplies as (a2). Enter the Net income under the Income Statement column after recording both adjustments. Statement of Cash Flows a. Financing…arrow_forwardDuring its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. Began business by making a deposit in a company bank account of $60,000, in exchange for 6,000 shares of $10 par value common stock. July 1 July 3 Paid the current month's rent, $3,500 July 5 Paid the premium on a 1-year insurance policy, $4,200 July 7 Purchased supplies on account from Little Company, $1,000. July 10 Paid employee salaries, $3,500 July 14 Purchased equipment from Lake Company, $10,000. Paid $2,500 down and the balance was placed on account. Payments will be $500.00 per month until the equipment is paid. The first payment is due 8/1. Note: Use accounts payable for the balance due. July 15 Received cash for preparing tax returns for the first half of July, $8,000 July 19 Made payment on account to Lake Company, $500. July 31 Received cash for preparing tax returns for the last half of July, $9,000 July 31 Declared and paid cash…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education