FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

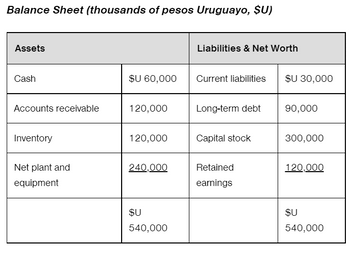

Tristan Narvaja, S.A. (C). Calculate Tristan Narvaja’s contribution to its parent’s translation gain or loss using the current rate method if the exchange rate on December 31 is $U12 = $1.00. Assume all peso accounts remain as they were at the beginning of the year.

Transcribed Image Text:Balance Sheet (thousands of pesos Uruguayo, $U)

Assets

Cash

Accounts receivable

Inventory

Net plant and

equipment

$U 60,000

120,000

120,000

240,000

$U

540,000

Liabilities & Net Worth

Current liabilities

Long-term debt

Capital stock

Retained

earnings

$U 30,000

90,000

300,000

120,000

$U

540,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- KA. On July 1, 2019, Great White North (GWN) Inc. purchased merchandise from a supplier in the U.S. for US$800,000 with terms requiring full payment by October 31, 2019. GWN has a July 31st year end. On October 31, 2019, GWN paid its supplier in full. Selected dates and spot rates are shown below: July 1, 2019 CDN $1.2150 July 31, 2019 CDN $1.2175 October 31, 2019 CDN $1.22 1) Prepare all journal entries on Settlement date. 2) Prepare all journal entries that would be prepared at year end.arrow_forwardHull Manufacturing Corp. (HMC), a Canadian company, manufactures instruments used to measure the moisture content of barley and wheat. The company sells primarily to the domestic market, but in Year 3, it developed a small market in Argentina. In Year 4, HMC began purchasing semi-finished components from a supplier in Romania. The management of HMC is concerned about the possible adverse effects of foreign exchange fluctuations. To deal with this matter, all of. HMC's foreign-currency-denominated receivables and payables are hedged with contracts with the company's bank. The year-end of HMC is December 31. The following transactions occurred late in Year 4: • On October 15, Year 4, HMC purchased components from its Romanian supplier for 807,000 Romanian leus (RL). On the same day, HMC entered into a forward contract for RON807,000 at the 60-day forward rate of RON1 = $0.415. The Romanian supplier was paid in full on December 15, Year 4. • On December 1, Year 4, HMC made a shipment to a…arrow_forwardStuff Inc., a U.S. company, imported goods for 50,000 euro on Dec. 10, Year 1 and paid for them on Jan. 10. Year 2. The following exchange rates were applicable in Years 1 and 2: Exchange Rate Date Dec. 10, Yr. 1 Dec 31, Yr 1 Jan 10, Yr. 2 What approximate gain or loss will Stuff book on Jan. 10, Year 2? OA gain of $3,000. OA loss of $3,000 O Again of $5,500 OA loss of $5,500. 0.79 € 0.82 € 0.75 €arrow_forward

- Journal entries for an account payable denominated in Mexican Pesos ($US weakens and strengthens) Assume that your company purchases inventories from a Mexican supplier on December 15. The invoice specifies that payment is to be made on March 15 in Mexican Pesos (Peso) in the amount of 350,000 Pesos. Your company operates on a calendar year basis. Assume the following exchange rates: December 15 $0.046:1 Peso December 31 $0.053:1 Peso March 15 $0.050:1 Peso Prepare the journal entries to record the purchase (assume perpetual inventory accounting), the required adjusting entry at December 31, and the payment on March 15. General Journal Date Description Debit Credit Accounts payable Accounts payable Dec 15 Inventory Dec 31 Foreign currency transaction loss Mar 15 Accounts payable ÷ 16,100 0 0 16,100 2,450 0 0 2,450 28,000 × 0 Foreign currency transaction gain 0 10,500 x Cash 0 17,500arrow_forward2.Jameson Ltd purchased goods on credit from a European supplier costing Euros 80,000 on 29th May 2020 when the exchange rate was A$1 = O.78 Euros. At 30th June 2020, its balance date . the exchange rate was A$1 = 0.79 Euros . Jameson Ltd paid the European supplier on 5th July 2020 when the exchange rate was A$1= 0.76 Euros Required: Prepare the journal entries for the abovearrow_forwardOn December 1, Year 1, Triaxal Incorporation enters into a forward contract to sell one million Philippines pesos (PP) to its bank in exchange for Canadian dollars on March 1, Year 2, at the market rate for a 90-day forward contract of PP1=$0.0227. On December 31, Year 1, Triaxal’s year-end, the 60-day forward rate to sell Philippines pesos on March 1 is quoted at PP1=$0.0222. On March 1, Year 2, the currencies are exchanged when the spot rate is PP1=$0.0220. Required Prepare journal entries for speculative forward contract under Gross Method and Net Method.arrow_forward

- 2 XYZ Company sells goods to a foreign customer on June 8. Payment of 3,000,000 foreign currency units (FC) is due in one month. June 30 is XYZ Company’s fiscal year-end. The following exchange rates were in effect during the period: June 8 Spot rate $1.10 June 8 30 day forward rate $1.15 June 30 Spot rate $1.14 July 8 Spot rate $1.20 A For what amount should XYZ Accounts Receivable be debited on June 8 B How much foreign exchange gain or loss should XYZ record on June 30arrow_forward4) Brief, Inc., had a receivable from a foreign customer that is payable in the customer’s local currency. On December 31, 2020, Brief correctly included this receivable for 200,000 local currency units (LCU) in its balance sheet at $110,000. When Brief collected the receivable on February 15, 2021, the U.S. dollar equivalent was $120,000. In Brief’s 2021 consolidated income statement, how much should it report as a foreign exchange gain? a) $–0– b)$10,000 c) $15,000 d) $25,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education