FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

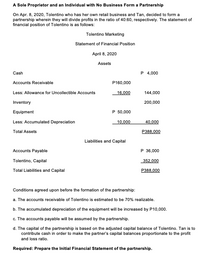

Transcribed Image Text:A Sole Proprietor and an Individual with No Business Form a Partnership

On Apr. 8, 2020, Tolentino who has her own retail business and Tan, decided to form a

partnership wherein they will divide profits in the ratio of 40:60, respectively. The statement of

financial position of Tolentino is as follows:

Tolentino Marketing

Statement of Financial Position

April 8, 2020

Assets

Cash

P 4,000

Accounts Receivable

P160,000

Less: Allowance for Uncollectible Accounts

16,000

144,000

Inventory

200,000

Equipment

P 50,000

Less: Accumulated Depreciation

10,000

40,000

Total Assets

P388,000

Liabilities and Capital

Accounts Payable

P 36,000

Tolentino, Capital

352,000

Total Liabilities and Capital

P388,000

Conditions agreed upon before the formation of the partnership:

a. The accounts receivable of Tolentino is estimated to be 70% realizable.

b. The accumulated depreciation of the equipment will be increased by P10,000.

c. The accounts payable will be assumed by the partnership.

d. The capital of the partnership is based on the adjusted capital balance of Tolentino. Tan is to

contribute cash in order to make the partner's capital balances proportionate to the profit

and loss ratio.

Required: Prepare the Initial Financial Statement of the partnership.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please create the journals and balance sheet and using correct chart of accounts and labels and amount descriptions. Only answer using what i have provided. On March 1, 20Y8, Eric Keene and Renee Wallace form a partnership. Keene agrees to invest $20,900 in cash and merchandise inventory valued at $55,950. Wallace invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $60,390. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow: Wallace’s Ledger Agreed-Upon Balance Valuation Accounts Receivable $19,370 $18,480 Allowance for Doubtful Accounts 1,240 1,520 Equipment 83,050 54,330 Accumulated Depreciation 29,920 – Accounts Payable 14,980 14,980 Notes Payable (current) 35,860 35,860 The partnership agreement includes the following provisions regarding the division of net income: interest on original…arrow_forwardAhmed and Wahid are partners sharing profits and losses in the ratio of 3:1. Their Balance sheet as on March 31, 2021 is as follows. Liabilities Amount (RO) Assets Amount (RO) Creditors 210000 Cash 17500 Bills Payable 70000 Debtors 245000 General Reserve 140000 Stock 105000 0 Plant 280000 Buildings Capital: 87500 Ahmed 350000 Wahid 140000 Profit & Loss Ac 35000 Bank Overdraft 210000 Equipment 210000 Total 1050000 Total 1050000 On April 01, 2021, they agreed to admit Khalid into the firm for 1/5th Share of future profits on the following terms: a) Building is revalued at 420000 b) Stock is revalued at 75250 c) Goodwill is raised at 140000 d) Provision for bad debts is to be made at 5% e) Khalid has to bring in a Capital 175000 f) Khalid was unable to bring the amount of goodwill Pass Journal Entries and Prepare Revaluation Account, Capital Accounts and the Balance Sheet of the reconstituted firm.arrow_forwardDerry Co. is a company in the industry of selling and installing laundry systems, Derry choose financial period ending by December 31. The following were selected from among the transactions completed during 2020. 2019 Oct 10 Sold merchandise to Edin, and received $6,000 cash. The cost of the merchandise sold was $3,800. Nov 13 Sold $25,000 merchandise to Flora, receive $12,000 in cash this day and the rest would follow Derry’s credit policy of 1/15, n/30. The cost of merchandise sold was $15,300. Dec 31 During 2019, Derry Co. offered sales of 30,000 laundry devices with one-year warranty-on-part policy. A provision was made by Derry Co., based on the management’s experience, 900 units (3%) will be defective and that warranty repair costs will average $4 per unit. Journalize this provision. Dec 31 Based on an analysis of the $92,000 of accounts receivable, it was estimated that $9,848 will be uncollectible, given the balance of the account Allowance for doubtful accounts…arrow_forward

- Lawler and Riello formed a partnership on March 15, 2024. The partners agreed to contribute equal amounts of capital. Lawler contributed her sole proprietorship's assets and liabilities (credit balances in parentheses) as follows: X Data table Lawler's Business Current Market Value its. Select the explanation on the last line of the journal entry table.) Accounts Receivable 10,600 Merchandise Inventory 29,000 Prepaid Expenses 2,800 Credit 26,000 Store Equipment, Net Accounts Payable (25,000) Done More info On March 15, Riello contributed cash in an amount equal to the current market value of Lawler's partnership capital. The partners decided that Lawler will earn 60% of partnership profits because she will manage the business. Riello agreed to accept 40% of the profits. During the period ended December 31, the partnership earned net income of $70,000. Lawler's withdrawals were $36,000, and Riello's withdrawings totaled $26,000. Print Done Requirement 1. Journalize the partners' initial…arrow_forwardMrs. Shine was registered in Jamaica as a sole trader in 2015. To grow her practice Mrs. Shine decided to enter into a partnership agreement with Mr. Rain, thus the status of the business was changed in 2021. In 2022, the partnership income statement for Shine & Rain was as follows: Income Statement for the year ended 31 December 2022$ $Revenue 11,600,000ExpensesSalaries & Wages 7,600,000Employer NIS Contribution 1,400,000 Rent and Rates 2.400,000Interest 500,000Maintenance 120,000Depreciation 550,000Loss on Disposal of Vehicle 80,000Telephone 235,000Electricity 255,000General Expenses 700,000Donations 85,000Provision for Bad Debts 80,000Fines and Penalties 115,000Drawings 105,000 14,225,000Net Loss 2,625,000 Notes to the Income Statement1. $55,000 of the drawings relate to Mrs. Shine and $50,000 to Mr. Rain2. Gross Salary for Mrs. Shine was $250,000 per month, and $200,000 for Mr. Rain. Both partners worked in the business during the year. 3. The annual allowance was…arrow_forwardShowing your workings, answer the following question. “Carnita and Cornwall are in partnership. The following is their trial balance as at 31 October 2020.” £ £ Capital Accounts: Carnita 400,000 Capital Accounts: Cornwall 500,000 Current Accounts: Carnita (at 1 November 2019) 164,000 Current Accounts: Cornwall (at 1 November 2019) 41,200 Drawings Accounts: Carnita 200,000 Drawings Accounts: Cornwall 160,000 Premises at cost 1,600,000 Vehicles at cost 520,000 Accumulated depreciation on vehicles at 31 October 2020 500,000 Debtors 464,200 Creditors 539,400 Stock at 31 October 2020 268,800 Bank 67,200 Bank loan at 5% 800,000 Net profit for the year 396,000 Accrued expenses 22,000 3,321,400 3,321,400 “You are given additional information as follows: i) Interest is charged on drawings, which has been calculated as: Carnita…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education